Select Language

By Faith Hung

TAIPEI (Reuters) - Money is pouring into Taiwan exchange-traded funds as investors scramble for exposure to the artificial intelligence supply chain, raising analyst and regulator caution just as a rally in the sector has turned fickle and volatile.

The rush into exchange-traded funds (ETFs) has changed the ownership structure of a $2 trillion dollar market that sits at a geopolitical flashpoint.

Regulators and ETF managers fear less sophisticated investors tapping into the AI fever could end up in pain if markets sour or tensions flare with China, which views democratically governed Taiwan as its own territory.

As of March, Taiwan's ETF sector was valued at T$4.74 trillion ($145.8 billion), according to data from the island's Financial Supervisory Commission (FSC).

That is up 77% from a year earlier, against a rise of 20% in the value of the benchmark equity index over the same period, pointing to heavy inflows.

The speed of the investment, and the borrowed money that much of it rests on, has helped drive the market higher. Money managers say it also raises the risk of an outsized reversal.

"Our clients have concerns. Taiwan stocks have risen above 20,000 points. How much higher can they go?" said Peter Yang, manager of an ETF launched by Fuh-Hwa Securities Investment Trust.

The ETFs include broad index trackers, dividend funds and thematic and sector funds and are popular with foreign and local investors alike. Stability risks were on display when Middle East tensions and a warning of restrained global demand from market leader TSMC set off a wave of chip stock selling.

On April 19 the benchmark index ended down 3.8%, losing 774 points, the most it has lost in a single day. Stock exchange data showed the second-largest net selling by foreign investors on record, with ETFs among four of the top ten most-sold stocks: Yuanta Taiwan High Value Dividend ETF, UPAMC Taiwan High Dividend Momentum ETF, Fuh Hwa Taiwan Technology Dividend Highlight ETF and Capital TIP Customized Taiwan Select High Dividend ETF.

Regulators are watching.

"Our attitude is cautious," Hwang Howming, a vice director-general of the FSC, Taiwan's top financial regulator, told Reuters. "We want to ensure that investors' interests, including in ETFs, are protected."

CRAZE

Taiwanese media have carried reports of students and even Buddhist nuns using ETFs to play the stockmarket and investors mortgaging their houses to get in on the rally.

Frank Hung, a Taipei hotel manager who has found a so-far lucrative side-hustle dabbling in ETFs, considers them a convenient investment in which he sees little risk.

"It's an investment that flies high on the AI boom, offers high yields, and suits busy people like me," he said.

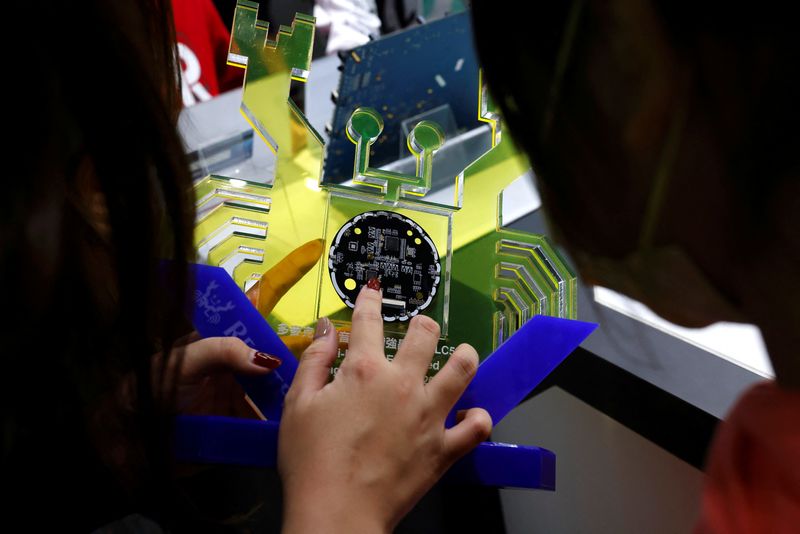

To be sure, the ETF craze reflects one of the easiest ways to access a market that is seen as offering profitable exposure to the raw computing materials that big tech firms have promised to buy as they seek to grow artificial intelligence businesses.

"Generally investors see ETFs as investments that will always be profitable. That is not necessarily correct," said Peter Hong, manager of Capital TIP Customised Taiwan High-Tech Dividend & Growth ETF.

"However, in the longer term, Taiwan and U.S. ETFs in this sector can be expected to reliably trend upwards because of the tremendous potential of new applications such as AI," Hong said.

Yet if the rally, which has faltered, starts to turn, then those who bought ETFs in the good times may be the first out the door, or the over-leveraged might get trapped in investments they can no longer afford.

"ETFs mostly track the broader market, making them vulnerable and unprotected when there is volatility in the market," said Adrian Wang, a senior vice president of Cathay Securities Investment Trust.