Select Language

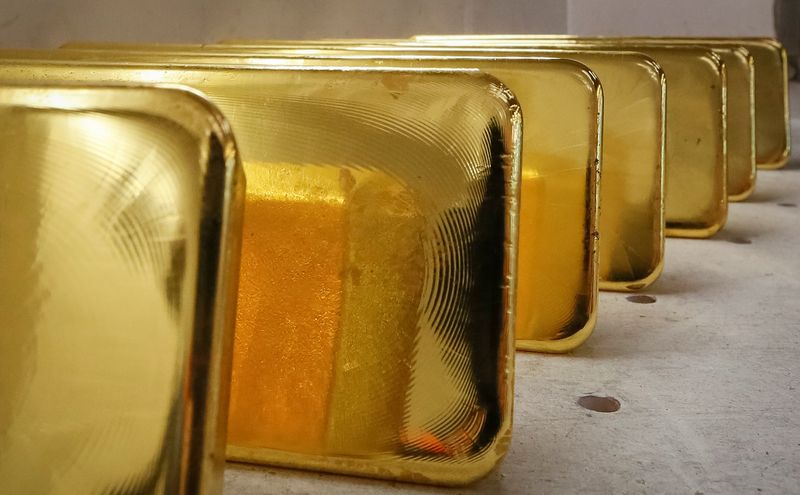

Gold prices fell slightly in Asian trade on Thursday, while silver hovered close to recent record highs as markets awaited key U.S. inflation data and a host of major central bank decisions.

Metal markets faced some profit-taking after rallying sharply over the past week on increased uncertainty over the U.S. economy. Haven demand still remained high ahead of the U.S. inflation print, which is due later on Thursday.

A potential hitch in Russia-Ukraine peace talks– amid disagreements over territory concessions and Moscow’s frozen overseas assets– also lent support to safe haven assets.

Spot gold fell 0.1% to $4,334.48 an ounce, while gold futures for February fell 0.2% to $4,364.90/oz by 00:42 ET (05:42 GMT).

Spot silver rose 0.5% to $66.5095/oz, remaining close to a record high of $66.90 hit on Wednesday. Platinum outperformed, with spot prices rising as high as $1,977.80/oz and coming back in sight of their record peak of more than $2,200/oz.

Silver and platinum vastly outpaced gold this week. While bullion was up 0.7%, silver was sitting on an over 7% gain, while platinum was up 12.2%.

US economic uncertainty builds ahead of CPI data

Uncertainty over the U.S. economy rose this week, especially as official government readings provided mixed signals on the labor market. The Federal Reserve’s asset buying operations also spurred some doubts over market liquidity in the country.

Markets were now looking to upcoming consumer price index inflation data for cues on the world’s largest economy. The data is expected to show headline CPI inflation rising slightly, while core CPI is expected to remain steady at 3% annually.

The labor market and inflation are the Fed’s two biggest considerations for adjusting policy. But in addition to interest rates, markets were also concerned over a potentially stagflationary period for the U.S. economy– a scenario where unemployment increases in tandem with inflation.

Fears of such a scenario also drove outsized buying in gold and other precious metals.

BOE, ECB, and BOJ decisions on tap

Interest rate decisions from the Bank of England and the European Central Bank are due on Thursday, while the Bank of Japan is due on Friday.

The BOE is expected to cut interest rates by 25 basis points as it moves to further shore up a laggard UK economy. The ECB is expected to stand pat after slashing rates this year, amid some signs of resilience in the eurozone.

The Bank of Japan is an outlier, with markets widely pricing in a 25 basis point rate hike. This comes amid persistent yen weakness and sticky Japanese inflation, with the BOJ also having signaled it will consider a rate hike in December.

Focus will be squarely on the three banks’ outlook on their respective economies going into 2026, amid growing concerns over slowing growth in the developed world.