Select Language

By Rae Wee

SINGAPORE (Reuters) - The dollar looked set on Friday to end 2023 with a loss, reversing two straight years of gains, dragged by market expectations that the U.S. Federal Reserve could begin easing rates as early as next March.

The greenback stayed broadly on the back foot on the last trading day of the year, with currency moves subdued amid a holiday lull leading up to the New Year.

Since the Fed launched its aggressive rate-hike cycle in early 2022, expectations of how far U.S. rates would have to rise have been a huge driver of the dollar for the most part of the past two years.

But as economic data subsequently pointed to signs that inflation in the United States is cooling, investors turned their focus to how soon the Fed could begin cutting rates - expectations which gathered steam after a dovish tilt at the central bank's December policy meeting.

Against a basket of currencies, the greenback fell 0.02% to 101.18, languishing near a five-month trough of 100.61 hit in the previous session.

The dollar index was on track to lose more than 2% for the month and roughly 2.2% for the year.

"The dollar is likely to come under pressure in 2024 as (the) Fed formally signals a dovish pivot, but we need to see how growth outside the U.S. transcends," said Charu Chanana, head of FX strategy at Saxo.

A weakening dollar meanwhile brought relief to other currencies, with the euro last at $1.1076, hovering near a five-month peak, and on track to rise more than 3% for the year.

Sterling was similarly on track for a 5% yearly gain, its best performance since 2017. The British pound was last 0.04% higher at $1.2740.

While policymakers at the European Central Bank (ECB) and the Bank of England (BoE) did not signal any imminent rate cuts at their policy meetings this month, traders continue to bet that a Fed pivot and the prospect of lower U.S. rates next year would give room for other major central banks to follow suit.

"We believe central banks in the advanced economies are on pace to pull forward the timing of pivoting to interest rate cuts," said economists at Wells Fargo in their 2024 outlook.

"As far as the outlook for G10 central banks, the 'higher for longer' stance that many institutions adopted in 2023 is becoming less of a priority."

All in, the prospect that 2024 could be a year where major central banks begin easing rates have sparked a risk-on rally, sending global equities higher [MKTS/GLOB].

Global bonds have likewise marched higher, after being battered for the most part of the past two years as interest rates rise. The benchmark 10-year U.S. Treasury yield was last at 3.8387%, having fallen nearly 120 basis points from its 16-year high of 5.021% hit in October. [US/]

Yields fall when bond prices rise.

The risk-sensitive Australian and New Zealand dollars were on track to gain 3.5% and 3% for the month, respectively, though were largely unchanged for the year.

The Aussie, which was last 0.14% higher at $0.68385, looked set to eke out a marginal yearly gain of 0.3%. The kiwi was on track to lose 0.2% for the year.

Both currencies, often used as liquid proxies for the Chinese yuan, have come under pressure as a result of an underwhelming post-COVID economic recovery in China.

ASIA CONTRAST

The yen was meanwhile set to fall more than 7% in 2023, extending into a third straight year of losses, as the Japanese currency continues to come under pressure as a result of the Bank of Japan's (BOJ) ultra-loose monetary policy stance.

While market expectations are for the BOJ to exit negative interest rates in 2024, the central bank continues to stand by its dovish stance and has provided little clues on if, and how, such a scenario could play out.

BOJ Governor Kazuo Ueda said he was in no rush to unwind ultra-loose monetary policy as the risk of inflation running well above 2% and accelerating was small, public broadcaster NHK reported on Wednesday.

A summary of opinions from the BOJ's policy meeting this month showed some policymakers called for deeper debate on a future exit from ultra-loose monetary policy as the economy makes progress toward achieving the bank's price target.

"The outlook for Japan is encouraging going into 2024, with expectations of robust economic growth and improving inflation that shows signs of being sustainable," said Aadish Kumar, international economist at T. Rowe Price, citing a weak currency and accommodative policy stance as "key supports" to the view.

"Any potential moves to tighten policy via a hike in interest rates represent a key risk to the outlook. Given the BOJ will not want to risk undoing all the good work achieved to date, we believe it will remain dovish in its communication and keep policy accommodative."

The yen was last steady at 141.45 per dollar.

In China, the onshore yuan was headed for a yearly loss of nearly 3%, pressured by a faltering post-COVID recovery in the world's second-largest economy.

The country's central bank said on Thursday it would step up macroeconomic policy adjustments to support the economy and promote a rebound in prices, amid signs of rising deflationary pressures.

The yuan last stood at 7.0925 per dollar, while its offshore counterpart was last at 7.0898 per dollar.

(Reuters) - The interest rate on the most common type of U.S. home loan fell for a ninth straight week this week to close out the year at their lowest level since May, according to data released Thursday by Freddie Mac.

The interest rate on a 30-year fixed-rate mortgage averaged 6.61% as of Dec. 28, down from 6.67% a week earlier. The rate has declined each week since hitting the highest level in 22 years in late October, tumbling 1.18 percentage points in that span.

Rates, which had tumbled to below 3% during the height of the COVID-19 pandemic, had surged starting in 2022 when the Federal Reserve began an aggressive rate hiking campaign to rein in inflation.

The Fed recently signaled that it is done with rate hikes and is likely to start lowering them in 2024. Bond markets have responded with a ferocious end-of-year rally that has brought yields on the 10-year Treasury note used to set mortgage rates to below 4% from around 5% in late October.

MEXICO CITY (Reuters) - Mexican and U.S. officials have agreed to work together more closely to tackle record migration at their shared border, the countries' governments said in a joint statement on Thursday, a day after high-level talks on stemming record numbers.

Following a visit to Mexico by U.S. Secretary of State Antony Blinken, the countries said they would seek to strengthen a sponsorship initiative for Venezuelan, Cuban, Nicaraguan and Haitian migrants and look to tackle the root causes of migration.

The delegations, who are set to meet again in Washington next month, also discussed regularizing the situation of beneficiaries of the U.S. Deferred Action for Childhood Arrivals (DACA) program - the so-called Dreamers who were brought into the country illegally as children - and long-time undocumented Hispanic migrants living in the United States.

The talks came after the U.S. temporarily shuttered some border crossings to redeploy agents toward enforcement, sparking a trade slowdown and criticism by Republicans of the Biden administration's border policies. Immigration and the border are expected to be top issues in the U.S. 2024 elections, where President Joe Biden, a Democrat, is running for a second term.

Earlier Thursday, Mexican President Andres Manuel Lopez Obrador said the two parties had agreed to keep border crossings open after the temporary closures.

"This agreement has been reached, the rail crossings and the border bridges are already being opened to normalize the situation," Lopez Obrador told a morning press conference.

Lopez Obrador said Wednesday's meetings with the U.S. delegation were "direct," and he praised the Biden administration's relationship with Mexico.

'FAITH IN GOD'

More than half a million migrants this year crossed the dangerous Darien Gap jungle connecting South America with Central America – double last year's record – with many fleeing crime, poverty and conflict to seek better prospects in the United States.

The latest of a series of caravans of migrants and asylum seekers, many with small children, is slowly walking across southern Mexico, heading towards the U.S border. Lopez Obrador estimated that the caravan counts some 1,500 people but some activists and local media have put the figure at 7,000.

"We have to have faith in God," Honduran migrant Marvin Mejias said as he traveled with his son, who has had foot surgery. Mejias said he hoped the governments had reached a deal which would help him enter the U.S. and be able to work there.

Lopez Obrador said the issue of fentanyl, a powerful and deadly opioid that Mexican cartels have been trafficking into the U.S., was "hardly discussed" in Wednesday's meeting.

The United States has been pressing Mexico to do more to combat fentanyl trafficking, while Mexico has been pushing for stronger U.S. controls to prevent U.S. firearms from reaching the powerful cartels.

By Harry Robertson

LONDON (Reuters) - A huge two-month rally in bond prices, powered by expectations that central banks will soon be cutting interest rates, has rescued fixed income markets from an almost unheard-of third straight year of declines.

The U.S. 10-year Treasury yield, the benchmark for borrowing costs globally, has dropped 50 basis points (bps) in December after falling 53 bps in November. Its two-month fall is the biggest since 2008, when the Federal Reserve was slashing rates during the global financial crisis.

ICE BofA's global broad bond market index, which includes government and corporate debt, has rallied roughly 7% over the last two months -- its strongest eight-week period on record, according to LSEG data which goes back to 1997.

The sharp drop in yields, which move inversely to prices, has eased pressure on companies and households as well as housing markets and governments that in October faced the steepest borrowing costs in more than a decade.

It has also been a balm for highly indebted countries such as Italy, where bond yields are poised for their biggest monthly fall since 2013.

HAWKS TURN DOVISH

Central bankers abruptly changed their tone on inflation in December, fuelling investors' rate-cut bets. That followed a blockbuster November, when data showed U.S. and European inflation falling much faster than expected.

"We were surprised by the strength of this rally," said Oliver Eichmann, head of European fixed income at asset manager DWS.

The Fed's Christopher Waller and the European Central Bank's Isabel Schnabel, both previously renowned monetary policy hawks, softened their language in December and acknowledged - in Schnabel's words - a "remarkable" fall in inflation.

The Fed triggered fresh market euphoria when it used its December meeting to say that rate hikes were over. Fed Chair Jerome Powell notably declined to push back against market bets on deep cuts next year, although the Fed's "dot plot" envisaged three 25 bp cuts in 2024, compared to the more than 150 bps priced in by markets.

"That was a surprise," said Jamie Niven, bond portfolio manager at asset manager Candriam. "And it does leave you with the question, what are they seeing that maybe the market isn't?"

The riskier parts of the bond market, increasingly attractive as investors bet on rate cuts next year, have rallied the most.

Italy's benchmark 10-year bond yield is on track to fall more than 75 bps in December, its biggest monthly drop since the euro zone debt crisis in 2013.

Meanwhile, the spread of junk bond yields over benchmark risk-free rates in the United States and Europe has fallen to its lowest level since the second quarter of 2022.

The two-month jump in bond prices has saved the market from the ignominy of a third year in the red, something not seen in 40 years or more, after two down years driven by inflation and rate hikes.

Bond indexes were in negative territory in October as U.S. growth and inflation kept surprising economists, bolstering the case for higher rates for longer.

The ICE BofA broad bond market index is now heading for an annual gain of around 5%.

Not all investors are convinced their luck will hold.

"It's gone too far," said DWS's Eichmann. He expects more "push-back" from central bankers in the new year and fewer rate cuts than priced in by markets.

BEIJING (Reuters) - China's manufacturing activity likely contracted for the third consecutive month, a Reuters poll showed on Thursday, weighed by soft demand for manufactured goods, a reading that would embolden calls for more policy support.

The official purchasing managers' index (PMI) likely was at 49.5 in December from last month's 49.4, according to the median forecast of 24 economists in a poll conducted 22-28 December. The 50-point mark separates growth from contraction.

The world's second-biggest economy has staggered following a feeble post-pandemic recovery, held back by a property crisis, local government debt risks and slow global growth.

The government has in recent months unveiled a series of measures to prop up growth.

Only three of 24 economists expected an expansion of factory activity in December, with the highest forecast reading of 50.5, showed the poll.

New bank lending in China jumped less than expected in November, even as the central bank keeps policy accommodative to lift confidence and spur the recovery.

Ratings agency Moody's (NYSE:MCO) in December slapped a downgrade warning on China's credit rating as property pressures mount.

China will strive to expand domestic demand, ensure a speedy economic recovery and promote stable growth, according to an interim report on the country's 14th five-year plan published by parliament on Wednesday.

The official PMI will be released on Sunday. The private Caixin factory survey will be issued on Tuesday, and analysts expect its reading to slowed to 50.4 from an unexpected expansion reading of 50.7 in November.

By Stephen Culp

NEW YORK (Reuters) -U.S. stocks closed slightly higher in languid trading on Wednesday, with little market-moving news to fuel conviction as the S&P 500 hovered just below bull market confirmation.

The three major U.S. stock indexes oscillated between modest gains and losses throughout the session but finished up for the day. All are on course for monthly, quarterly, and annual gains.

The S&P 500 ended 0.3% below its record closing high of 4,796.56 reached on Jan. 3, 2022. The Dow notched a new record closing high.

"When you have very few catalysts and minimal trading activity you tend to see continuation of the trends," said Chuck Carlson, chief executive officer at Horizon Investment Services in Hammond, Indiana.

"We’ve got three days left of trading in the year," Carlson added. "That means three days left of tax harvesting, three days of portfolio window dressing ... those sort of things can get magnified because of the lack of trading volume."

Reaching a new record close would confirm the bellwether index entered a bull market when it reached the bear market closing trough in October 2022.

"Those kind of milestones are important because they can generate activity for investors who are sitting on the fence," Carlson said.

In the wake of Friday's cooler-than-expected U.S. PCE price index data, bets are firming that the Fed will start issue its first rate cut as soon as March, which is supporting interest rate sensitive shares and giving Wall Street's major indexes an upward bias.

At last glance, financial markets have priced in a 73.9% probability that policymakers will reduce the Fed funds target rate by 25 basis points at the conclusion of their March policy meeting, according to CME's FedWatch tool.

The Dow Jones Industrial Average rose 111.19 points, or 0.3%, to 37,656.52, the S&P 500 gained 6.83 points, or 0.14%, to 4,781.58 and the Nasdaq Composite added 24.60 points, or 0.16%, to 15,099.18.

Among the 11 major sectors in the S&P 500, real estate enjoyed the largest percentage gain, while energy shares, weighed down by falling crude prices, lost the most.

Shares of Bit Digital jumped 18.6% following the bitcoin miner's announcement that it plans to double its mining operations.

Coherus BioSciences rose 23.6% after the U.S. Food and Drug Administration approved its drug delivery device for its infection-fighting treatment.

First Wave BioPharma shares surged 49.6% after the drug developer agreed to sell its inflammatory bowel disease drug to an undisclosed company.

Cytokinetics (NASDAQ:CYTK) soared 82.6% after its experimental heart disease drug met the main goal of late-stage study, putting it on track to compete with a rival treatment from Bristol Myers (NYSE:BMY) Squibb.

Advancing issues outnumbered declining ones on the NYSE by a 1.86-to-1 ratio; on Nasdaq, a 1.46-to-1 ratio favored advancers.

The S&P 500 posted 50 new 52-week highs and no new lows; the Nasdaq Composite recorded 218 new highs and 60 new lows.

Volume on U.S. exchanges was 11.96 billion shares, compared with the 12.67 billion average for the full session over the last 20 trading days.

WASHINGTON (Reuters) - The U.S. will provide up to $250 million in arms and equipment to Ukraine in the final package of aid this year to help Kyiv in its war with Russia, Secretary of State Antony Blinken said on Wednesday.

President Joe Biden has asked Congress to provide another $61 billion in aid to Ukraine, but Republicans are refusing to approve the assistance without an agreement with Democrats to tighten security along the U.S.-Mexico border.

The White House has warned that without the additional appropriation U.S. aid will run out by the end of the year for Ukraine's fight to retake territory occupied by Russian forces since it invaded in February 2022.

Blinken said the latest aid package included air defense munitions, additional ammunition for high-mobility artillery rocket systems, artillery ammunition, anti-armor munitions and over 15 million rounds of ammunition.

Congress has approved more than $110 billion for Ukraine since Russia's invasion, but it has not approved any funds since Republicans took control of the House of Representatives from Democrats in January 2023.

By Koh Gui Qing and Dhara Ranasinghe

NEW YORK/LONDON (Reuters) -World stocks rallied to their highest level in more than a year on Wednesday, while the U.S. dollar hit a five-month low, as expectations mounted that key central banks such as the Federal Reserve will start to cut interest rates early next year.

In line with expectations of lower interest rates, the benchmark 10-year Treasury yield fell to a five-month low, while the two-year Treasury yield tumbled to a low not seen in seven months.

Investor hopes that monetary conditions might be loosening boosted the MSCI's gauge of stocks across the globe by 0.46% to a level not seen since October 2022.

On Wall Street, the Dow Jones Industrial Average added 0.21%, while the S&P 500 and the Nasdaq Composite were flat.

European shares edged up 0.21%, with trade subdued given public holidays across the region on Monday and Tuesday.

Analysts said the main risk for markets was that rates might not fall as fast as expected.

"If global equity markets have one Achilles' heel going into January 2024, it is the expectation that the Fed will be methodically and consistently cutting interest rates throughout the year," said Nicholas Colas, Co-founder of DataTrek Research.

The benchmark 10-year Treasury yield fell to 3.793%, and the 2-year yield retreated to 4.2375%. [US/]

Expectations of rate cuts also dragged on the U.S. dollar, which fell 0.51% against a basket of six major currencies to a level last seen on Jul. 27. [USD/]

The jovial mood in world equity markets and a sluggish dollar lifted the euro by 0.54% to $1.1102, more than a four-month peak.

“If the Fed cuts rates because inflation has come so far down that they don’t want policy to unintentionally tighten ... then that’s probably a good scenario,” said Lou Brien, market strategist at DRW Trading in Chicago.

If they cut because of a weakening economy, however, “then the history is kind of harsh” for the economy and the stock market. “The motivation behind the rate cuts is still unknown and is going to be the most important factor,” Brien said.

Market pricing shows a more than 80% chance the Fed is likely to begin cutting rates next March, according to the CME FedWatch tool, with over 150 basis points of easing priced in for all of 2024.

Oil prices slipped as some major shippers returned to the Red Sea - an area disrupted after Yemen's Houthi militant group began targeting vessels earlier this month.

U.S. crude fell 2.02% to $74.04 per barrel and Brent was at $79.6, down 1.81% on the day.

Maersk shares fell more than 4.5%, and other shipping stocks also declined, giving back part of this month's gains that were driven by expectations a Red Sea traffic halt could boost rates.

In Asia, MSCI's broadest index of Asia-Pacific shares outside Japan rose more than 1% to an over four-month high.

China's November industrial profits posted double-digit gains as overall manufacturing improved, data showed, although soft demand continued to constrain business growth expectations, emboldening calls for more macro policy support.

Japan's Nikkei rallied more than 1%, and Hong Kong's Hang Seng Index rose 1.7% in its first trading day after the Christmas and Boxing Day holidays. Chinese blue chips eked out a marginal gain of 0.35%.

Spot gold added 0.5% to $2,077.39 an ounce [GOL/], while Bitcoin jumped rose 2.08% to $43,393.00.

By Ankur Banerjee

SINGAPORE (Reuters) -The dollar remained under pressure on Wednesday and the euro was close to a four-month peak, as expectations that the Federal Reserve would soon cut interest rates took hold in the market, with thin year-end flows keeping movements limited.

With many traders out for holidays, volumes are likely to be muted until the New Year.

The dollar index, which measures the U.S. currency against six rivals, was at 101.47, just shy of the five-month low of 101.42 it touched last week. The index is on course for a 1.9% drop in 2023 after two straight years of strong gains, driven by first the anticipation of and then the actual hiking of rates by the Fed to battle inflation.

"With little to speak of on the economic calendar for this week between global holidays, we do not expect a large swing in pricing to wrap up this calendar year," analysts at Monex USA said in a note.

The recent weakness in the dollar - the index is set to clock a second straight month of losses - has been the result of the markets anticipating rate cuts from the Fed next year, denting the appeal of the greenback.

Markets are now pricing in a 79% chance of a rate cut starting in March 2024, according to CME FedWatch tool, with over 150 basis points of cuts priced in for next year.

Data showing cooling inflation has emboldened bets of easing next year.

"Disinflation is proving entrenched (and) expectations are for central banks to pivot next year while growth is still trudging along," said Christopher Wong, a currency strategist at OCBC in Singapore.

"This paints a goldilocks market that is favourable for risk proxies."

The Australian dollar and the New Zealand dollar both touched a fresh five-month peak earlier in the session. The Aussie last bought $0.6828, while the kiwi was at $0.6333.

Meanwhile, the euro was down 0.04% at $1.10385, having touched a four-month high of $1.1045 on Tuesday. The single currency is up nearly 3% in the year and is on course for a third straight month of gains, matching the run it had last year.

The Japanese yen weakened 0.14% to 142.58 per dollar and is headed for an 8% drop in the year although the Asian currency has witnessed a bout of strength in recent weeks as traders wager that the Bank of Japan will soon exit its ultra-loose policy.

A summary of opinions at the central bank's Dec. 18-19 meeting showed that BOJ policymakers saw the need to maintain its ultra-easy monetary policy for now, with some calling for a deeper debate on a future exit from massive stimulus.

The summary of opinions was somewhat dovish and showed no sense of urgency to end the ultra-loose policies, according to Saxo strategists.

The likely timing of the end of the policies will be later than what the market is anticipating, the Saxo strategists said in a note.

========================================================

Currency bid prices at 0555 GMT

Description RIC Last U.S. Close Pct Change YTD Pct High Bid Low Bid

Previous Change

Session

Euro/Dollar $1.1041 $1.1043 +0.00% +3.05% +1.1044 +1.1029

Dollar/Yen 142.5600 142.3900 +0.17% +8.69% +142.8400 +142.4500

Euro/Yen 157.41 157.23 +0.11% +12.20% +157.6700 +157.1600

Dollar/Swiss 0.8535 0.8537 -0.01% -7.69% +0.8545 +0.8535

Sterling/Dollar 1.2730 1.2723 +0.03% +5.24% +1.2732 +1.2720

Dollar/Canadian 1.3189 1.3195 -0.06% -2.67% +1.3210 +1.3187

Aussie/Dollar 0.6828 0.6825 +0.05% +0.18% +0.6840 +0.6818

NZ 0.6333 0.6329 +0.09% -0.24% +0.6336 +0.6321

Dollar/Dollar

All spots

Tokyo spots

Europe spots

Volatilities

Tokyo Forex market info from BOJ

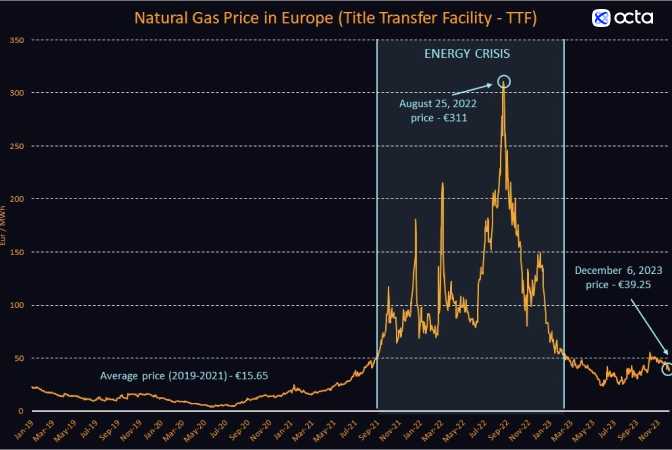

Europe faced an unprecedented energy crisis for around seventeen months (from September 2021 to February 2023), as coal, natural gas, and electricity prices surged to all-time highs. Governments across the continent rushed in to introduce energy-saving measures and implement conservation policies, while households and businesses had to cut consumption rapidly.

Now, as 2023 draws to a close, can we confidently conclude that the energy crisis in Europe is over? How prepared is Europe to cope with the upcoming winter? What are the risks and challenges that lie ahead?

The energy crisis's most acute phase occurred in the summer of 2022. One only needs to look at the evolution of Europe's benchmark natural gas price (TTF) to assess the scale of the emergency (see the chart above). On 25 August 2022, TTF price reached €311 per megawatt-hour (MWh), the highest level ever recorded. On that specific day, the price was 44% above the previous maximum reached on March 7, 2022, and was a staggering 18 times higher than the three-year average price recorded over 2019-2021. Despite Europe's gas storage sites being 78% full in August 2022, supply worries were rife as imports from Russia dropped by around 60%, forcing Europe to rely extensively on liquefied natural gas (LNG) imports—especially from the United States. However, the aggregate supply of LNG in the global market at that time was reduced as one of the U.S. LNG export plants—Freeport LNG—had to go offline due to an explosion incident. Thus, to secure an adequate number of LNG cargoes, Europe had to outbid other customers in South and East Asia by agreeing to pay higher prices to suppliers.

A lot has changed since last summer. The European gas prices have returned to normality but remain above the level observed before the crisis. On Monday, 6 December, the front-month futures contract for delivery in January at TTF settled at €39.25 per MWh, 87% below the peak observed in August 2022 but still some two times above the historical average seen in 2019-2021. Kar Yong Ang, Octa analyst singles out several reasons for normalisation:

‘Although natural gas prices in Europe remain higher than they were before the crisis, the situation has improved dramatically. There are several reasons for this. First, there was a structural loss of demand partly due to reduced economic activity and partly due to conservation policies. Second, imports of pipeline gas and that of LNG increased. On top of it, there was a bit of luck as well, as weather conditions allowed the Europeans to build the stocks faster than normal.’

Indeed, probably the most painful adjustment that Europe had to endure was the loss of demand. According to Eurostat, total gas use in the EU's top 6 consuming countries—Germany, Italy, France, Netherlands, Spain, and Poland—was down by 17% in the first ten months of 2023 compared with the five-year average for 2017-2021. Obviously, energy-intensive industries such as chemicals and steel production had to bear the brunt of adjustment. For example, according to Statistisches Bundesamt, Germany's energy-intensive manufacturing production has decreased by about 20% since the start of 2022 and has not shown any signs of recovery yet.

Thus, Europe had to rely on imports more and more to balance its natural gas market. Russia has long been the main supplier of affordable pipeline gas into Europe, but geopolitical tensions, sanctions, and explosions of the Nord Stream pipeline have brought the flows to a minimum. According to Eurostat, Russia exported just 22.3 billion cubic metres of natural gas into Europe in the first nine months of 2023, which is 57% lower than during the same period in 2022 and 65% lower than during the same period in 2021. Concurrently, imports of LNG from the United States reached 30.01 billion cubic metres during the first nine months of the year, up a whopping 185% from the same period in 2021.

‘Overall, Europe has managed to bring its natural gas inventories to a rather comfortable level and is now well-protected to withstand future supply shocks,’ says Kar Yong Ang, Octa analyst. Indeed, according to the latest data from Gas Infrastructure Europe, gas storage levels are at record highs for this time of the year at around 94% full, said the Octa analyst, adding that the general bias for TTF price remains bearish. ‘I would not be surprised to see European natural gas prices drop to €30 per MWh in case of a normal winter. Alternatively, if this upcoming winter turns out to be colder than normal, we might see TTF temporarily hitting €60 per MWh.’

However, Kar Yong Ang says that different kinds of challenges and risks lie ahead for Europe. ‘It appears that Europe is placing too much faith in LNG. It's betting too much on a single supply source, which may backfire in the long run. If Europe is to permanently replace relatively cheap pipeline imports from Russia with expensive LNG imports, then, I am afraid, economic activity in its traditional industries may never recover to the pre-crisis levels.’

Indeed, Europe's top competitors—the United States and China—benefit from lower prices. The United States has ample resources at home, while China is getting cheap imports from Russia. Europe risks losing its competitive standing in the global marketplace. Furthermore, as we explained at the beginning of the article, the temporary shutdown of a single LNG export plant in the U.S. has already highlighted how strongly European energy security is now connected with the intricacies of the global LNG market. Most recently, Houthi militants in Yemen have stepped up attacks on vessels in the Red Sea, which has already prompted some LNG vessels to reroute in order to avoid Bab-el-Mandeb strait between Yemen and Djibouti. So far, the maritime attacks in the region have had a much stronger impact on the price of oil, but natural gas and LNG markets could also be affected.

‘With supply options more limited than in the past, European consumers will have to get used to more volatile natural gas prices, as they will increasingly be determined by the whims of the weather and by the bargaining power of other LNG importers in Asia,’ says Kar Yong Ang, Octa analyst.

Europe has survived the energy crisis and managed to adapt but has done so at the cost of lower demand and reduced economic activity. Now, Europe will have to learn to navigate the global LNG trade successfully to secure the most favourable deals.