Select Language

SHANGHAI (Reuters) -China surprised markets by lowering a key short-term policy rate and its benchmark lending rates on Monday, in an attempt to boost growth in the world's second-largest economy.

The cuts come after China last week reported weaker-than-expected second-quarter economic data and its top leaders met for a plenum that occurs roughly every five years.

The country is verging on deflation and faces a prolonged property crisis, surging debt and weak consumer and business sentiment. Trade tensions are also flaring, as global leaders grow increasingly wary of China's export dominance.

The People's Bank of China (PBOC) said on Monday it would cut the seven-day reverse repo rate to 1.7% from 1.8%, and would also improve the mechanism of open market operations.

Minutes later, China cut benchmark lending rates by the same margin at the monthly fixing. The one-year loan prime rate (LPR) was lowered to 3.35% from 3.45% previously, while the five-year LPR was reduced to 3.85% from 3.95%.

"PBOC starts to implement pro-growth policy, consistent with the message out of the plenum - authorities are committed to reach whole year GDP target, and policies will adjust after the disappointing Q2 GDP," said Ju Wang, head of Greater China FX & rates strategy at BNP Paribas (OTC:BNPQY).

Wang added that rising expectations for the Federal Reserve to start cutting interest rates also gave the PBOC room to manoeuvre its monetary easing.

China's yuan eased after the rate cuts, and Chinese bond yields fell across the board after the rate cut announcement.

"The fact that PBOC didn't wait for the Fed to cut first indicates that the government recognises the downward pressure on China's economy," said Zhang Zhiwei, president and chief economist at Pinpoint Asset Management.

He expects more rate reduction in China after the Fed enters its rate cut cycle.

China's rate cut is aimed at "strengthening counter-cyclical adjustments to better support the real economy," the PBOC said in a statement.

The announcement also comes after the PBOC said it would revamp its monetary policy transmission channel. PBOC Governor Pan Gongsheng said last month the seven-day reverse repo basically serves the function of the main policy rate.

Investing.com -- It’s set to be a busy week in markets with U.S. inflation data on tap that could help cement expectations for a September rate cut. Earnings season kicks into high gear with the first of the mega caps and a swathe of European banks set to report. Meanwhile PMI data out of the eurozone will bring the path towards the next European Central Bank rate cut more sharply into focus. Here's your look at what's happening in markets for the week ahead.

1. PCE inflation data

U.S. inflation data on Friday will test market expectations that the Federal Reserve is all but certain to cut interest rates in September.

Economists are expecting June's personal consumption expenditures (PCE) price index to have climbed 0.1% for the second straight month, which would bring three-month annualized core inflation down to the slowest pace this year, below the Fed’s 2% target.

The consumer price index fell in June for the first time in four years. That cooler-than-expected report set off a rotation in equities and cemented market expectations that the Fed is primed to cut rates in September.

Several days after CPI, Fed Chair Jerome Powell said second-quarter inflation readings "add somewhat to confidence" that the pace of price increases is returning to the Fed's target in a sustainable fashion.

2. Earnings season gets into full swing

As earnings season enters high gear, bullish investors hope solid corporate results will stem a tumble in technology shares that has cooled this year’s U.S. stock rally.

By Rae Wee

SINGAPORE (Reuters) -Asian shares are set to end the week on a sour note, as uncertainty across major economies added to headwinds for investors even as the global rate easing cycle gets under way.

It has been a turbulent week in markets, with a tech sell-off sparked by deepening Sino-U.S. trade tensions, uncertainty over U.S. President Joe Biden's fate in the presidential race, disappointing Chinese economic data and a lacklustre third plenum outcome casting a shadow over the global mood.

In the foreign exchange market, Tokyo's recent bouts of intervention also kept traders on edge.

"We could just be getting a taste of things to come. And that is more turbulence," said Matt Simpson, senior market analyst at City Index.

MSCI's broadest index of Asia-Pacific shares outside Japan slid 1.56% and was headed for its worst week in three months with a nearly 3% loss.

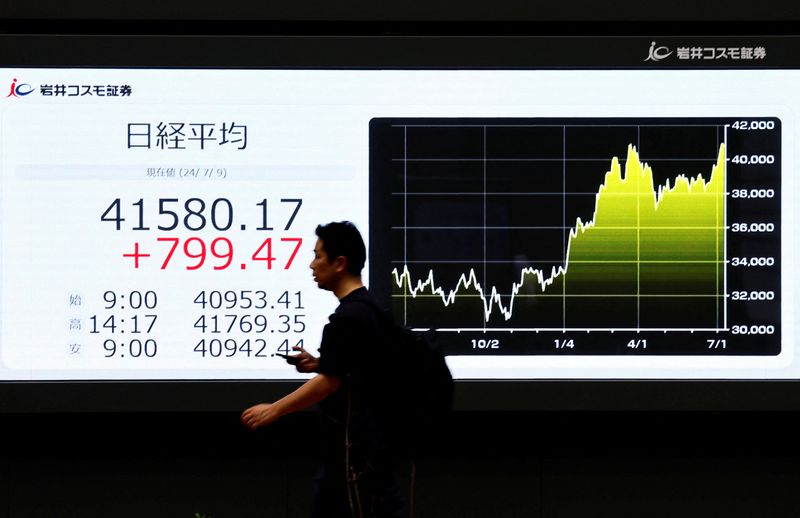

Japan's Nikkei fell to a more than two-week low and was last down 0.09%, extending its sharp 2.4% fall from the previous session.

The Nikkei was on track to lose 2.7% for the week, also its steepest weekly decline in three months.

European shares looked set for a mixed start, with EUROSTOXX 50 futures up 0.08%, while FTSE futures fell 0.4%.

S&P 500 futures tacked on 0.16%, while Nasdaq futures gained 0.3%.

Technology stocks continued to struggle, with South Korea's tech-heavy KOSPI index and Taiwan stocks both falling 1.5% and 2%, respectively.

South Korean chipmaker SK Hynix slid more than 1%, though Japan's Tokyo Electron, a chipmaking equipment manufacturer, rebounded some 2.5%, after an 8.75% tumble on Thursday.

Shares of Taiwan's TSMC, the world's largest contract chipmaker, fell 2.7%, even after the company posted better-than-expected earnings on Thursday and raised its full-year revenue forecast.

In China, investors were left disappointed over the lack of details provided on the implementation steps for achieving economic policy goals at the conclusion of its closely watched plenum on Thursday.

Chinese officials on Friday acknowledged that the sweeping list of economic goals contained "many complex contradictions", pointing to a bumpy road ahead for policy implementation.

Chinese blue-chips were last a touch higher, though the CSI300 Real Estate index slid more than 2%, as an anaemic property sector continued to weigh on China's growth outlook.

The Shanghai Composite Index edged 0.08% lower, while Hong Kong's Hang Seng index fell 2.1%.

"Apart from very broad-brush platitudes devoid of stimulus, economic policy references of quality over quantity may also imply willingness to stomach slower overall growth," said Vishnu Varathan, chief economist for Asia ex-Japan at Mizuho Bank.

The onshore yuan was weaker on the day at 7.2666 per dollar.

RATES VIEW

The euro was last 0.08% lower at $1.0887, having fallen 0.4% in the previous session after the European Central Bank (ECB) kept rates on hold as expected but left the door open to a September cut as it downgraded its view of the euro zone's economic prospects.

"The policy statement gives little away, offering no meaningful changes from June - continuing to stress a data-dependent approach to policy setting," said Nick Rees, FX market analyst at MonFX.

By Leika Kihara

TOKYO (Reuters) -Japan's government cut this year's growth forecast on Friday as consumption took a hit from rising import costs due to a weak yen, highlighting the fragile nature of the economic recovery.

But it projected growth to accelerate next year on robust capital expenditure and consumption, retaining its view the economy will sustain a domestic demand-led recovery.

Some members of the government's top economic council, however, voiced concern over recent weakness in consumption and the pain the yen's fall was inflicting on households.

"We can't overlook the impact a weak yen and rising prices are having on households' purchasing power," the private-sector members of the council told Friday's meeting that discussed the new growth forecasts.

"The government and the Bank of Japan must guide policy with a close eye on recent yen declines," they said.

Prime Minister Fumio Kishida told the meeting that the government must be vigilant about the impact rising prices, driven in part by a weak yen, can have on the economy, according to the Kyodo news agency.

The government releases its economic growth forecasts in January and then revises them around July. They serve as a basis for compiling the state budget.

In the revised estimates, the government cut its economic growth forecast for the current fiscal year ending in March 2025 to 0.9% from 1.3% projected in January.

The new forecast is above private-sector forecasts for 0.4% growth, reflecting government hopes that broadening wage hikes, tax cuts and an extension of fuel subsidies will boost consumer spending.

The government expects the economy to grow 1.2% in fiscal 2025, the estimates showed.

While a weak yen gives exporters a boost, it has become a source of concern for policymakers as it hurts consumption by inflating the cost of fuel and food imports.

The government is suspected to have intervened on several occasions this month to slow down the yen's decline, shifting the market's attention to whether the Bank of Japan would raise interest rates at its two-day policy meeting ending on July 31.

The BOJ is also likely to trim its growth forecast for this fiscal year at the meeting, reflecting a rare unscheduled downgrade to historical gross domestic product (GDP) figures, sources have told Reuters. It currently projects growth of 0.8% in the current fiscal year.

BEIJING (Reuters) - China's Ministry of Commerce said on Friday it will implement anti-dumping duties on propionic acid products originating from the United States for five years from July 21.

The anti-dumping duties are set at 43.5% for all U.S. companies, the ministry said.

BRASILIA (Reuters) -Brazil's Finance Minister Fernando Haddad unveiled plans on Thursday to freeze 15 billion reais ($2.70 billion) from the 2024 budget as the government struggles to meet this year's fiscal target, responding to market calls to cut spending after a recent slump in local assets.

According to Haddad, out of the total 15 billion announced on Thursday, 11.2 billion reais in expenditures will be blocked to comply with a fiscal framework rule that imposes a cap on annual spending growth.

Additionally, another 3.8 billion reais will need to be frozen due to the lack of agreement with the Senate on alternatives to payroll tax benefits approved by lawmakers, he said. Haddad said those funds could be unfrozen if a deal to offset revenue losses from the tax exemptions is reached.

The decision to hold back on spending comes amid market worries about the government's ability to meet its goal of eliminating the primary deficit. Since the beginning of the year, the real has fallen more than 13% against the U.S. dollar, while interest rate futures have soared amid higher risk premia.

Haddad's announcement to the press followed a meeting with President Luiz Inacio Lula da Silva and preempted data that was set to be revealed on Monday, when the government will release its bimonthly revenue and expenditures report. Haddad said this was done to prevent leaks.

The government's goal this year is to eliminate the primary deficit, which excludes interest payments, with a tolerance band of 0.25% of GDP, either up or down. This means the primary deficit could be close to 29 billion reais.The IMF also recommended raising federal excise taxes on gasoline and diesel, which have not been raised since 1993.

On the expenditure side, the IMF recommended indexing Social Security benefits to the chained consumer price index and subjecting earnings greater than $250,000 a year to payroll taxes.

According to Haddad, the revenue and expenditure report will show a primary deficit near the upper limit of the tolerance band but still within the fiscal target.

($1 = 5.5647 reais)

By David Lawder

WASHINGTON (Reuters) -The International Monetary Fund on Thursday said the U.S. Federal Reserve should not cut interest rates until "late 2024" and the government needs to raise taxes to slow the growing federal debt - including on households earning less than President Joe Biden's $400,000-a-year threshold.

The prescriptions came in the detailed staff report from the IMF's annual "Article IV" review of U.S. economic policies released on Thursday. The Fund has been emphasizing in recent weeks the need for more fiscal prudence as U.S. deficits continue to grow despite robust economic growth and as Republicans and Democrats formulate tax and spending proposals ahead of November's presidential election.

IMF chief economist Pierre-Olivier Gourinchas told Reuters on Tuesday that the Fed could afford to wait longer to start easing monetary policy due to a strong labor market.

But the staff report specifies that this shift should come in "late 2024," to avoid more upside surprises in inflation data, without specifying a particular month. The Fed's next policy-setting meeting is July 30-31, with other meetings scheduled for Sept. 17-18, Nov. 6-7 - after the U.S. election - and Dec. 17-18.

"Given salient upside risks to inflation — brought into stark relief by data outturns earlier this year — it would be prudent to lower the policy rate only after there is clearer evidence in the data that inflation is sustainably returning to the FOMC’s 2% goal."

RAISE TAXES

The IMF said that the U.S. public debt to GDP ratio is projected to remain well above pre-pandemic forecasts over the medium term, reaching 109.5% by 2029 compared to 98.7% in 2020.

"Such high deficits and debt create a growing risk to the U.S. and global economy," the IMF said, adding that progressive tax increases were needed, including for those earning less than $400,000 per year, and eliminating a range of tax expenditures.

Biden has proposed raising tax rates on corporations and wealthy Americans but has vowed not to increase taxes on households with annual earnings below $400,000. Republican rival Donald Trump has said he wants to preserve tax cuts passed when he was president in 2017 and possibly cut some taxes further for middle-income Americans and corporations.

Individual income tax cuts are scheduled to expire at the end of 2025, snapping back to pre-2017 levels unless Congress acts to extend or adjust them. The Congressional Budget office estimates that extending the cuts would add a further $4.6 trillion to deficits over 10 years.

The IMF, which often requires fiscal prudence among its borrowing countries, recommended a series of options to lower deficits, including reducing some longstanding tax deductions and exemptions that it said were "poorly targeted." These include tax exemptions for the value of employer-provided healthcare plans and capital gains on the sale of a primary residence, and deductions for mortgage interest and state and local taxes - breaks that add up to about 1.4% of U.S. GDP per year.

The U.S. should consider closing the "carried interest" provision under which investment partnership income can be taxed at lower capital gains income rather than normal income, the IMF said. It added that corporate tax rates should be raised and the corporate tax system shifted to a cash flow tax.

The IMF also recommended raising federal excise taxes on gasoline and diesel, which have not been raised since 1993.

On the expenditure side, the IMF recommended indexing Social Security benefits to the chained consumer price index and subjecting earnings greater than $250,000 a year to payroll taxes.

SEOUL (Reuters) - South Korea's finance minister on Thursday vowed to take policy steps to stabilise the real estate market, as house prices are rising in the area of the capital Seoul.

"Volatility is increasing in the real estate market recently, with apartment prices rising more sharply in Seoul and the wider capital area," Finance Minister Choi Sang-mok said during a policy meeting with the land minister.

"The government will make an all-out effort to stabilise the real estate market," Choi said.

Choi said the government would take policy measures to increase house supplies, speed up the restructuring of real estate project financing, and step up efforts to control the rise in household debt.

The government will consider "extraordinary" measures if the real estate market is deemed overheated due to speculative demand, Choi said.

Last week, the Bank of Korea said household debt growth and rising home prices were key factors the central bank was watching, as it opened the door for rate cuts after keeping the policy rate unchanged at 3.50%, the highest since late 2008, for the 12th straight meeting.

In June, South Korea's house prices rose 0.04% over the month, snapping a six-month run of declines. Prices rose 0.38% in Seoul, the fastest since November 2021, according to Korea Real Estate Board data.

By David Shepardson and Karen Freifeld

(Reuters) - The U.S. Commerce Department plans to issue proposed rules on connected vehicles next month and expects to impose limits on some software made in China and other countries deemed adversaries, a senior official said Tuesday.

"We're looking at a few components and some software - not the whole car - but it would be some of the key driver components of the vehicle that manage the software and manage the data around that car that would have to be made in an allied country," said export controls chief Alan Estevez at a forum in Colorado.

In May, Commerce Secretary Gina Raimondo said her department planned to issue proposed rules on Chinese-connected vehicles this autumn and had said the Biden administration could take "extreme action" and ban Chinese-connected vehicles or impose restrictions on them after the Biden administration in February launched a probe into whether Chinese vehicle imports posed national security risks.

The comments of Estevez, who is the Commerce under secretary for industry and security, are the most definitive to date about the administration's plans on Chinese vehicles that sparked wide alarm.

Connected cars have onboard integrated network hardware that allows internet access, allowing them to share data with devices both inside and outside the vehicle.

Estevez said Tuesday the threat is serious.

"A car is a very scary thing. Your car knows a lot about you. Your car probably gets a software update, whether it's an electric vehicle or an autonomous combustion engine vehicle," he said.

"A modern car has a lot of software in it. It's taking lots of pictures. It has a drive system. It's connected to your phone. It knows who you call. It knows where you go. It knows a lot about you."

The Chinese foreign ministry has previously urged the United States "to respect the laws of the market economy and principles of fair competition." It argues Chinese cars are popular globally because they had emerged out of fierce market competition and are technologically innovative.

Raimondo said in May "you can imagine the most catastrophic outcome theoretically if you had a couple million cars on the road and the software were disabled."

There are relatively few imports of Chinese-made light duty vehicles in the United States. The Biden administration has proposed sharp hikes in tariffs on Chinese electric vehicles and other goods that they expect to be in place by Aug. 1.

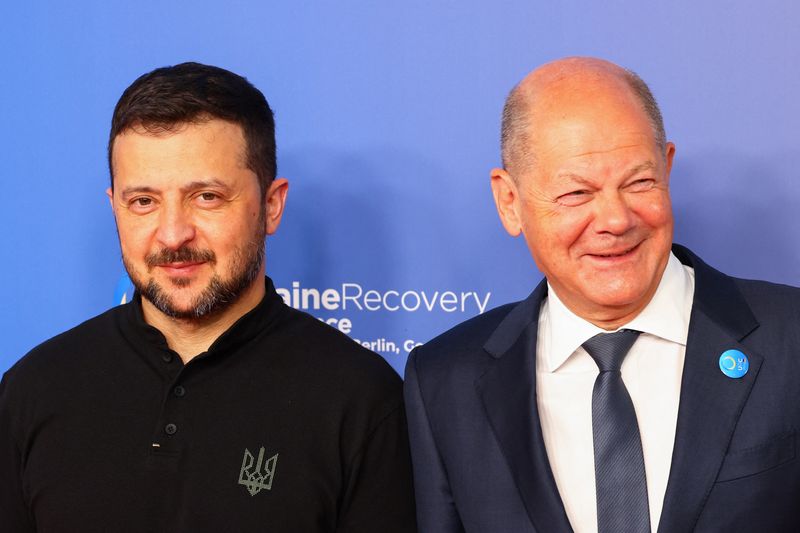

By Maria Martinez and Holger Hansen

BERLIN (Reuters) -Germany plans to halve its military aid to Ukraine next year, despite concerns that U.S. support for Kyiv could potentially diminish if Republican candidate Donald Trump returns to the White House.

German aid to Ukraine will be cut to 4 billion euros ($4.35 billion) in 2025 from around 8 billion euros in 2024, according to a draft of the 2025 budget seen by Reuters.

Germany hopes Ukraine will be able to meet the bulk of its military needs with the $50 billion in loans from the proceeds of frozen Russian assets approved by the Group of Seven, and that funds earmarked for armaments will not be fully used.

"Ukraine's financing is secured for the foreseeable future thanks to European instruments and the G7 loans," German Finance Minister Christian Lindner said on Wednesday at a news conference.

Washington pushed to "front load" the loans to give Ukraine a big lump sum now.

Officials say EU leaders agreed to the idea in part because it reduces the chance of Ukraine being short of funds if Trump returns to the White House.

Alarm (NASDAQ:ALRM) bells rang across Europe this week after Trump picked Senator J.D. Vance, who opposes military aid for Ukraine and warned Europe will have to rely less on the United States to defend the continent, as his candidate for vice president.

Trump sparked fierce criticism from Western officials for suggesting he would not protect countries that failed to meet the transatlantic military alliance's defence spending targets and would even encourage Russia to attack them.

Germany has faced criticism for repeatedly missing a NATO target of spending 2% of its economic output on defence.

DEPLETED MILITARY STOCKS

The stocks of Germany's armed forces, already run down by decades of underinvestment, have been further depleted by arms supplies to Kyiv.

So far, Berlin has donated three Patriot air defence units to Kyiv, more than any other country, bringing down the number of Patriot systems in Germany to nine.

Germany's fractious coalition of left-leaning Social Democrats, pro-business liberals and ecologist Greens has struggled to comply with NATO's spending target due to self-imposed rules that limit the amount of state borrowing they can take on.

Although military aid to Ukraine will be cut, Germany will comply with the NATO target of spending 2% of GDP on defence in 2025, with a total of 75.3 billion euros.

Days after Russia's 2022 invasion of Ukraine, Chancellor Olaf Scholz announced a "Zeitenwende" – German for historic turning point - with a 100 billion euro special fund to bring the military up to speed.

From this special fund, there will be 22.0 billion euros more for defence, plus 53.3 billion euros in the regular budget, still less than that sought by Defence Minister Boris Pistorius.

The defence budget is set to receive a meagre 1.3 billion euros more than in 2024, far below the 6.7 billion euros requested by Pistorius.

As ever-increasing annual operating costs outpace this rise, the defence ministry is being forced to cut ammunition orders for 2025 by more than half, reduce procurement by 260 million euros and research and development by over 200 million euros.

The budget for 2025 comes with the mid-term financial planning until 2028, the year when the armed forces' special fund to meet NATO's minimum spending goals is due to run out and 80 billion will be needed for defence, as noted in the financial plan.

In 2028, there is a gap of 39 billion euros in the regular budget, of which 28 billion euros are needed to comply with the NATO target without the special fund, sources from the finance ministry said.

Decisions on how the hole will be plugged are not likely to be taken until after the 2025 election.

"The 80 billion euros that have been put on display for 2028 simply do not exist," said Ingo Gaedechens, member of the parliament's budget committee from the conservative opposition party CDU.

"The coalition is not even trying to cover this up but are openly admitting it."

($1 = 0.9192 euros)