Select Language

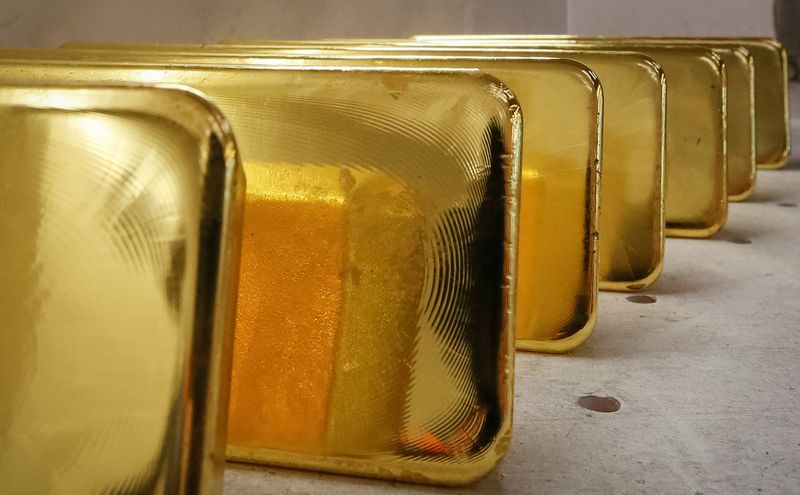

Investing.com-- Gold prices rose in Asian trade on Thursday, briefly hitting a record high as safe haven demand was underpinned by U.S. President Donald Trump threatening to impose more trade tariffs.

But gains in the yellow metal were stymied by some resilience in the dollar, following hawkish signals from the minutes of the Federal Reserve’s January meeting.

Spot gold rose 0.3% to $2,940.96 an ounce, briefly hitting a record high of $2,947.23 an ounce earlier in the session.

Gold futures expiring in April rose 0.2% to $2,957.80 an ounce.

Gold buoyed by haven demand as Trump talks tariffs

Trump on Wednesday said his planned 25% tariffs on automobiles, pharmaceuticals, and semiconductors will be imposed within the coming month.

He also flagged the potential for 25% tariffs on all lumber imports to the U.S.

Trump’s comments ramped up concerns that increased U.S. tariffs will disrupt global trade and spark a renewed trade war between the world’s biggest economies.

The U.S. President had recently threatened to impose reciprocal tariffs on major trading partners. Still, Trump also said on Wednesday that a trade deal with China was possible, even though he recently imposed 10% tariffs on the country, drawing ire and retaliation from Beijing.

Concerns over Trump’s trade policies battered risk-driven markets on Thursday, pushing up demand for safe havens such as gold and the yen. U.S. policy uncertainty has been a key driver of gold’s recent gains.

Other precious metals also advanced, but were nursing some losses this week. Platinum futures rose 0.2% to $992.70 an ounce, while silver futures rose 0.9% to $33.353 an ounce.

Among industrial metals, copper prices advanced as top importer China kept its benchmark loan prime rate at record lows. Benchmark copper futures on the London Metal Exchange rose 0.7% to $9,507.30 a ton, while March copper futures rose 0.2% to $4.5785 a pound.

Dollar strength, Fed jitters limit gold gains

Gold spent only a brief period at record highs, as strength in the dollar and concerns over high-for-longer U.S. interest rates weighed.

The greenback caught some bids this week as several Fed officials reiterated the bank’s caution over cutting interest rates further, due to signs of sticky inflation and resilience in the U.S. economy.

This messaging was repeated in the Fed’s January minutes on Wednesday, which showed policymakers also cautious over the inflationary effects of Trump’s trade policies.