Select Language

Gold prices slipped from record highs in Asian trading on Tuesday, pressured by profit-taking and signs of easing U.S.–China trade tensions that dampened demand for the metal’s safe-haven appeal.

Spot gold was last down 0.8% at $4,322.95 an ounce by 02:27 ET (06:27 GMT), retreating from Monday’s all-time high of $4,381.21/oz as investors locked in gains following a week-long rally.

U.S. Gold Futures for December fell 0.5% 4,339.35/oz.

Gold slips amid signs on easing trade tensions; US CPI awaited

The pullback came as U.S. President Donald Trump struck a conciliatory tone on trade, saying he expected a “strong and fair” deal with China, aiming constructive exchanges with President Xi Jinping at a summit in South Korea next week.

U.S. Treasury Secretary Scott Bessent is expected to meet Chinese Vice Premier He Lifeng in Malaysia later this week, following renewed strained relations. Trump has threatened to impose additional 100% tariffs on Chinese goods starting Nov. 1.

Adding to the shifting sentiment, White House economic adviser Kevin Hassett said on Monday that the prolonged U.S. government shutdown was “likely to end this week,” with negotiators nearing a bipartisan funding deal.

The easing of political uncertainty, alongside trade optimism, reduced the urgency for investors to hold defensive assets like gold.

Meanwhile, attention remains fixed on the delayed U.S. Consumer Price Index (CPI) data, now due on Friday.

Economists expect headline inflation to rise around 3.1% year-on-year. A hotter reading could temper expectations for a rate cut at Fed’s October meeting.

Metal markets fall as greenback strengthens

Other precious and industrial metals also traded lower on Tuesday as a slightly stronger greenback made them costlier for overseas buyers.

Silver Futures dropped 1.5% to $50.68 per ounce, while Platinum Futures fell 1.1% to $1,633.60/oz.

Benchmark Copper Futures on the London Metal Exchange edged down 0.2% to $10,666.20 a ton, while U.S. Copper Futures declined 1% to $5.00 a pound.

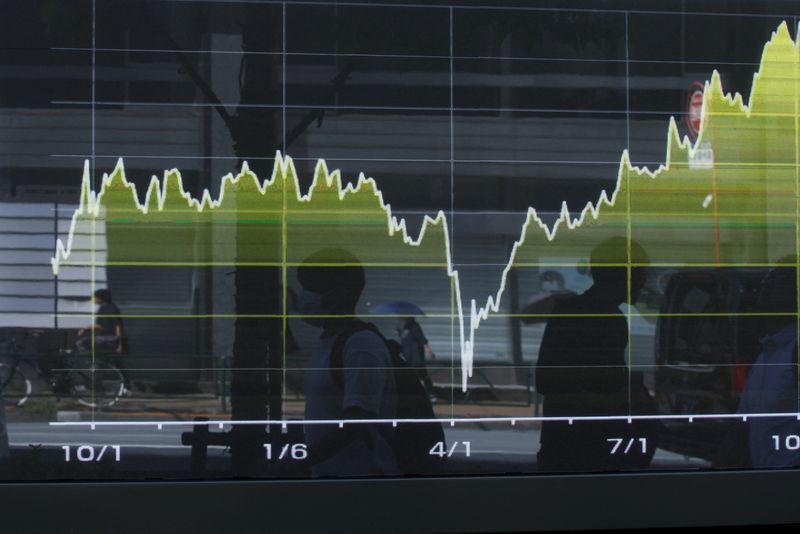

U.S. stock index futures rose Monday, boosted by hopes for more trade talks with China at the start of a week that includes a slew of big-name earnings reports as well as important inflation data.

At 06:05 ET (10:05 GMT), Dow Jones Futures gained 95 points, or 0.2%, S&P 500 Futures rose 20 points, or 0.3%, and Nasdaq 100 Futures climbed 90 points, or 0.4%.

The main averages all closed higher at the end of last week, after President Donald Trump suggested that his proposed triple-digit tariffs on China were not sustainable, raising hopes that trade tensions between the two largest economies in the world could be smoothed over.

Sentiment lifted by easing U.S.-China tensions

Trump also confirmed that a meeting later this month with Chinese counterpart Xi Jinping in South Korea will go ahead, adding in a television interview that the U.S. is "going to be fine with China."

Treasury Secretary Scott Bessent later said he expects to meet with Chinese Vice Premier He Lifeng this week in a bid to prevent an escalation of the levies. Chinese state news sources noted that He and Bessent held "constructive discussions" and had agreed to conduct fresh trade discussions as soon as possible.

Heightened U.S.-China tensions had battered Wall Street earlier in October, with stock benchmarks falling from record highs after Trump threatened to impose 100% tariffs against China, drawing a sharp rebuke from Beijing.

Data released earlier Monday showed that China’s economy grew slightly more than expected in the third quarter of 2025, but at its slowest pace in a year amid persistent headwinds from rampant disinflation and U.S. trade tensions.

Tesla, Netflix to headline Q3 earnings

Apart from the trade talks, traders will be keeping tabs this week on corporate earnings from a host of major Wall Street companies, with streaming giant Netflix (NASDAQ:NFLX) due on Tuesday and electric vehicle maker Tesla (NASDAQ:TSLA) on Wednesday.

Others, including GE Aerospace (NYSE:GE), Coca-Cola (NYSE:KO), Philip Morris (NYSE:PM), Rtx Corp (NYSE:RTX), General Motors (NYSE:GM), Lockheed Martin (NYSE:LMT) and Texas Instruments (NASDAQ:TXN) will report earnings during the week.

The focus will be squarely on whether corporates have continued to generate profits amid disruptions from trade tariffs and a cooling labor market. Markets are seeking more cues on the U.S. economy as an ongoing government shutdown has delayed the release of several key economic readings.

Major Wall Street banks reported positive third-quarter earnings last week, offering markets some support.

Elsewhere, Apple’s (NASDAQ:AAPL) iPhone 17 series has outperformed its predecessor by 14% during the first 10 days of availability in the United States and China, according to data released Monday by Counterpoint Research.

Amazon (NASDAQ:AMZN) will also be in the spotlight after an outage to the retail giant’s Web Services, the backbone of many sites.

Crude prices slip lower

Oil prices fell Monday, adding to recent losses as escalating U.S.-China trade tensions added to persistent concerns over sluggish demand and a looming supply glut.

Brent futures dropped 0.4% to $61.03 a barrel, and U.S. West Texas Intermediate crude futures fell 0.4% to $56.90 a barrel.

Both benchmarks declined more than 2% last week, marking their third consecutive weekly decline, partly due to the International Energy Agency’s outlook for a growing supply glut in 2026.

Tumbling bank shares pulled global stocks lower on Friday, while gold hit a fresh peak, as signs of credit stress at U.S. regional lenders unnerved investors and drove them into safe-haven assets.

European banks fell 2.7% in early trade - dragging the wider stock index down 1.8% - with the likes of Deutsche Bank and Barclays down more than 5%, following losses across Asian financial stocks.

S&P 500 futures and Nasdaq futures were down more than 1% ahead of more earnings from U.S. regional banks later in the day.

DOLLAR UNDER PRESSURE, GOLD AND TREASURIES CLIMB

Overnight, U.S. regional lender Zions sank 13% after disclosing it would take a $50 million loss in the third quarter on two loans from its California division. Western Alliance’s stock slumped 11% after it initiated a lawsuit alleging fraud by Cantor Group V, LLC. Cantor’s attorneys denied the allegations.

The developments pummelled U.S. banking stocks and weighed on the U.S. dollar to the benefit of the yen and Swiss franc.

"While the recent issues of the two lenders seems well contained, where there is smoke there is often fire and the remedy of the 2023 crisis has created a tinderbox for another banking flare-up," said IG analyst Tony Sycamore, referring to a series of bank failures that year which prompted the U.S. Federal Reserve to take steps to stabilise the financial system.

Safe-haven Treasuries rallied further, with two-year yields down to a fresh three-year low of 3.376% as investors priced in at least two more quarter-point rate cuts from the Fed this year.

The flight to safety saw gold hit a record of $4,378.69 per ounce. Bullion is set for a weekly gain of 7.8%, and earlier in the session had temporarily been on track for its biggest gain since September 2008 when the collapse of Lehman Brothers fuelled the global financial crisis.

“It wouldn’t surprise me, frankly, if gold hits $5,000 before it actually stops for air .... Equally, it could fall 20% in the next month. So we’re more holders than buyers at current levels," said Eren Osman, managing director of wealth management at Arbuthnot Latham.

Sentiment in equities has also taken a hit due to rising trade tensions between China and the United States. China on Thursday accused the U.S. of stoking panic over its rare earth controls, rejecting a White House call to roll back the curbs.

MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 1.4%, taking the week into negative territory.

The credit worries and rate cut bets have weighed on the U.S. dollar, which is off 0.6% this week. [FRX/]

The yen and the Swiss franc have gained most, with both up about 1% this week.

Bank of Japan Governor Kazuo Ueda said that the central bank would scrutinise various data in deciding whether or not to raise interest rates this month.

Oil prices extended losses, after falling 1% overnight as U.S. President Donald Trump said he and Russian President Vladimir Putin had agreed to meet in Hungary soon to discuss ending the war in Ukraine.

U.S. crude fell 0.5% to $57.18 a barrel, while Brent was also off 0.5% to $60.78.

Federal Reserve Governor Christopher Waller stated Thursday that a rate cut is "the right thing to do" amid growing concerns about labor market weakness.

Speaking on Bloomberg TV, Waller emphasized that his job focuses on the labor market, which he described as "not good." He noted that "data from all sources" is telling a story of weakness in employment.

"We can cut 25 basis points, see what happens, get better idea," Waller said, suggesting a measured approach to monetary policy adjustment.

The Fed governor pointed to several factors affecting the economy, including tariff uncertainty and artificial intelligence, which he said have "put firms on back foot." He observed that business investment is "concentrated in AI, not widespread" and described the impact of AI on labor as feeling "like a structural change."

Waller expressed puzzlement over financial markets but clarified that current conditions aren’t loose for households. He estimated inflation is "about 2.5% excluding tariffs" and expressed optimism that "tariff stuff will settle out and be ok."

Regarding his potential candidacy for Fed Chair, Waller confirmed he had "a great interview with Bessent" that "went quick" and that the interview process "is going well." However, he noted he hasn’t spoken with the President and doesn’t know if he will.

Waller also emphasized that a strong economy cannot coexist with zero job growth, adding that "not much has changed in last six weeks" regarding economic conditions.

Gold prices climbed to a fresh record high in Asian trading on Wednesday, marking a third straight session of record peaks, as expectations of imminent U.S. interest rate cuts and renewed U.S.-China trade tensions fueled strong safe-haven demand.

Spot gold last traded 1.1% higher at $4,186.84 per ounce as of 02:05 ET (06:05 GMT), after reaching an all-time high of $4,193.6/oz earlier in the day. U.S. December Gold Futures climbed 1% to $4,203.27.

The yellow metal has seen strong gains for the last eight consecutive weeks, and was set for yet another weekly jump if gains hold.

Fed easing bets, US-China tensions support bullion

The rally gathered pace after Federal Reserve Chair Jerome Powell delivered remarks on Tuesday that investors interpreted as dovish.

Powell said the U.S. economy may be on a firmer trajectory than some expected, but cautioned that a notably softer labor market is emerging. He added that there was “no risk-free path” for policy and emphasized that future decisions would be made “meeting by meeting.”

His comments reinforced market expectations for potential Fed rate cuts in both October and December, sending U.S. Treasury yields lower and weakening the dollar -- both supportive for non-yielding bullion.

Adding to the bullish momentum were escalating trade tensions between the U.S. and China. President Donald Trump floated the idea of ending certain trade ties with China, specifically targeting cooking oil imports, in response to Beijing’s pullback on U.S. soybean purchases.

The two countries also imposed reciprocal port fees on ocean shipping firms this week, deepening their tariff standoff.

"Gold and silver are two of the best-performing commodities this year, with prices up by more than 55% and 80% YTD, respectively, supported by the Fed’s policy easing, the central bank’s purchases and geopolitical tensions, which have fuelled demand for safe-haven assets," ING analysts said in a recent note.

Metal markets rise; China inflation data in focus

Other precious and industrial metals also traded higher on Wednesday, supported by a weaker greenback.

Silver prices rose 1.4% to $52.12 per ounce, after hitting a record high of $53.6/oz in the previous session. Platinum Futures also climbed 1.4% to $1,687.20/oz.

Benchmark Copper Futures on the London Metal Exchange rose 0.7% to $10,667.50 a ton, while U.S. Copper Futures added 0.8% to $5.04 a pound.

Data on Wednesday showed that China’s consumer prices fell 0.3% in September from a year earlier, compared with a 0.4% decline in August, while producer prices fell 2.3% year-on-year, easing from a 2.9% drop the previous month.

The data signaled persistent deflationary pressures in the world’s second-largest economy, stoking hopes the government will dole out more supportive measures in the coming months

Global shares fell, while safe havens such as bonds and gold rallied on Tuesday, as investors grew uneasy over mounting tensions between the U.S. and China ahead of talks between the two countries aimed at striking a durable trade deal.

Markets had earlier joined the rebound from Monday’s cash session after U.S. Treasury Secretary Scott Bessent said President Donald Trump remains on track to meet Chinese leader Xi Jinping in South Korea for a two-day summit starting on October 31. But he added fuel to the fire in an interview in the Financial Times where he accused Beijing of trying to damage the global economy.

As negotiations between the U.S. and China intensify, the two nations will begin from Tuesday charging port fees on ocean shipping firms that move everything from toys to crude oil.

’ESCALATE TO DE-ESCALATE’

"Both Washington and Beijing are posturing before the November summit - escalate to de-escalate," said Marc Velan, head of investments at Lucerne Asset Management in Singapore. "Neither can afford a trade war heading into U.S. midterms."

Stocks in Europe, which have hit record highs this month, were down 0.7%, echoing weakness in Asian markets, where technology stocks got hit hard.

Futures on the S&P 500 and the Nasdaq sank 1%, suggesting there may not be a repeat of Monday’s rally, but a full reversal also looked unlikely.

"If one looks at the recent history of export controls and charges for ships docking in ports, then it’s been largely interpreted as a path towards negotiation rather than a fresh outbreak of hostilities on the trade front between the U.S. and China," Investec chief economist Philip Shaw said.

"So yes, there is uncertainty, but you’ve had a huge rally, not just in U.S. stocks, but a lot of global indices as well. And while there are still some question marks over U.S.-China trade friction, I’d interpret the latest sell-off as a bit of a correction rather than a huge stepping-up of investor uncertainty," he said.

Wall Street’s main indexes had ended as much as 2.2% higher on Monday, led by chipmakers, after Trump struck a more conciliatory tone on trade tensions with China, reversing some of the panic from Friday when Trump announced 100% tariffs on China.

MARKET RISK BAROMETERS FLASH RED

Reflecting the increased investor angst, gold reversed overnight losses and rose 0.7% to $4,140 an ounce, just shy of Tuesday’s new record of $4,179.48. In contrast, bitcoin, which tends to move in line with other risk assets, fell 3.5% to $111,793.

In the foreign exchange market, the dollar gained an edge over currencies that typically benefit when investors are feeling confident, such as the pound or the Australian dollar, which fell 0.5% and 0.9% respectively against the greenback.

The yen, which tends to act as a safe haven, strengthened 0.1% to 152.04 against the dollar after Japan’s finance minister said the country needs a new economic strategy that deals with inflation rather than deflation.

The yield on the U.S. 10-year Treasury bond was 4.02%, down 3 basis points. The U.S. bond market was closed on Monday for a public holiday.

Two-year yields, which are far more responsive to shifts in expectations for U.S. interest rates, were down 4.6 bps at 3.48%, having fallen 12 bps since Friday, marking their largest two-day fall since early August.

Analysts at Danske Bank said any escalation in the trade war would only increase the likelihood of the Federal Reserve front-loading planned rate cuts.

Traders fully expect the Fed to cut rates this month and into next year to combat a weakening labour market.

The euro dipped 0.1% to $1.1554 after French President Emmanuel Macron rejected calls to resign on Monday, as his latest government was threatened by two no-confidence motions.

Brent crude fell 1.7% to $62.63 per barrel after an OPEC report showed world oil supply is expected to closely match demand next year, a contrast from last month’s outlook, which projected a shortfall.

U.S. stock index futures rose on Monday following Friday’s pullback, as investors returned to risk assets after President Donald Trump’s softer tone eased concerns over renewed U.S.-China trade tensions.

Trump on Friday said he would impose an additional 100% tariff on China’s U.S.-bound exports, along with new export controls on critical U.S.-made software in retaliation for Beijing tightening rare earth restrictions.

The revived trade tensions sent the S&P 500 and the Nasdaq, both previously on track to register weekly gains, to suffer their steepest weekly declines in months.

However, in a more conciliatory tone over the weekend, Trump posted that "it will all be fine" and the U.S. did not want to "hurt" China.

China on Sunday blamed the U.S. for the escalation. However, Beijing did not roll out further countermeasures ahead of a potential meeting between Trump and his Chinese counterpart later this month, which the U.S. president threatened to cancel.

"The path for markets in the near term depend heavily on the path escalation takes," analysts at UBS Global Wealth Management said in a note.

"More generally, we think that the bull market remains intact and so pullbacks should offer an opportunity for investors, who are underallocated to equities, to consider adding long-term exposure."

The AI-driven momentum and optimism around U.S. rate cuts have helped markets in the recent months.

At 05:23 a.m. ET, Dow E-minis were up 448 points, or 0.98%, S&P 500 E-minis were up 89.75 points, or 1.36%, and Nasdaq 100 E-minis were up 462 points, or 1.89%.

Investor focus is also on the earnings season that kicks off this week with major U.S. banks including JPMorgan Chase, Goldman Sachs, Citigroup, and Wells Fargo set to release quarterly results on Tuesday.

The season will be a crucial litmus test for U.S. stock markets and it will provide fresh clues on the economy at a time when major official data releases remain delayed due to a government shutdown that is currently in its 13th day.

In premarket trading, shares of "Magnificent Seven" companies rose following Friday’s pullback. Nvidia was up 3.7%, Tesla gained 2.8%, Microsoft advanced 1.5%, while Meta and Alphabet rose 1.6% each.

In the Middle East, Hamas handed over the first group of the last surviving Israeli hostages, a key step in ending two years of devastating conflict in Gaza as part of a ceasefire deal pushed by Trump.

U.S. stock index futures were muted on Friday, extending a pause after a blistering rally, while investors awaited consumer sentiment data due later in the day for fresh insights into the economy.

The earnings season that begins next week will be a crucial litmus test for U.S. stock markets, but traders so far have brushed off concerns about a bubble in equities.

Some analysts expect the AI trade, mostly concentrated in tech so far, to spill over into energy and construction firms as demand for data center buildout accelerates.

"I feel pretty confident that AI will broaden out to other areas of the market. Investors are going to realize that the companies that provide or create AI are one thing, but companies that will be the beneficiaries are equally, if not more, important," said Francis Gannon, co-chief investment officer at Royce Investment Partners.

Also adding to the rally is the fear of missing out, as some analysts say the nearly three-year-old bull market still has room to run, especially if the Federal Reserve continues to lower interest rates.

Recent data has reinforced expectations for easing. While the government shutdown has delayed official releases, proxies point to a weakening labor market, with layoffs tied to the impasse likely to deepen the strain.

At 06:55 a.m. ET, Dow E-minis were up 41 points, or 0.09%, S&P 500 E-minis were up 0.5 point, or 0.01%, and Nasdaq 100 E-minis were up 1.5 points, or 0.01%.

A preliminary reading of the University of Michigan’s consumer sentiment survey, due at 10:00 a.m. ET, will be in focus. It could carry extra weight because of the official data blackout.

Investors are also weighing developments in the Middle East, where Israeli troops began pulling back from some parts of Gaza on Friday under a ceasefire deal with Hamas. Signs of easing tensions could lift sentiment by removing a long-standing overhang on equities.

Among stocks, Intel rose 1.9% in premarket trading, after TD Cowen raised its price target on the stock. Data center operator Applied Digital surged 22.1%, a day after posting better-than-expected revenue for the first quarter.

Levi Strauss shares slipped 6.6% after it forecast annual profit below analysts’ expectations.

Qualcomm fell 2.6% after China’s market regulator said the country has launched an antitrust investigation into the semiconductor manufacturer over its acquisition of Israel’s Autotalks.

SINGAPORE (Reuters) -The surge in gold prices above $4,000 per ounce is spilling over into other precious metals on fears the Trump administration’s unorthodox economic policies will shift the prevailing trend from de-dollarisation to outright debasement of the U.S. currency.

Silver, platinum and palladium are enjoying upsized gains for the year as investors fret about a whole host of geopolitical and economic uncertainties, with U.S. President Donald Trump’s attempts to reshape global trade raising anxiety around world capitals and corporate boardrooms.

Surprisingly, gold is the worst-performing of the four precious metals this year despite a rousing 53.8% year-to-date rally making it the hottest streak for bullion in almost half a century. Platinum has had an even better year, leading the pack with an 83.6% rise year-to-date. Spot silver hit a record high of $49.57 this month after a 70.4% rally during the same period. And basking in a surge last month, palladium is up 60.5%.

In embracing what J.P. Morgan calls the "debasement trade", investors have turned to precious metals and other real assets as a safer store of value, fearing that Trump’s shakeup of the economic and political landscape and attacks on the independence of the Federal Reserve will erode the primacy of the U.S. dollar in global finance.

Taylor McKenna, a mining analyst at value fund manager Kopernik Global Investors in Tampa, Florida, expects further gains for gold, but says the rally could decelerate as prices become high enough to incentivise a search for new mines and increase future supply of the metal. "We still like gold, but we like it a lot less," he told Reuters last month.

Gold overtook the euro as the second biggest reserve asset in 2024 after the U.S. dollar, according to a report from the European Central Bank in June.

Since then, the gold rally has lifted the value of central banks’ bullion holdings above U.S. Treasury bonds. The IMF’s most recent data for the second quarter show gold accounting for a record high of 24% of total assets, up from 23.3% at the end of the previous quarter.

"Investors should not short U.S. bond or equity markets because of anything Trump does to data or the central bank," wrote BCA Research chief strategist Marko Papic. "Instead, they should go long hard assets, of which — for the time being — we like palladium the best."

"Silver’s rally is strongly linked to record-high gold prices," wrote HSBC chief precious metals analyst James Steel in a research note this week, raising the bank’s average price forecast to $38.56 per ounce this year and $44.50 per ounce in 2026.

"Gold exerts a strong gravitational pull on silver," he said, adding: "Gains in gold attract ancillary buying in silver, possibly by investors who have not taken full advantage of the gold rally."

Kopernik’s McKenna believes platinum will likely outperform as even after the rally, prices haven’t kept up with gold - despite a traditionally tight correlation between the two - and the resulting discount will create incentives that are likely to favour investment in new gold mines instead, taking supply off the market.

U.S. stock futures steady after equities slump in the prior session, with traders attempting to gauge mixed artificial intelligence-related headlines and a murky economic backdrop. Uncertainty over the economy and an extended U.S. government shuttering helps to fuel a spike in gold prices above the $4,000 per ounce level for the first time. The Federal Reserve is due to release minutes from its latest policy meeting, while AI-darling Nvidia is reported to be among a group of investors in xAI’s $20 billion capital raising round.

1. Futures point higher

U.S. stock futures hovered above the flatline on Wednesday, as investors assessed fresh worries over the AI boom and kept tabs on the broader economic outlook despite a lack of official data during an ongoing federal government shutdown.

By 03:48 ET (07:48 GMT), S&P 500 futures had climbed by 8 points, or 0.1%, Nasdaq 100 futures had edged up by 38 points, or 0.2%, and Dow futures had risen by 60 points, or 0.1%.

On Tuesday, equities on Wall Street retreated from recent record highs, with the benchmark S&P 500 falling by 0.4% and the tech-heavy Nasdaq Composite declining by 0.7%. The blue-chip Dow Jones Industrial Average also dipped by 0.2%.

Partly fueling these drops was a slump in shares of cloud software group Oracle, which had surged just last month on hopes that it would be a major winner in the AI race. Analysts flagged a news report in The Information, which suggested that the margin profile of Oracle’s AI cloud infrastructure business, which has been pressurized by heavy expenditures on the nascent technology, was worse than previously thought.

Still, the narrative around AI, perhaps the biggest supporter of the torrid run higher for stocks, remained intact. Shares in AMD, which announced a deal with ChatGPT-maker OpenAI earlier this week, extended a rise into a second day, while IBM advanced on a partnership with AI-name Anthropic and AI server firm Dell rallied on a raised long-term guidance.

With the prolonged shutdown leading to the delay of several key economic indicators from the government, traders have had to turn to alternative data sources to check in on the health of the American economy. These measures dented sentiment in the previous session, especially a New York Federal Reserve survey displaying a deterioration in future expectations and rising projections for inflation.

2. Gold tops $4,000 per ounce

Gold prices have soared above $4,000 per ounce for the first time, as market participants like private investors and central banks moved to take advantage of the safe-haven status of the yellow metal during a time of political upheaval and economic uncertainty.

Bullion has surged by over 50% so far this year, posting a series of fresh all-time peaks along the way. It is now on track to jump to its best year since 1979.

Analysts have noted that the U.S. government shutdown, combined with a weakening of other popular havens such as the dollar and U.S. government bonds due to anticipated Fed rate cuts and concerns over America’s fiscal profile, have burnished gold.

The Japanese yen, also a traditional haven, took a knock as well following the election of a new, more dovish leader of the ruling Liberal Democratic Party. The global political landscape was even made more unclear after the surprise resignation of France’s Prime Minister on Monday, giving additional support to gold.

Meanwhile, many exchange-traded funds have been expanding their holdings of gold as anticipation of Fed rate reductions intensifies, analysts at ING said in a note. Some central banks are also snapping up the precious metal, with the People’s Bank of China in particular extending its gold buying streak in September for an eleventh straight month despite record high prices.

3. FOMC minutes ahead

Attention is now set to turn to the release of minutes on Wednesday from the Fed’s latest policy meeting in September.

At the gathering, Fed members voted to slash interest rates by a quarter of a percentage point, restarting a cycle of policy easing that had been put on hold since December.

Officials broadly predicted that further rate cuts may be coming at the central bank’s final two meetings of the year, one later this month from October 28-29 and another in December.

Underpinning these projections was a perceived desire to prioritize bolstering a recently slowing U.S. labor market over stubborn inflation. In theory, rate reductions can promote hiring and investment, albeit at the risk of driving up prices.

"The Fed minutes in aggregate should echo the incrementally dovish shift in bias" from the Fed’s September statement and a press conference from Chair Jerome Powell, analysts at Vital Knowledge said. "[B]ut they will probably reflect deep divisions too, as some officials push for a fairly aggressive rate cutting campaign while others prefer to limit the easing to 1-2 reduction given persistent inflation challenges and an employment situation that remains decent on an absolute basis."

Elsewhere, a few Fed officials are scheduled to speak, although the lack of new economic data means that their comments are not likely to fundamentally alter rate path bets, the analysts added.

4. Nvidia among investors in xAI’s $20-billion capital raise - Bloomberg

Elon Musk-backed artificial intelligence startup xAI increased a planned capital raise to as much as $20 billion, including an investment from Nvidia to procure more AI processors, Bloomberg News reported.

The financing is largely aimed at procuring more Nvidia chips that xAI plans to use in its upcoming Colossus 2 data center in Memphis, the report said. The capital raise includes equity and debt.

Nvidia will invest as much as $2 billion in the equity portion of the deal, Bloomberg reported. The move is largely part of Nvidia’s strategy to help accelerate its customers’ AI investments, with the chipmaker having pledged about $100 billion to OpenAI last week -- although some observers have become increasingly concerned that the circular nature of these deals may belie the robustness of the AI boom.

Previous reports said xAI was aiming to raise around $10 billion in its ongoing funding round. Other reports also valued xAI at $200 billion in September, making it among the most valuable startups in the world, behind OpenAI.

5. ABB to sell robotics unit to Japan’s SoftBank

Swiss engineering giant ABB on Wednesday said it agreed to sell its robotics unit to SoftBank Group Corp. for an enterprise value of $5.38 billion, dropping its initial plan to spin off the business.

The deal will generate cash proceeds of roughly $5.3 billion, ABB said in a statement, and is expected to close in mid-to-late 2026.

ABB said the proceeds of the deal will be used towards its “long-term capital allocation principles,” which will include investing in acquisitions, organic growth, and potential returns to shareholders.

SoftBank CEO Masayoshi Son said in a statement that the acquisition was aimed at furthering the Japanese conglomerate’s ambitions of “physical AI,” in that the firm will meld its robotics and artificial intelligence capabilities. SoftBank, under Son, has aggressively invested in AI and AI-linked sectors over the past two years.