Select Language

By Joe Cash

BEIJING (Reuters) -China's manufacturing activity shrank for a second straight month in November and at a quicker pace, suggesting more stimulus will be needed to shore up economic growth and restore confidence that the authorities can ably support industry.

Economists upgraded their forecasts for the world's second-largest economy after better-than-expected third quarter data, but despite a flurry of policy support measures, negative sentiment among factory managers appears to have become entrenched in the face of weak demand both at home and abroad.

The official purchasing managers' index (PMI) fell to 49.4 in November from 49.5 in October, National Bureau of Statistics data showed on Thursday, missing economists' forecast of 49.7. The 50-point mark demarcates contraction from expansion.

"The domestic market cannot make up for losses in Europe and the United States. The data shows that factories are producing less and hiring fewer people," said Dan Wang, chief economist at Hang Seng Bank China.

"(The data) could also show a loss of confidence in government policy," she added, warning factory activity was unlikely to improve anytime soon as other economic problems dominate. "The priority now is clearly containing the local government debt risk and the risk posed by regional banks."

The new orders sub-index contracted for a second consecutive month, while the new export orders component extended its decline for a ninth month.

In another worrying sign, the vast services sector contracted for the first time in 12 months. The non-manufacturing PMI, which includes services and construction, eased to 50.2 in November from 50.6 last month.

China's economy has struggled this year to mount a strong post-pandemic recovery, held back by a deepening crisis in the property market, local government debt risks, slow global growth and geopolitical tensions.

The factory PMI has contracted for seven out of the past eight months - rising above the 50-point mark only in September. The last time the indicator was negative for more than three consecutive months was in the six months to October 2019.

"The hard data have held up better than the survey-based measures lately... (which) may be overstating the extent of slowdown due to sentiment effects," Sheana Yue, China economist at Capital Economics, said in a note.

"But if that starts to change, policy support will need to be ramped up further to prevent the economy from backsliding."

The patchy recovery has prompted many analysts to warn that China may decline into Japanese-style stagnation later this decade unless policymakers take steps to reorient the economy towards household consumption and market-allocation of resources.

"Today's PMI reading will further raise expectations towards policy support," said Zhou Hao, economist at Guotai Junan International. "Fiscal policy will be under the spotlight and take centre stage over the coming year and will be closely monitored by the market."

Oil prices fell in early Asia following weaker-than-expected manufacturing activity in China, the world's largest energy consumer, while the offshore yuan also slipped.

MORE SUPPORT NEEDED

China's central bank governor on Tuesday said he was "confident that China will enjoy healthy and sustainable growth in 2024 and beyond," but urged structural reforms to reduce reliance on infrastructure and property for growth.

Policy advisers say the government will need to implement further stimulus should it wish to sustain an annual economic growth target of "around 5%" next year, which would match this year's goal.

But the People's Bank of China (PBOC) is constrained when it comes to implementing further monetary stimulus over concerns a widening interest rate differential with the West may weaken the currency and spur capital outflows.

In October, China unveiled a plan to issue 1 trillion yuan ($138.7 billion) in sovereign bonds by the end of the year, raising the 2023 budget deficit target to 3.8% of GDP from the original 3%.

The PBOC has also implemented modest interest rate cuts and pumped more cash into the economy in recent months, pledging to sustain policy support.

China still channels more funds into infrastructure projects to drive growth, which likely lifted the construction index to 55.0 from 53.5 in October, though the government has been trying to reduce the economy's reliance on property.

"Despite the raft of stimulus measures announced over the past several months, we believe it is still too early to call the bottom," Ting Lu, chief China economist at Nomura, said in a note. "We expect another economic dip towards end-2023 and spring 2024."

SINGAPORE (Reuters) - The dollar was rooted near a three-month low on Thursday and was set to post its steepest monthly decline in a year as investors ramped up bets that the Federal Reserve is done with rate hikes ahead of a crucial inflation report later in the day.

The dollar index, which measures U.S. currency against six rivals, eased 0.058% to 102.74, not far from 102.46 - its lowest since Aug. 10 it touched on Wednesday.

The index is down 3.7% in November on growing expectations the Fed will cut interest rates in the first half of 2024.

The dollar clawed back some of its losses on Wednesday after data showed the U.S. economy grew faster in the third quarter than initially reported.

"I think it's still pretty much all about U.S. yields. And by extension FOMC policy," said Carol Kong, currency strategist at Commonwealth Bank of Australia (OTC:CMWAY).

"Markets will continue to play to focus on what FOMC officials say about the prospect of the upcoming rate-hike cycle."

Investor focus will be on comments from Fed Chair Jerome Powell, who is due to speak on Friday in the wake Fed Governor Christopher Waller on Tuesday flagging a possible rate cut in the months ahead.

But before that, spotlight will be on Thursday's crucial personal consumption expenditure (PCE) inflation report.

Christopher Wong, currency strategist at OCBC, said the data will offer a glimpse into whether the disinflation trend seen so far remains intact. "If core PCE undershoots expectations to the downside, then USD may extend the move lower again."

U.S. financial conditions are the loosest since early September and have eased 100 basis points (bps) in a month, according to Goldman Sachs. The bank's global and emerging market indexes ticked up a bit last week, but financial conditions are also looser by around 100 bps from a month ago.

U.S. rates futures markets are now pricing in more than 100 basis points of rate cuts next year starting in May, and the two-year Treasury yield is its lowest since July - it has slumped nearly 40 basis points this week alone. [US/]

The weakness in the dollar has allowed most Asian and regional currencies to take advantage. Two of the best-performers are at the polar opposite ends of the 'carry' spectrum - the New Zealand dollar and Japanese yen.

The kiwi got an extra boost on Wednesday following the central bank's 'hawkish hold' - policymakers kept the key cash rate at a relatively high 5.50%, but unexpectedly signalled that it could be raised again if inflation doesn't moderate.

The currency was 0.26% higher at $0.6172, staying close to the four month peak of $0.6207 it touched on Wednesday.

Meanwhile, expectations that the Bank of Japan will soon end its negative rate policy has pulled the yen up from the depths, and in the process, eased pressure on the central bank to support the currency via direct FX market intervention.

On Thursday, yen strengthened 0.09% to 147.11 per dollar, remaining close to two and half month high of 146.675 per dollar it touched on Wednesday.

Sterling was last at $1.2695, up 0.01% on the day, while the euro was up 0.06% at $1.0975. The Australian dollar rose 0.08% to $0.6623.

(Reuters) - U.S. economic activity slowed from early October through the middle of November, while businesses reported inflation largely moderated and it was easier to hire workers, the Federal Reserve said in a report on Wednesday, underscoring waning economic momentum into the tail end of the year.

The U.S. central bank released its latest temperature check on the state of the economy a day after Fed Governor Christopher Waller, an influential voice on its policy-setting committee, flagged that current progress on lowering inflation means the possibility of a reduction in the Fed's benchmark overnight lending rate next year is coming into view.

"Economic activity slowed since the previous report, with four districts reporting modest growth, two indicating conditions were flat to slightly down, and six noting slight declines in activity," the Fed said in its survey, known as the "Beige Book," which polled business contacts across the central bank's 12 districts through Nov. 17. "The economic outlook for the next six to twelve months diminished over the reporting period."

The Fed kept its policy rate unchanged in the 5.25%-5.50% range earlier this month for the second consecutive meeting after ramping up borrowing costs by more than 5 percentage points over the past 20 months to quell high inflation. The Fed is seeking to weaken the economy just enough to bring inflation down without causing a recession.

The four Fed districts reporting growth were Dallas, Richmond, Atlanta and Chicago. Most districts said growth was down, with the Kansas City Fed reporting consumers increasingly likely to "share a roof and share meals" to manage household budgets, and contacts in the San Francisco Fed district expressing concern over a weaker economic outlook and increased overall uncertainty.

PRICE PRESSURES

Investors expect Fed policymakers to stand pat again at the Dec. 12-13 policy meeting, given the progress made in returning inflation to the central bank's 2% target rate and the fact that it will take more time for the full impact of the rise in its policy rate to filter through the economy.

By the Fed's preferred measure, inflation in September was running at a 3.4% annual rate, down from the 7.1% peak reached in June of last year when pandemic-induced goods and labor supply shortages juiced price pressures. New inflation data is scheduled to be released on Thursday.

There were some hints in the survey that firms are finding it harder to raise prices, potentially an important signal for policymakers on the hunt for signs of further cooling in inflation. "Some firms noted that pricing power was reduced by weakening demand and competition," the Cleveland Fed reported.

The Dallas Fed noted that price pressures were above average in the service sector, but modest in other sectors, adding that "outlooks worsened ... with numerous contacts citing geopolitical instability and high interest rates as headwinds."

The economy grew faster than initially thought in the third quarter, government data showed earlier on Wednesday, but activity appears to have since moderated as higher borrowing costs dampen hiring and spending.

A separate gauge of consumer prices was flat in October, retail spending has weakened, and there has been a slow easing in wage growth, although the labor market still remains tight.

The mixed picture on the labor market featured in the Fed's latest survey, with demand for labor continuing to ease and "flat to modest" increases in overall employment.

Some employers reported feeling comfortable letting go low performers, although "several districts continued to describe labor markets as tight with skilled workers in short supply."

Wage growth remained modest to moderate in most Fed districts, the report said, although some wage pressures did persist.

By Mike Dolan

LONDON (Reuters) - With a rosy picture of stock and bond gains next year now the running consensus, forecasters are managing an impressive leap of faith over three main assumptions - soft economic landings, hefty interest rate cuts and above-target inflation.

Too good to be true?

Soft landings - at least in the broadest sense that may include moderate recession - seem a high bar after two years of brutal credit tightening. And yet, a holy grail for policymakers, such an outcome is now the glue that binds the upbeat forecasts and represents majority thinking among investors.

But perhaps the greater epiphany in annual outlooks is the idea that central banks will be easing rates substantially through the year even with inflation still above 2% goals.

Disinflation, but really not of the immaculate sort - as the now-tired jibe runs.

For Europe's biggest asset manager Amundi, for example, U.S. and euro inflation will stay at 2.6% through next year - and remain above 2% in 2025. But it still thinks the Federal Reserve and European Central Bank will chop more than 100 basis points off rates in 2024 regardless.

"Inflation will remain just above targets, but the central banks will tolerate that outcome and start to ease anyway," Amundi chief investment officer Vincent Mortier told reporters.

Deutsche Bank sees U.S. inflation a bit lower at 2.1% next year, but still above target despite a forecast 'mild' recession - and it sees the Fed slashing rates by a whopping 175bps by the end of 2024.

There is of course an intensely-debated and nuanced take on ebbing momentum in core inflation - a sense that post-pandemic supply-side bottlenecks are easing at last and expectations remain sufficiently in check to allow central banks to reverse.

What's more, central banks can dial back borrowing rates but still leave them in relatively 'restrictive' territory above long-term averages for longer, as per their new-found mantra.

And yet long-term market inflation expectations concur with the view that central banks may - quietly perhaps - just agree to live with slightly above-target inflation even as they insist otherwise - in part as a trade off for dodging painful recession.

While relatively well behaved through the recent two-year inflation spike, five and 10-year inflation expectations embedded in the inflation-linked bond markets remain at 2.2-2.3%. Five-year, five-year forward inflation-linked swaps are as high as 2.55%.

The most recent Reuters poll of economists showed all 100 surveyed expect all the main measures of headline and core U.S. inflation to remain above 2% at least until 2025.

And yet, 90% said the Fed was done hiking and almost 60% expected cuts to commence by midyear. In fact, almost a fifth of banks surveyed expect U.S. policy rates to be cut to below 4.0% by next December from the current 5.25-5.50%.

FIGHTING THE FED?

To be sure, Fed policymakers themselves don't see inflation back to target next year either - with their median core PCE gauge projection from the most recent quarterly forecasts at 2.6% through next year and still at 2.3% in 2025.

But neither has the Fed, rhetorically at least, taken another hike off the table yet and is only projecting one quarter-point rate cut at most by the end of 2024.

So what gives? Will almost sacrosanct central bank commitment to getting back to a promised land of 2% or lower inflation just be fudged at the last moment and quietly set aside?

Goldman Sachs' U.S. economist Jan Hatzius trumpets success in supply-side dynamics that will rein central bank hawks, pointing to the fact that job openings have fallen without a significant rise in joblessness - as the so-called 'Beveridge curve' might have suggested - and allowing wage growth to ease back without a major recession.

"Last year's disinflation does indeed have further to run," he said, characterising core inflation rates of 2-2.5% being 'broadly consistent' with targets but also seeing just one quarter point rate cut next year.

"The most novel reason for optimism on growth is that because central banks don't need a recession to bring inflation down, they will try hard to avoid one," Hatzius wrote.

And while Goldman may be one of the more cautious houses on the policy rate view, it's this hoped-for Fed pivot to the second of its mandates - to maximise employment - that likely encourages investors to look through rhetoric on a strict target.

Harking back to the banking crash and recession of 2008, economists David Blanchflower - a former Bank of England policymaker - and Alex Bryson studied the best leading indicators of an oncoming recession and pointed out how Fed policymakers were wide of the mark 15 years ago.

Fed meeting minutes from August 2008 suggested the central bank's next move was likely to be tightening - a month before Lehman Brothers crashed, forcing the Fed to slash rates again to 0.25% from 2% and launch an unprecedented bond buying campaign.

What's more, recent renewed buzz around the so-called 'Sahm Rule' as a real-time U.S. recession indicator is well founded judging by history, Blanchflower and Bryson say, and may be a better guide to a pivot than Fed statements.

Developed by Fed economist Claudia Sahm before the pandemic as a potential rule of thumb for triggering benefit payments, the formula suggests recession is underway when the three-month rolling average of the unemployment rate rises half a point above the low of the prior 12 months.

Right now, it's running as high as 0.33 point - its highest in 2-1/2 years and up from near zero just six months ago.

If the Fed's watching this as closely as markets seem to be now, then next week's November payrolls report may be an even bigger deal than usual and go some way to explaining some of the more aggressive rate cuts being pencilled in for next year.

The opinions expressed here are those of the author, a columnist for Reuters

(By Mike Dolan; Editing by Susan Fenton)

SYDNEY (Reuters) - New Zealand's new government will introduce legislation to reform the Reserve Bank of New Zealand's mandate and lift a ban on the sale of cigarettes to future generations within its first 100 days, Prime Minister Christopher Luxon said in a statement on Wednesday.

The centre-right National Party, led by Luxon, returned to power alongside the populist New Zealand First party and libertarian ACT New Zealand after six years of rule by governments led by the left-leaning Labour Party.

Luxon, who was sworn in on Monday, said its 49-point action plan was focused on the economy, easing the cost of living and restoring law and order.

"New Zealanders voted not only for a change of government, but for a change of policies and a change of approach - and our Coalition Government is ready to deliver that change," he said in a statement.

New Zealand's central bank has a dual mandate to target low inflation and full employment but Luxon said last week his government would amend the bank's governing legislation to focus monetary policy solely on price stability.

The coalition will also push ahead with its plans to repeal amendments to the Smokefree Environments and Regulated Products Act 1990, including a world-first ban on the sale of cigarettes to future generations.

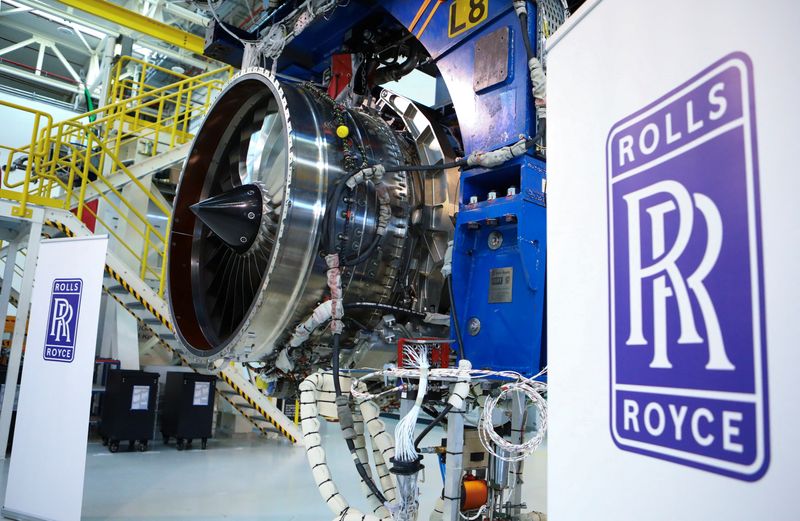

By Paul Sandle and Sarah Young

LONDON (Reuters) -Rolls-Royce aims to quadruple profit in the next five years by boosting the performance of its jet engines and bearing down on costs in boss Tufan Erginbilgic's masterplan for Britain's most prestigious engineering company.

Setting out a strategy that has been almost a year in the making, the chief executive said on Tuesday he would deliver up to 2.8 billion pounds ($3.5 billion) in annual operating profit by 2027, four times 2022's outcome and double its guidance for up to 1.4 billion pounds this year.

That would be driven by surge in profit margins at its civil aerospace business to 15-17% from 2.5% last year.

Erginbilgic, a former BP (NYSE:BP) executive who took over in January, said he would tackle Rolls-Royce (OTC:RYCEY)'s inefficiencies by focusing on the widebody plane sector, where it is Airbus's exclusive supplier, business aviation, defence and power systems.

Its electrical-powered aircraft business will be sold in a drive to raise up to 1.5 billion pounds from selling non-core assets, he said, while the company could re-enter the single-aisle jet market through a partnership, leveraging its next-generation UltraFan technology.

The biggest driver of profit will be a step change in margins in an engine business that powers nearly half of long-haul aircraft, including all Airbus A330neo and A350 models and some Boeing (NYSE:BA) 787 planes.

The margin target would bring Rolls-Royce closer to rivals such as General Electric (NYSE:GE), its major competitor in widebodies.

Erginbilgic said it would be achieved by extending the "time on wing" of its engines between maintenance, reducing the costs of manufacturing and repairs, a new pricing strategy and tackling previous low-margin contracts.

The company is planning 300-350 engine deliveries a year, a target Erginbilgic told investors was "totally aligned" with the plans of Airbus and Boeing.

Shares in Rolls-Royce, which have soared 161% in the year to date, reached a four-year high and were trading up 6% by mid-afternoon.

"We are setting compelling and achievable financial targets for the mid-term which will take Rolls-Royce significantly beyond any previous financial performance," Erginbilgic said.

Agency Partners analyst Nick Cunningham said the targets implied Rolls-Royce was willing to shed revenues in exchange for better profitability.

"If so, that is a deeper culture change from Rolls-Royce's traditional market share optimisation approach of past decades," he said.

Asked if he was willing to sacrifice market share, Tufan said the company had a 55% share of widebody deliveries last year and he expected that level to continue this year, with growth over the next five to 10 years.

"We will capture market share every year, but in a profitable way," he said.

SINGLE-AISLE OPPORTUNITY

Rolls-Royce said it would sell non-core assets from across the group and create partnerships if that would create extra value, including potentially returning to the single-aisle sector split between RTX's Pratt & Witney and CFM International, a joint venture between Safran (EPA:SAF) and GE.

"We don't need to enter narrowbody but it is an opportunity," Erginbilgic told analysts. "With a partnership approach, I believe it can be a profitable place."

Rolls-Royce's finances were hit by problems with its Trent 1000 engine and by the pandemic, which grounded long-haul aircraft and wiped out revenue tied to engine flying hours.

Recovery under Erginbilgic has been rapid, with a five-fold rise in first-half operating profit reported in August, helped by increasing prices for maintaining its engines and tightly managing its cost base.

($1 = 0.7921 pounds)

By Ju-min Park

SEOUL (Reuters) - Once a North Korean experiment in limited capitalism, the Rason Special Economic Zone appears to be the epicentre of the isolated country's growing cooperation with Russia, experts say, including possible shipments of arms for the war in Ukraine.

With apartment blocks and booming markets flooded with imported goods, the Rason SEZ, established in the 1990s on the border with China and Russia, was a dream destination for many North Koreans before tighter sanctions hit and pandemic-era border closings choked off nearly all trade and tourism, two experts who study Rason said.

In recent months, there have been clear signs that the area is poised for a comeback, with ships docking there for the first time since 2018, and satellite imagery suggesting a spike in trade from both the port and a rail line to Russia.

Although China - with its vastly larger economy and deeper historic ties with North Korea - might seem the obvious driver of a recovery in Rason, experts say the country's deepening cooperation with Russia may make a more immediate impact.

"Now that North Korea and Russia are becoming very close against the backdrop of the Ukraine war, Russia might send more tourists to North Korea, which can reinvigorate tourism (in Rason)," said Jeong Eunlee, a North Korea economy expert at South Korea’s government-run Korea Institute for National Unification.

Russia can also sell coal, oil, and flour through Rason, Jeong said, and if more North Korean workers are allowed to cross the border, they can send Russian medicine and other goods home for relatives to sell.

The Russian Federal Customs Service said it had "temporarily suspended the publication of foreign trade statistics".

China accounted for 97% of North Korea's overall trade in 2022, according to South Korea's Korea Trade Investment Promotion Agency (KOTRA).

But Russia resumed oil exports to North Korea in December 2022 and had exported 67,300 barrels of refined petroleum to North Korea by April, United Nations data shows, the first such shipments reported since 2020.

Lee Chan-woo, a North Korea economy expert at Teikyo University in Tokyo, said Russian wood cut by North Korean loggers could be resold to China through Rason, a town of about 200,000 people.

Cho Sung-chan of Hananuri, a South Korean nonprofit that has financed a food-processing factory in Rason, predicted Russian influence there would grow.

"Assuming North Korea and Russia's honeymoon period becomes a long one, North Korea could get Russian support on food, energy and infrastructure through Rason," Cho said.

The two countries discussed expanding trade and testing delivery of meat products next year, Russia's natural resources minister Alexander Kozlov said on his Telegram channel after meeting with North Korean officials in Pyongyang in November.

MILITARY LOGISTICS

Since August, Rason's port has seen visits from Russian ships linked to that country’s military logistics system, according to U.S. and South Korean officials and reports by Western researchers citing satellite imagery.

Those ships are suspected of military supplies from North Korea to Russia, the reports said. The Kremlin has denied such shipments.

From Rason's port, North Korea has sent Russia an estimated 2,000 containers suspected of carrying artillery shells, and possibly short-range missiles, South Korean military officials have told reporters.

Since late 2022, activity has been spotted around Rason's Tumangang station, which has rail links to Russia, said Chung Songhak, a senior researcher at the Korea Institute for Security Strategy who analyses satellite imagery around Rason.

More train carriages were spotted after the Russian defence minister visited Pyongyang in July, Chung said, citing satellite imagery, adding that possible new cargo depots popped up in May.

When leader Kim Jong Un visited Russia in September, he discussed restarting a stalled joint logistics project in Rason, building a new road bridge connecting it with Russia and additional grain supplies, Kozlov said.

'GLOBAL HUB'

Since Kim’s grandfather Kim Il Sung designated Rason a special zone in 1991 after the Soviet Union’s collapse and as China opened further, North Korean officials have tried to attract investment there.

Rason, the oldest and largest of North Korea's 29 economic development zones, has been central to the country's push to attract foreign investment.

It has one of North Korea's first and biggest markets, was the site of the country's first mobile network, and is the only place where North Korea legalised buying and selling homes in 2018, according to experts and North Korea’s government publications.

The other zones have had poor results because of shaky infrastructure and international sanctions, according to South Korea's National Institute for Unification Education.

Abraham Choi, a Korean American pastor who works on religion exchanges with North Korea, said that when he last visited Rason in 2015, he saw both Chinese and Russian tourists.

South Korean media reports said that the Rason border with China had reopened in January 2023 and that trucks were trickling in. Choi said there were no signs yet of large groups of foreign tourists visiting Rason.

Lee of Teikyo University said that whichever outside country helped reinvigorate the special economic zone, it offered a potential bright spot for North Koreans after years of pandemic restrictions.

"Rason took a harder hit than other places in North Korea because it used to be on the front lines of the opening," Lee said. "Now many businesses have collapsed there, but as soon as the border fully reopens, North Koreans might think that the paradise can come back."

LONDON (Reuters) - Three of the world's cornerstone institutions - the International Monetary Fund, the World Bank and the Bank for International Settlements - are to work together for the first time to "tokenise" some of the financial instruments that underpin their global work, a BIS official said on Tuesday.

The trio will also work with Switzerland's central bank which has been pioneering tokenisation, the process of turning conventional assets into uniquely coded "tokens" that can be used in faster new systems.

Their collaboration will initially focus on simple but still paper-based processes such as when richer countries donate into some of the World Bank's funds to support poorer parts of the world.

That original pledge can be in the form of what is known as "promissory note." It is that note that could be tokenised, making it easier to transfer when required.

"We will work together ... to simplify the process for making development money available for emerging and developing economies," BIS official Cecilia Skingsley said at conference hosted by the Atlantic Council think tank in Washington.

She added that tokenisation also opens up the possibility of "encoding policy and regulatory requirements" into a "common protocol" for tackling problems such as international money laundering.

She also touched on the new breed of central bank digital currencies (CBDCs), repeating calls for some global rules and technology standards so they can work across the world and with existing payment systems.

"Questions remain," Skingsley said. "Do these standards need to be implemented early on or else they would be difficult to change later? To what extent do they need to be adapted to ensure they can operate with non-CBDC systems?

The International Monetary Fund (IMF) has stressed the pressing need for a substantial surge in green investments to effectively tackle climate change. In a recent blog post, IMF economists Simon Black, Florence Jaumotte, and Prasad Ananthakrishnan emphasized that annual green investments need to skyrocket from $900 billion in 2020 to $5 trillion by 2030 to realize net-zero emissions by mid-century. This call to action comes as the world anticipates the forthcoming COP28 summit in Dubai.

The IMF pinpointed that emerging and developing countries (EMDEs) are especially in need of financial backing, necessitating $2 trillion annually in green investments—a considerable leap from current figures. The private sector is anticipated to play a crucial role, with predictions suggesting it could furnish up to 90% of this funding due to limited public resources.

Present global policies, as per the IMF, are inadequate in meeting the Paris Agreement benchmarks aimed at alleviating climate change. Although existing technologies could implement more than four-fifths of the necessary emission reductions, attaining net-zero also hinges on innovations that are still under development or have yet to be created.

The IMF's focus on investment aligns with India's ambitious climate objectives, known as the "Panchamrit" pledge, which aims for net-zero emissions by 2070. Ahead of COP28, India's Finance Minister Nirmala Sitharaman has emphasized the importance of definitive actions on climate finance and technology transfer. She particularly underscored the need for clear guidance on funding mechanisms and technological advancements to effectively combat climate change.

A decrease in patent filings for eco-friendly technologies since a peak in 2010 adds another dimension to the challenge, signifying a deceleration in innovation precisely when speed-up is required. The IMF's blog serves as a timely reminder of the financial and technological commitments necessary to address the climate crisis, as global leaders and policymakers prepare for crucial negotiations in Dubai.

The IMF also highlighted investment hurdles like foreign exchange volatility and immature capital markets, calling for policy reforms to facilitate private investments in sustainable projects within EMDEs.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

By Brigid Riley

TOKYO (Reuters) -The U.S. dollar ticked down to a three-month low against peer currencies on Tuesday after slipping overnight on weaker-than-expected new home sales data, while traders hunkered down on bets that the Federal Reserve could start cutting interest rates in the first half of next year.

U.S. new home sales fell 5.6% to a seasonally adjusted annual rate of 679,000 units in October, data showed, below the 723,000 units expected by economists polled by Reuters and sending Treasury yields into a decline.

The dollar index, a measure of the greenback against a basket of currencies, was last at 103.16, hanging around its lowest since Aug. 31. The dollar was track for a loss of more than 3% in November, its worst performance in a year.

Market expectation that the Fed's rate increase cycle has finally come to an end has also put downward pressure on the greenback. U.S. rate futures showed about a 25% chance that the Fed could begin cutting rates as early as March and increasing to nearly 45% by May, according to the CME FedWatch tool.

"Slowing growth momentum, peak rates, rate cuts next year, and unwinding of long positioning: it's the dynamic feeding a weaker U.S. dollar and driving the entire currency complex," said Kyle Rodda, senior financial market analyst at Capital.com.

"Anything that brings that trend into question will change the outlook; however, the bar for that to happen is high," he added, saying the dollar likely has more room to fall.

Traders are now eyeing U.S. core personal consumption expenditures (PCE) price index - the Fed's preferred measure of inflation - this week for more confirmation that inflation in the world's largest economy is slowing.

PCE tops off a slew of other key economic events this week, including Chinese purchasing managers' index (PMI) data and OPEC+ decision.

After delaying its policy meeting to this Thursday, OPEC+ is looking at deepening oil production cuts, according to an OPEC+ source.

Elsewhere, the Australian dollar briefly touched a near four-month high of $0.6632 against the greenback before easing to $0.6621. Data out Tuesday morning showed that domestic retail sales in October declined from the previous month.

The kiwi also momentarily hit its highest since Aug. 10 at $0.6114 before sliding back down to $0.61015. The Reserve Bank of New Zealand has its monetary policy meeting on Wednesday, where it is expected to keep interest rates steady at 5.50% for the fourth straight time.

Elsewhere, the yen made up some ground on Tuesday in the wake of continued dollar weakening, with dollar/yen inching down around 0.3% to 148.21 yen per greenback.

The Japanese currency may, however, be in for some turbulence depending on the outcome of this week's inflation data from the United States.

"The risk for dollar bears is that U.S. PCE inflation does not come in as soft as hoped," said Matt Simpson, senior market analyst at City Index. "That leaves (dollar/yen) vulnerable to a bounce this week."