Select Language

By Hyonhee Shin

SEOUL (Reuters) - North Korean leader Kim Jong Un has kicked off a key meeting of the country's ruling party, state media KCNA reported on Wednesday, setting the stage for unveiling policy decisions for the new year.

The ninth Plenary Meeting of the 8th Central Committee of the Workers' Party of Korea wraps up a year during which the isolated country enshrined nuclear policy in its constitution, successfully launched a spy satellite and fired a new intercontinental ballistic missile (ICBM).

The days-long assembly of the party and government officials has been used in recent years to make key policy announcements. Previously, state media released Kim's speech on New Year's Day.

On the first day of the meeting on Tuesday, participants discussed six major agenda items, including this year's policy and budget implementation, a draft budget for 2024 and ways to bolster the party's leadership, KCNA said.

Kim "defined 2023 as a year of great turn and great change," lauding progress in all areas including the military, economy, science and public health despite some "deviations," it said.

He presented a detailed report involving "indices of the overall national economy which is clearly proving that the comprehensive development of socialist construction is being pushed forward in real earnest," KCNA said.

The development of new strategic weapons including the reconnaissance satellite has put the country "on the position of a military power," it added.

Tension has rekindled in recent weeks after North Korea tested its newest ICBM which it said was aimed at gauging the war readiness of its nuclear forces against mounting U.S. hostility.

Kim also said last week that Pyongyang would not hesitate to launch a nuclear attack if an enemy provokes it with nuclear weapons.

The United States, South Korea and Japan condemned the missile test, and activated a system to detect and assess North Korea's missile launches in real-time and established a multi-year trilateral military exercise plan.

LONDON (Reuters) - Ethiopia became Africa's third default in as many years on Tuesday after it failed to make a $33 million "coupon" payment on its only international government bond.

Africa's second most populous country announced earlier this month that it intended to formally go into default, having been under severe financial strain in the wake of the COVID-19 pandemic and a two-year civil war that ended in November 2022.

It had been supposed to make the payment on Dec. 11, but technically had up until Tuesday to provide the money due to a 14-day 'grace period' clause written into the $1 billion bond.

According to two sources familiar with the situation, bondholders had not been paid the coupon as of the end of Friday Dec. 22, the last international banking working day before the grace period expires.

Ethiopian government officials did not respond to requests for comment on Friday or over the weekend, but the widely-expected default will see it join two other African nations, Zambia and Ghana, in a full-scale "Common Framework" restructuring.

The East African country first requested debt relief under the G20-led initiative in early 2021.

Progress was initially delayed by the civil war but, with its foreign exchange reserves depleted and inflation soaring, Ethiopia's official sector government creditors, including China agreed to a debt service suspension deal in November.

On Dec. 8, the government said parallel negotiations it had been having with pension funds and other private sector creditors that hold its bond had broken down.

Credit ratings agency S&P Global then downgraded the bond, to "Default" on Dec. 15 on the assumption that the coupon payment would not be made.

(Reuters) -U.S. retail sales rose 3.1% between Nov. 1 and Dec. 24, as shoppers looked for last-minute Christmas deals amid big promotions, a Mastercard (NYSE:MA) report showed on Tuesday.

The increase is lower than the 3.7% growth Mastercard forecast in September and last year's 7.6% rise as higher interest rates and inflation pressured consumer spending.

Amazon.com (NASDAQ:AMZN) and Walmart (NYSE:WMT) ramped up promotions through November in the United States to entice bargain-hunting shoppers, but analysts said that the discounts were not as deep as the prior year, when retailers were saddled with excess stock after the pandemic.

Some of those discounts were rolled back starting in December, when customers were expected to buy last-minute gifts and household goods on the Saturday before Christmas - dubbed "Super Saturday."

Arun Sundaram, an analyst at CRFA Research, said many shoppers waited for Black Friday and Cyber Monday to make holiday purchases and finished the final sprint during Super Saturday.

"Consumers are still spending, but they're still price conscious and want to stretch their budgets," Sundaram said. He said the weeks between Cyber Monday and Super Saturday were a "soft period" for spending, but shoppers used the final weekend before Christmas to look for "big deals."

Ecommerce sales grew at the slower pace of 6.3% compared to last year's 10.6% as the popularity of online shopping came off pandemic highs, the report showed.

Sales in the apparel and restaurant categories rose 2.4% and 7.8%, respectively, during the holiday shopping period, according to the Mastercard SpendingPulse report, while sales of electronics fell 0.4%.

Mastercard SpendingPulse measures in-store and online retail sales across all forms of payment. It excludes automotive sales.

LONDON (Reuters) - Ethiopia became Africa's third default in as many years on Tuesday after it failed to make a $33 million "coupon" payment on its only international government bond.

Africa's second most populous country announced earlier this month that it intended to formally go into default, having been under severe financial strain in the wake of the COVID-19 pandemic and a two-year civil war that ended in November 2022.

It had been supposed to make the payment on Dec. 11, but technically had up until Tuesday to provide the money due to a 14-day 'grace period' clause written into the $1 billion bond.

According to two sources familiar with the situation, bondholders had not been paid the coupon as of the end of Friday Dec. 22, the last international banking working day before the grace period expires.

Ethiopian government officials did not respond to requests for comment on Friday or over the weekend, but the widely-expected default will see it join two other African nations, Zambia and Ghana, in a full-scale "Common Framework" restructuring.

The East African country first requested debt relief under the G20-led initiative in early 2021.

Progress was initially delayed by the civil war but, with its foreign exchange reserves depleted and inflation soaring, Ethiopia's official sector government creditors, including China agreed to a debt service suspension deal in November.

On Dec. 8, the government said parallel negotiations it had been having with pension funds and other private sector creditors that hold its bond had broken down.

Credit ratings agency S&P Global then downgraded the bond, to "Default" on Dec. 15 on the assumption that the coupon payment would not be made.

MANILA (Reuters) - Philippine President Ferdinand Marcos Jr. has approved the extension of reduced tariffs on rice and other food items until the end-2024 to keep prices stable amid a threat of dry weather in the coming months, his office said on Tuesday.

The modified rates first approved in 2021 had already been extended this year due to high inflation, and Marcos said another extension was needed until the end of next year.

"The present economic condition warrants the continued application of the reduced tariff rates on rice, corn, and (pork)...to maintain affordable prices for the purpose of ensuring food security," Marcos was quoted as saying in a statement.

Inflation was at 4.1% in November, easing for a second straight month, but has averaged 6.2% in the first 11 months of 2023, well outside the Philippine central bank's 2%-4% target for the year.

The extension of the modified tariffs, Marcos said, is aimed at ensuring affordable prices of rice, corn and meat products with the looming effects of the El Nino dry weather phenomenon early next year and the continued threat of African Swine Fever.

The tariff rate for rice will remain at 35%, while import levies on corn will stay at 5%-15% and 15%-25% for pork products, according to the new executive order extending the modified tariff rates.

NEW DELHI (Reuters) - The Indian government said on Friday a warning from the International Monetary Fund (IMF) that the country's debt to GDP ratio could hit 100% was a worst-case scenario, and not a "fait accompli".

The IMF, in a so-called article IV review, said India's general government debt, which includes federal and state government debt, could be 100% of GDP under adverse circumstances by fiscal 2028.

India's finance ministry said this was "a worst-case scenario and is not fait accompli".

India's debt to GDP ratio, which was 81% in 2022/23, may decline to below 70% in the same period under favourable circumstances, the IMF report also said, according to the ministry.

"Therefore, any interpretation that the report implies that General Government debt would exceed 100% of GDP in the medium term is misconstrued," the ministry added.

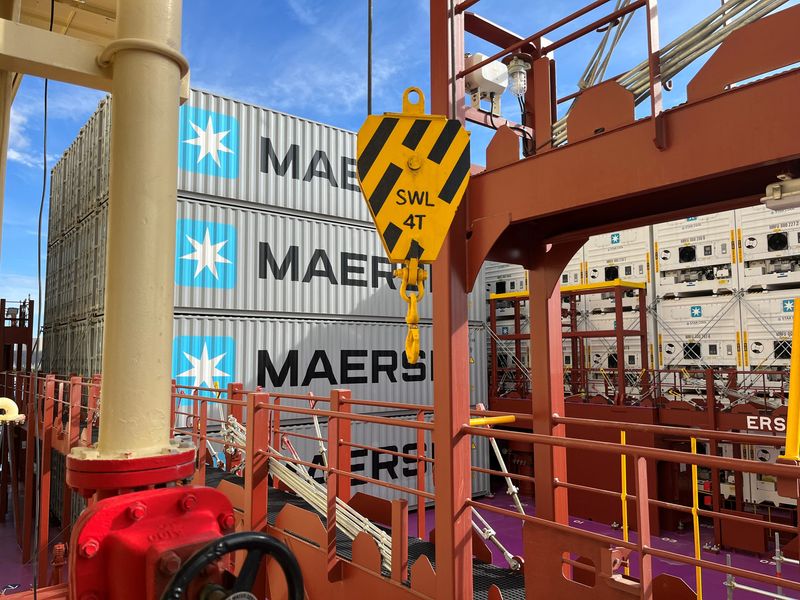

By Terje Solsvik and Gus Trompiz

OSLO/PARIS (Reuters) -Some of the world's largest shipping firms, including Maersk and CMA CGM, will impose extra charges after they re-routed ships in response to attacks on vessels in the Red Sea, as worries about disruption to global trade grow.

The surcharges, designed to cover longer voyages around Africa compared with routes via the Suez Canal, will add to rising costs for sea transport since Yemen's Houthi militant group started targeting vessels.

Maersk and CMA CGM were the first to introduce the fees, followed by Germany's Hapag-Lloyd later on Friday.

The three are among leading shipping lines to have suspended the passage of vessels through the Red Sea that connects with the Suez Canal, the quickest sea route between Asia and Europe.

Instead, they are directing ships around the Cape of Good Hope at the southern tip of Africa, adding about 10 days to a journey that would normally take about 27 days from China to northern Europe.

Citing "severe operational disruption", Maersk said late on Thursday it was imposing an immediate transit disruption surcharge (TDS) to cover extra costs associated with the longer journey, plus a peak season surcharge (PSS) from Jan. 1.

Hapag-Lloyd has said it would redirect 25 ships by the end of the year to avoid the area.

On Friday, Chinese automaker Geely told Reuters its electric vehicle sales were likely to be hurt by a delay in deliveries to Europe, the latest company to warn of disruption.

China's second largest automaker by sales said most of the shipping firms it uses for European exports have plans to go around southern Africa.

The alert bodes ill for other automakers in China as they seek to increase exports to Europe due to overcapacity and weak demand at home.

The United States has announced a multinational force to patrol the Red Sea, but shipping sources say details have yet to emerge and companies continue to avoid the area.

In a message to customers, logistics firm CH Robinson Worldwide (NASDAQ:CHRW) said it had re-routed more than 25 vessels to southern Africa over the past week.

"That number will likely continue to grow due to ongoing war risks in the Red Sea and the drought in the Panama Canal," it said.

SURCHARGES

CH Robinson said cancellations and rate increases were expected to continue into the first quarter and recommended customers book 4-6 weeks in advance to ensure space on vessels.

Maersk said a standard 20-foot container travelling from China to Northern Europe now faced total extra charges of $700, consisting of a $200 TDS and $500 PSS.

Containers bound for the east coast of North America will be charged $500 each, consisting of the $200 TDS payment and a $300 PSS, the company added.

Maersk also said routes in other parts of its network would be affected by the Suez disruption, triggering emergency contingency surcharges on a wide range of journeys.

CMA CGM announced surcharges late on Thursday including an extra $325 per 20-foot container on the North Europe to Asia route and $500 per 20-foot container for Asia to the Mediterranean.

The charges were part of its contingency plan to re-route vessels around the Cape of Good Hope, it said.

France-based CMA CGM listed 22 of its vessels as having been re-routed.

MOSCOW (Reuters) - Russia was short of around 4.8 million workers in 2023 and the problem will remain acute in 2024, the Izvestia newspaper reported on Sunday, citing experts and research from the Russian Academy of Science's Institute of Economics.

Central Bank Governor Elvira Nabiullina said last month that Russia's depleted labour force was causing acute labour shortages and threatening economic growth as Moscow pumps fiscal and physical resources into the military.

Hundreds of thousands of Russians left the country following what the Kremlin calls its special military operation in Ukraine which began in February 2022, including highly-qualified IT specialists.

Those who took flight either disagreed with the war or feared being called up to fight in it.

The outflows intensified after President Vladimir Putin, who earlier this month lauded a historically low jobless rate of 2.9%, announced a partial military mobilisation of around 300,000 recruits in September 2022.

Putin has said he sees no need for a new wave of mobilisation for now.

Izvestia, citing the author of the research, Nikolai Akhapkin, said that labour shortages had sharply increased in 2022 and 2023. It said that drivers and shop workers were in particularly high demand.

According to official data, cited by the newspaper, the number of vacancies in the total workforce rose to 6.8% by the middle of 2023, up from 5.8% a year earlier.

"If we extend the data presented by Rosstat (the official statistics agency) to the entire workforce, the shortage of workers in 2023 will tentatively amount to 4.8 million people," the newspaper cited the new research as saying.

It noted that Labour Minister Anton Kotyakov had said that workforce shortages were felt hard in the manufacturing, construction and transportation sectors, forcing companies to raise wages to try to attract more employees.

The newspaper cited Tatyana Zakharova of Russia's University of Economics named after G.V. Plekhanov as saying that the labour shortages would probably persist next year, as vacancies for factory workers, engineers, doctors, teachers and other professions would he especially hard to fill.

She cited poor demographics and "the migration of the population" as among the reasons for the labour shortages.

By Siyi Liu and Dominique Patton

BEIJING (Reuters) - This Dec. 21 story has been corrected to clarify that the ban was on the export of technology to make rare earth magnets and that the ban on technology to extract and separate critical materials was already in place, in paragraphs 1 and 6. It also removes context and the comment on rare earth processing operations, in paragraphs 3 and paragraphs 18-20.

China, the world's top processor of rare earths, banned the export of technology to make rare earth magnets on Thursday, adding it to a ban already in place on technology to extract and separate the critical materials.

Rare earths are a group of 17 metals used to make magnets that turn power into motion for use in electric vehicles, wind turbines and electronics.

"This should be a clarion call that dependence on China in any part of the value chain is not sustainable," said Nathan Picarsic, co-founder of the geopolitical consulting firm Horizon Advisory.

China's commerce ministry sought public opinion last December on the potential move to add the technology to prepare smarium-cobalt magnets, neodymium-iron-boron magnets and cerium magnets to its "Catalogue of Technologies Prohibited and Restricted from Export."

In the list it also banned technology to make rare-earth calcium oxyborate and production technology for rare earth metals, adding them to a previous ban on production of rare earth alloy materials.

The catalogue's stated aims include protecting national security and public interest.

China has significantly tightened rules guiding exports of several metals this year, in an escalating battle with the West over control of critical minerals.

It introduced export permits for chipmaking materials gallium and germanium in August, followed by similar requirements for several types of graphite since Dec. 1.

"China is driven to maintain its market dominance," said Don Swartz, CEO of American Rare Earths, which is developing a rare earths mine and processing facility in Wyoming. "This is now a race."

WEST STRUGGLES

The move to protect its rare earth technology comes as Europe and the United States scramble to wean themselves off rare earths from China, which accounts for nearly 90% of global refined output.

China has mastered the solvent extraction process to refine the strategic minerals, which MP Materials and other Western rare earth companies have struggled to deploy due to technical complexities and pollution concerns.

Shares of MP, which has slowly begun increasing rare earths processing in California, jumped more than 10% on Thursday after China's move. The company did not immediately respond to requests for comment.

Ucore Rare Metals said on Thursday that it had finished commissioning of a facility to test its own rare earths processing technology, which is being funded in part by the U.S. Department of Defense.

"New technologies will be needed to outmaneuver the Chinese grip on these important areas," said Ucore CEO Pat Ryan. Ucore's stock rose more than 16%.

It is not clear to what extent China's rare earths technology is actually being exported. Beijing has discouraged its export for years, said Constantine Karayannopoulos, former CEO of Neo Performance Materials, which separates rare earths in Estonia.

"This announcement just formalises what everyone knew to be the case," Karayannopoulos said.

By Tom Westbrook

SINGAPORE (Reuters) -Chinese internet stocks slumped on regulatory news on Friday to drag Asian stocks down for the final full trading week of the year, while the dollar wobbled ahead of U.S. inflation data that's expected to validate bets on rate cuts in 2024.

MSCI's broadest index of Asia-Pacific shares outside Japan gave up gains to trade 0.3% lower after China issued draft rules that would impose spending limits on gamers. For the week the index is down 0.6%.

Netease stock was down 29% at one point and Tencent shares more than 12%, pulling the Hang Seng 1.2% lower.

"It's not necessarily the regulation itself - it's the policy risk that's too high," said Steven Leung, executive director of institutional sales at broker UOB Kay Hian in Hong Kong.

"People had thought this kind of risk should have been over and had started to look at fundamentals again. It hurts confidence a lot."

Banking shares helped Japan's Nikkei rise 0.2%. The euro poked above $1.10.

Outside Asia, markets have been in a festive mood for weeks as inflation data around the world has showed a slowdown and the Federal Reserve signalled it was done raising interest rates.

Two-year U.S. Treasury yields are down almost 38 basis points in a week and a half and fell 2 bps overnight when third-quarter U.S. core PCE inflation was revised down to 2%.

The data has markets girding for a downside surprise on the last key number before Christmas, November's personal consumption expenditure index, due at 1330 GMT with consensus expectations for a monthly increase of 0.2%.

"Analysts are confident it shouldn't be higher than 0.2%," said National Australia Bank (OTC:NABZY)'s head of currency strategy Ray Attrill in Sydney.

"Could we get 0.1%? It'd probably take a 0.1% to see and extension of the moves we have seen."

Overnight U.S. stocks bounced back from a sudden slide at the end of Wednesday's session and the S&P 500 rose 1%.

The index is within 2% of its record high.

S&P 500 futures dipped 0.1% in Asia and Nike (NYSE:NKE) shares slid almost 12% in after-hours trade after the company cut its sales forecast, blaming cautious consumers.

European futures were flat.

Oil is set for a weekly gain on nervousness about the security of Red Sea shipping, but prices fell overnight after Angola said it would quit OPEC, raising questions about the producer group's efforts to limit global supply. [O/R]

Brent crude futures were up 58 cents to $79.97 a barrel in Asia trade on Friday, for a weekly gain of 4.5%.

TALE OF TWO HAVENS

In currency trade the dollar has come under pressure from markets' expectation of more than 150 bps of rate cuts in 2024.

At $1.1002 the euro is up 1% this week, even though a similar amount of cuts are priced in for Europe next year. The common currency is also up about 1% against sterling, which fell sharply this week after a surprise dive in inflation.

Sterling was set for its biggest weekly drop on the euro and against the Aussie dollar for three months. It last bought $1.2686 and traded at 86.71 pence per euro.

The dollar index is down 0.7% this week to 101.85. For the year it is down 2.4%. Among G10 currencies the best performer of the year was the Swiss franc, up nearly 8% on the dollar, while the yen's 7.8% drop made it the worst.

NAB's Attrill noted the mirror moves of the two so-called "safe haven" currencies underscored the overwhelming influence of the Bank of Japan's (BOJ) monetary policy. It has stuck with negative interest rates while the rest of the world has hiked.

The dollar rose marginally to 142.43 yen on Friday.

Gold is set to end the week and the year ahead, with a 12% gain so far this year to $2,049 an ounce.

Bitcoin is up 160% this year to $44,114.