Select Language

Investing.com-- The S&P 500 closed lower Monday pressured by rising Treasury yields as Fed speakers continue to echo the need for a more gradual pace of rate cuts, though a Nvidia-led climb in tech kept losses in check.

At 4:00 p.m.ET (2000 GMT), the Dow Jones Industrial Average fell 344 points, or 0.8%, the S&P 500 index dropped 0.2%, and the NASDAQ Composite gained 0.3%.

Treasury yields rise as Fed speakers call for modest cuts

The 2-year Treasury yield, which is sensitive to Fed policy, jumped 7 basis points to 4.025%, and the 10-year Treasury climbed above 4%, as investors appear more cautious over the rate cut path ahead.

The rise in rates come as Fed speakers caution on a fast pace of rate cuts ahead.

"Right now I see modest cuts over the next quarters," Minneapolis Fed President Neel Kashkari said.

Nvidia swells to record ahead of tech earnings

NVIDIA Corporation (NASDAQ:NVDA) jumped 4% to close at a fresh record high, taking its market cap above $3.5 trillion for the first time ever, keeping a lid on losses in the broader market as investors looked ahead to the start of big tech earnings.

Tesla (NASDAQ:TSLA) will be the biggest company to report this week, on Wednesday, with the electric vehicle maker’s earnings in close focus after the revealing of its robotaxi earlier this month largely underwhelmed.

Prints from a string of major chipmaking firms are also due this week, coming after earnings from industry bellwethers ASML (NASDAQ:ASML) and TSMC (NYSE:TSM) provided mixed cues on demand.

Texas Instruments (NASDAQ:TXN), Western Digital Corporation (NASDAQ:WDC) and Lam Research Corp (NASDAQ:LRCX) are among the majors chip stocks set to report, while in the broader tech sector, IBM (NYSE:IBM), is also due this week.

By David Lawder

WASHINGTON (Reuters) - Global finance chiefs will gather in Washington this week amid intense uncertainty over wars in the Middle East and Europe, a flagging Chinese economy and worries that a coin-toss U.S. presidential election could ignite new trade battles and erode multilateral cooperation.

The International Monetary Fund and World Bank annual meetings are scheduled to draw more than 10,000 people from finance ministries, central banks and civil society groups to discuss efforts to boost patchy global growth, deal with debt distress and finance the green energy transition.

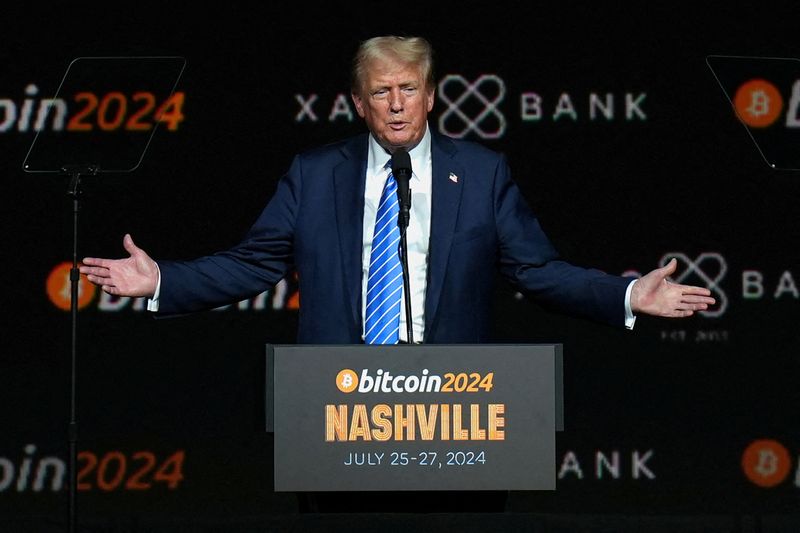

But the elephant in the meeting rooms will be the potential for a Nov. 5 election victory by U.S. Republican presidential candidate Donald Trump to upend the international economic system with massive new U.S. tariffs and borrowing and a shift away from climate cooperation.

"Arguably the most important issue for the global economy - the outcome of the U.S. election - is not on the official agenda this week, but it's on everyone's mind," said Josh Lipsky, a former IMF official who now heads the Atlantic Council's GeoEconomics Center.

The election "has huge implications on trade policy, on the future of the dollar, on who the next Federal Reserve chair is going to be, and all of those impact every country in the world," he added.

U.S. Vice President Kamala Harris, the Democratic presidential candidate, is largely expected to continue the Biden administration's resumption of multilateral cooperation on climate, tax and debt relief issues if she wins next month's vote.

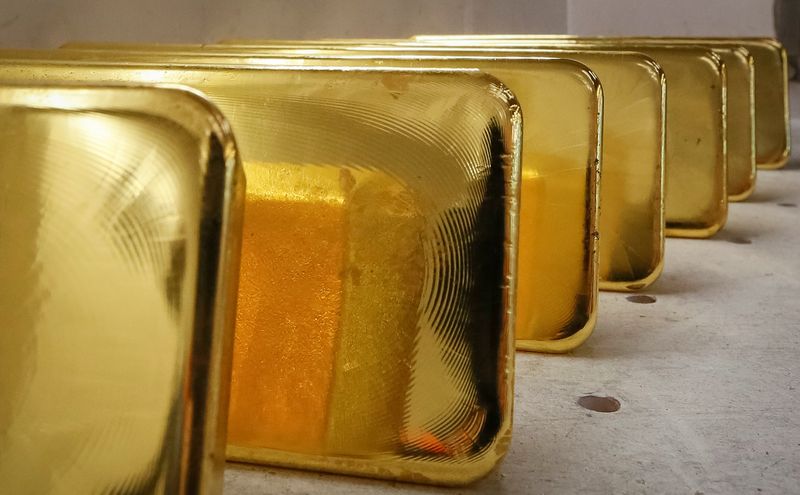

Investing.com-- Gold prices hit a record high in Asian trade on Monday, extending a rally from last week as uncertainty over the U.S. election and anticipation of Israel’s retaliation against Iran fueled safe haven demand.

Other precious metals also advanced, with silver in particular racing to a 12-year peak, while industrial metal prices, specifically copper, also firmed following an interest rate cut in top importer China.

Metal prices rose even as the dollar remained close to its highest levels since early-August, as traders penciled in a slower pace of interest rate cuts by the Federal Reserve.

Spot gold rose 0.4% to a record high of $2,732.86 an ounce, while gold futures expiring in December rose 0.6% to $2,747.70 an ounce.

Gold, silver prices surge on safe haven demand

Precious metal prices were buoyed chiefly by increased safe haven demand, especially as reports over the weekend showed Israel was planning a strike against Iran over a missile strike earlier in the month.

Hostilities between Israel and Hamas and Hezbollah also continued, pointing to little deescalation in Middle East tensions.

Traders were also biased towards safe havens before the U.S. presidential elections in early-November, with analysts at ANZ stating that the race was “too close to call.”

Recent polls showed Donald Trump and Kamala Harris almost neck-and-neck, although prediction markets largely favored a Tump victory.

The safe haven demand helped precious metals firm past signs of resilience in the U.S. economy, which saw traders positioning for a slower pace of rate cuts by the Fed. The Fed is widely expected to cut rates by 25 basis points in November.

Silver futures rallied 3.1% to $34.328 an ounce- their highest level since September 2012, while platinum futures 0.6% to $1,031.15 an ounce.

Copper rallies as China cuts interest rates

Among industrial metals, copper prices rose following a slightly bigger-than-expected rate cut by top importer China.

Benchmark copper futures on the London Metal Exchange rose 1.2% to $9,746.0 a ton, while December copper futures rose 1.2% to $4.4450 a pound.

The People’s Bank of China cut its benchmark loan prime rate slightly more than expected on Monday, the latest in a flurry of stimulus measures from Beijing.

But earlier signals on stimulus had somewhat underwhelmed traders, given that Beijing did not provide key details on the timing or scale of its planned measures.

This saw copper nursing steep losses over the past week.

SEOUL (Reuters) - South Korea's exports for the first 20 days of October fell 2.9% from a year earlier, customs agency data showed on Monday.

Exports of semiconductors rose 36.1%, but cars fell 3.3% and petroleum products dropped 40.0%; by destination, shipments to China rose 1.2%, while those to the United States and the European Union fell 2.6% and 8.9%, respectively.

In September, exports rose for the 12th consecutive month, but the pace of growth cooled.

On average per working day, exports were up 1.0%.

SINGAPORE (Reuters) - Cryptocurrency bitcoin hit a three-month high in early Asia trading on Monday and the dollar looked set to extend its gains in markets counting down to the U.S. presidential election in two weeks.

Election polls show rising odds of former President Donald Trump winning the Nov. 5 election and are boosting the dollar, since his proposed tariff and tax policies are seen as likely to keep U.S. interest rates high and undermine currencies of trading partners.

Currency moves in major markets last week were driven by the European Central Bank's dovish rate cut and strong U.S. data that pushed out expectations for how fast U.S. rates can fall, particularly if Trump wins the presidency.

The yen was down 0.1% at 149.32 per dollar, staying on the stronger side of 150 per dollar, having breached that level briefly last week for the first time since early August.

The dollar index measure against major rivals was at 103.45. It fell 0.3% on Friday as risk appetite picked up broadly across markets after China announced more details of its broad stimulus package, but logged 0.55% gains for the week. The euro stood flat at $1.0866 and sterling was also flat around $1.3045.

Bitcoin got a lift from Trump's improving prospects since his administration is seen as taking a softer line on cryptocurrency regulation. It was last up 0.8% at $69,400, and has risen 18% since Oct. 10.

With no major economic events due this week, market focus will be on corporate earnings and U.S. election risk, and possibly a rise in costs to hedge dollar and other portfolio risks, Chris Weston, head of research at Australian online broker Pepperstone, said in a note.

Investing.com -- Tesla (NASDAQ:TSLA) will be the first of the Magnificent Seven tech companies to report as corporate earnings kick into high gear. Global finance leaders are due to gather in Washington and oil prices look set to remain volatile. Here's your look at what's happening in markets for the week ahead.

1. Tesla reports

With earnings season kicking into high gear, Tesla will be one of the first U.S. big tech companies to report, with results due after the close of trade on Wednesday.

Tesla shares have taken a hit this month, following the unveiling of its long-awaited robotaxis, which some investors viewed as lacking in concrete details. Year-to-date, Tesla shares have underperformed the S&P 500, losing around 11% compared to the broader index's 22.5% gain.

Though investors are more upbeat about the U.S. economy after a robust jobs report and last month’s 50 bps rate cut from the Federal Reserve, a soft earnings report from Tesla could revive worries about tech stock valuations.

Stretched valuations - the S&P 500 is trading at nearly 22 times forward earnings - along with high expectations for corporate results and potential volatility around the upcoming U.S. presidential election, could leave stocks vulnerable to a pullback.

2. Semiconductor earnings

In what’s set to be a packed week for corporate earnings, results from Texas Instruments (NASDAQ:TXN) and equipment company Lam Research (NASDAQ:LRCX) will likely be in focus after a volatile week for the semiconductor sector last week.

Chip shares tumbled on Tuesday after equipment maker ASML (AS:ASML), Europe's biggest tech firm, projected lower-than-expected 2025 sales and bookings. But the group rebounded on Thursday after TSMC (BVMF:TSMC34), which produces advanced chips used in AI applications, reported a forecast-beating 54% jump in quarterly profit.

(Reuters) - European shares opened muted on Friday, after the European Central Bank's latest rate cut and upbeat earnings prompted strong gains in the previous session, with the main stocks gauge headed for a second weekly rise.

The Europe-wide STOXX 600 index was down 0.05% at 0718 GMT, with real estate firms leading losses down 0.6%, while basic resources and autos helped to keep it afloat.

The ECB trimmed its interest rates on Thursday to 3.25%, and while President Christine Lagarde did not provide hints on future moves, four sources close to the matter told Reuters a fourth cut in December is likely unless key data turns south in the coming weeks.

In single stocks, Swedish truck maker Volvo (OTC:VLVLY)'s shares fell 3% after the company reported a bigger-than-expected drop in its third-quarter adjusted operating profit and said it expects roughly unchanged demand next year.

British American Tobacco (NYSE:BTI) said it is close to settling its Canadian tobacco litigation, sending shares down 2%.

Switzerland's Avolta and Barry Callebaut were up between 2% and 3% after receiving upgrades from Deutsche Bank and Morgan Stanley, respectively.

By Saqib Iqbal Ahmed and Suzanne McGee

NEW YORK (Reuters) - Corners of financial markets that could feel the impact of a Donald Trump victory are stirring again, as the U.S. presidential race tightens with less than three weeks until Election Day.

Assets ranging from small-cap stocks to bitcoin have climbed in recent weeks while the Mexican peso and Treasuries have slipped, as polls show a tight race between Republican candidate Trump and his Democratic opponent, Vice President Kamala Harris.

The moves echo the so-called Trump trades from earlier this year when he pulled ahead of President Joe Biden, only to fade after Biden withdrew.

Harris led Trump by a marginal 45% to 42% in a Reuters/Ipsos poll released on Tuesday, a tighter race than the same poll showed several weeks earlier. Trump has taken the lead in online prediction markets such as Predictit and Polymarket.

Investors caution, however, that linking the investment moves to Trump this time is more difficult, as many can also be tied to rising economic optimism following a blowout U.S. jobs report this month and a 50-basis-point interest-rate cut from the Federal Reserve last month.

"Some of this certainly could be being driven by Trump's improved position in the predictive markets," said Steve Sosnick, chief strategist at Interactive Brokers (NASDAQ:IBKR).

Due to strong economic data, however, “it’s really hard to separate cause from effect, much less separate different causes,” he said.

Among the biggest gainers are shares of Trump Media & Technology Group, the former president’s media company, which have broadly tracked Trump’s fortunes in polls and online prediction markets since its listing this year.

Shares are up more than 140% since Sept. 23.

“It’s the trade that is most levered to Trump’s election prospects,” Sosnick said.

Other beneficiaries include private prison operators Geo Group (NYSE:GEO) and CoreCivic (NYSE:CXW), whose shares have risen about 18% and 10%, respectively, this month. Trump has promised to crack down on illegal immigration, which could boost demand for detention centers.

The small cap-focused Russell 2000 is up 4% since Oct. 10 and trades near its highest level since late 2021. Expectations that Trump will keep taxes low and reduce regulation have boosted shares of smaller companies, though analysts believe they are also benefiting from greater confidence in the economy.

In foreign-exchange markets, Trump trades are visible in the dollar’s rebound against a range of currencies, particularly the Mexican peso, strategists said.

The peso, seen as vulnerable to new tariffs Trump plans to impose, is down 4% from its September high. MSCI's gauge for Latin American currencies has slipped over 3% during that period.

"Implied volatility in the dollar-peso pair has been ratcheting up in line with Trump’s gains in betting markets," said Karl Schamotta, chief market strategist at payments company Corpay in Toronto.

Trump said on Sunday he would slap tariffs as high as 200% on vehicles imported from Mexico.

The former president’s economic policies are seen as growth-friendly and a catalyst for inflation, two factors that could translate to higher Treasury yields, which move inversely to bond prices, and a stronger dollar.

The dollar index, which measures the greenback's strength against six major currencies, has risen more than 3% since late September, as investors price in a shallower trajectory for interest-rate cuts. Some of its gains, however, are likely related to greater confidence of a Trump win, wrote Thierry Wizman, global FX & rates strategist at Macquarie.

Improved betting-market odds for Trump, who has positioned himself as pro-cryptocurrency, appear to be lifting bitcoin. The world's largest cryptocurrency is up 12% since Oct. 10, a rally that Sean Farrell, head of digital asset strategy at Fundstrat Global Advisors, attributed to rising confidence in a Trump victory.

"If Trump secures a second term, the regulatory-risk-driven discount applied to crypto would likely shrink to near-zero, and investors would need to price in the possibility, however small, of the government adopting a strategic bitcoin reserve," he said.

In government bond markets, some investors believe Trump’s improved standing has spurred a rise in the 10-year term premium - a measure of the compensation investors demand to hold long-term government debt securities - on concerns that the former president’s proposals for lower taxes could increase the budget deficit.

A New York Fed gauge measuring term premium turned positive last week for the first time since July. The move has come amid a broader rise in Treasury yields.

Part of the reason for those moves are expectations of a Trump win, said Matt Eagan, portfolio manager and head of the full discretion team at Loomis, Sayles & Company.

Investing.com-- Most Asian stocks were muted on Friday amid uncertainty over U.S. interest rates and the upcoming presidential election, while Chinese shares turned positive on data showing the economy grew as expected.

Technology stocks clocked relatively smaller losses, while chipmaker TSMC rallied to record highs on stronger-than-expected third-quarter earnings.

Regional markets took muted cues from a mostly flat overnight session on Wall Street. While investors did cheer signs of resilience in the U.S. economy, this enthusiasm was largely undercut by bets on a smaller upcoming interest rate cut by the Federal Reserve.

U.S. stock index futures were flat Asian trade.

Chinese shares rise as GDP meets expectations

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes rose around 1.2% each, recovering sharply from a negative start to the day. Hong Kong’s Hang Seng index rose 1.6% on gains in locally-listed mainland stocks.

Gross domestic data showed China’s economy grew 4.6% year-on-year in the third quarter, as expected. Quarter-on-quarter growth also accelerated, although year-to-date GDP growth still remained below the government’s 5% annual target.

Still, Friday’s gains helped Chinese stocks recoup a bulk of their weekly losses, putting them on track for a muted weekly performance.

Chinese shares had logged heavy losses earlier in the week after Beijing’s signals on more stimulus measures inspired limited confidence, given that the government still left investors wanting for more details on the planned measures.

TSMC hits record high on positive Q3, chipmakers lag

Taiwan’s TSMC (TW:2330) (NYSE:TSM) was an outlier on Friday, with the firm’s Taipei shares surging nearly 6% to a record high.

The world’s biggest contract chipmaker logged stronger-than-expected third-quarter earnings, and also presented an upbeat outlook, as it continued to benefit from robust demand fueled by the artificial intelligence industry.

TSMC is widely considered as a bellwether for the chipmaking industry, and flagged increasing demand from AI for the sector.

But other Asian chipmaking stocks mostly retreated on Friday. The sector was still reeling from weak guidance presented by chip equipment maker ASML (AS:ASML) Holding (NASDAQ:ASML) earlier this week, as the firm said chip demand from applications outside AI was likely to remain weak.

Asian markets muted, head for mild weekly losses

Broader Asian markets kept to a tight range, and were mostly headed for mild weekly declines.

Japan’s Nikkei 225 and TOPIX indexes rose slightly as consumer price index data showed inflation increased slightly more than expected in September, while underlying inflation remained robust.

Australia’s ASX 200 was the worst performer for the day, losing 0.9% as investors locked in profits from a recent record high. South Korea’s KOSPI fell 0.4%.

Futures for India’s Nifty 50 index pointed to a weak open, as the index sank from 25,000 points amid a broad exodus of foreign investors. Some disappointing earnings also weighed.

Investing.com-- Gold prices hit a record high in Asian trade on Friday, benefiting from safe haven demand with just weeks left to a closely contested U.S. presidential election, while an interest rate cut by the European Central Bank also helped.

Spot gold rose 0.4% to a record high of $2,705.26 an ounce, while gold futures expiring in December rose 0.5% to $2,720.15 an ounce.

The yellow metal firmed even as strong U.S. retail sales and labor market data furthered bets that U.S. interest rates will fall at a slower pace in the coming months.

Gold buoyed by pre-election safe haven demand

Bullion prices broke out of a tight trading range seen in the past two weeks, hitting new peaks as the U.S. election approached.

Recent polls showed Vice President Kamala Harris and former president Donald Trump set for a tight presidential race, with less than three weeks left to the ballot.

The disparity in the stances of both candidates spurred increased uncertainty over what the results of the election will entail.

While media polls showed Harris with a small lead over Trump, prediction and betting markets largely leaned towards a Trump victory, sparking more uncertainty over the potential outcome.

Gold was also favored by safe haven demand as the Middle East conflict raged on. Traders were bracing for Israel’s retaliation against Iran over an early-October attack.

Gold brushes off stronger dollar

The yellow metal firmed despite pressure from a stronger dollar, as the greenback hit an over 2-½ month high this week.

The dollar was boosted chiefly by stronger-than-expected retail sales data, and another print showing weekly jobless claims fell, pointing to strength in the labor market.

The readings furthered the notion that the Federal Reserve will cut interest rates by a smaller margin in the coming months.

But a 25 basis point cut by the ECB indicated that major global central banks were still set to cut rates further, with a lower rate environment likely to support gold and other non-yielding assets.

“The precious metal found support from the ECB rate cut, which reminded the market that most central banks have gone into easing mode. This helped it shrug off economic data, which could slow the Fed’s rate cutting cycle,” ANZ analysts wrote in a note, adding that haven demand for gold also remained in play.

Other precious metals were mixed. Platinum futures steadied at $1,005.95 an ounce, while silver futures rose 1% to $32.095 an ounce.

Among industrial metals, copper prices steadied on Friday but were headed for a third week of losses, as recent stimulus measures from top copper importer China largely underwhelmed.