Select Language

By Andrea Shalal

WASHINGTON (Reuters) - The United States will use restrictive tools like tariffs to push back against China's practice of making far more goods than it needs in order to dominate global markets, White House official Daleep Singh said on Thursday.

Singh, deputy national security adviser for international economics, said the Asian giant has amassed growing market power that it uses for economic and geopolitical leverage, and Washington viewed the costs as unacceptable.

"So that's the problem, and it's not abstract. You can see it in the numbers," Singh told an event hosted by the Alliance for American Manufacturing. "They're a big outlier and we've got to do something about it."

Beijing and Washington have had tense relations for years due to multiple issues ranging from trade tariffs and the origins of COVID-19 to human rights, intellectual property and Taiwan. Singh gave no details on any new measures being considered by Washington.

Data showed that China had a significant overcapacity relative to projected demand for electric vehicles, batteries or semiconductors, Singh said, noting that Chinese producers were reporting "persistent losses."

"We're seeing an unrivaled level and rate of growth in China's subsidies, and ... forget about the numbers, look at their public pronouncements to dominate key sectors and diffuse them with military pre-eminence," Singh said at the event, a week before finance officials from around the world gather in Washington for the annual meetings of the International Monetary Fund and World Bank.

Singh said that "a growing number of countries", including Brazil, India, South Africa and the European Union, were starting to see industrial overcapacity as a major problem like the U.S. did, adding China was using production to gain dominance in a number of sectors.

"China is flooding strategic sectors with supply that's well beyond what global demand can plausibly absorb, and therefore wiping out the competition," he said.

He said China had long used the same tactics for two decades to gain dominance in steel and solar and medical devices, but the trend was now "broadening and intensifying" to include electric vehicles, batteries and semiconductors, where Washington has been investing heavily.

Washington has previously said the U.S. may need to take further and "more creative" actions beyond tariffs to protect U.S. industries and workers against China's growing excess industrial capacity.

U.S. Treasury Secretary Janet Yellen, speaking at a separate Council on Foreign Relations event in New York, said every province in China is competing to try to invest more in advanced manufacturing sectors, such as clean energy and semiconductors.

"So the level of subsidization is utterly enormous. There are many profit-losing firms that are kept in existence. And so there is a gigantic amount of overcapacity that is threatening our own attempts to build in these areas," she said.

ZURICH (Reuters) - Unemployment in Gaza has soared to nearly 80% since the Israel-Hamas war erupted, with the devastated enclave's economy in almost total collapse, the International Labour Organization said on Thursday.

Economic output has shrunk by 85% since the conflict with Israel began a year ago, plunging almost the entire 2.3 million population into poverty, the United Nations agency said.

The conflict has caused "unprecedented and wide-ranging devastation on the labour market and the wider economy across the Occupied Palestinian Territory", the ILO said, referring to Gaza and the West Bank.

In the West Bank, the unemployment rate averaged 34.9% between October 2023 and the end of September 2024, while its economy has contracted by 21.7% compared with the previous 12 months, the ILO said.

Before the crisis, the unemployment rate in Gaza was 45.3% and 14% in the West Bank, according to the Geneva-based organisation.

Gazans either lost their jobs entirely or picked up informal and irregular work "primarily centred on the provision of essential goods and services," the ILO said.

Israel launched its offensive after Hamas-led gunmen attacked on Oct. 7, killing some 1,200 people and taking around 250 hostage, according to Israeli tallies.

Israel's campaign in response has killed more than 42,000 people, according to Gaza's health authorities.

Two-thirds of Gaza's pre-war structures - over 163,000 buildings - have been damaged or flattened, according to U.N. satellite data.

Israel says its operations are aimed at rooting out Hamas militants hiding in tunnels and among Gaza's civilian population.

The crisis has spilled into the West Bank, where Israeli barriers to movement of persons and goods, coupled with broader trade restrictions and supply-chain disruptions, have severely impacted the economy, the ILO said.

Israel says its actions in the West Bank have been necessary to counter Iranian-backed militant groups and to prevent harm to Israeli civilians.

"The impact of the war in the Gaza Strip has taken a toll far beyond loss of life, desperate humanitarian conditions and physical destruction," said ILO regional director for Arab states Ruba Jaradat.

"It has fundamentally altered the socio-economic landscape of Gaza, while also severely impacting the West Bank’s economy and labour market. The impact will be felt for generations to come."

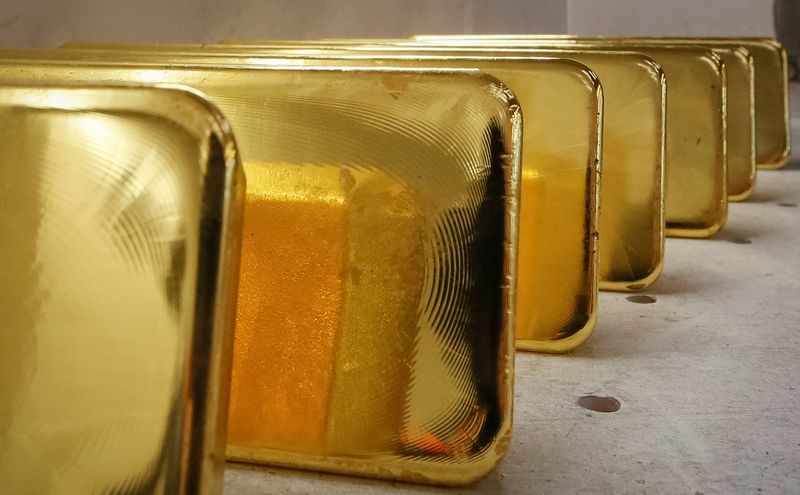

Investing.com-- Gold prices rose slightly in Asian trade on Thursday, remaining close to record highs even as strength in the dollar- on speculation over a second Trump presidency- weighed on broader metal markets.

Among industrial metals, copper prices logged fresh losses as a Chinese government briefing on support for the property market failed to impress.

A drop in Treasury yields helped support gold, as did expectations of interest rates by major central banks. The European Central Bank is widely expected to cut rates by 25 basis points later in the day.

Spot gold rose 0.2% to $2,678.90 an ounce, while gold futures expiring in December rose 0.1% to $2,694.40 an ounce by 00:23 ET (04:23 GMT).

Gold close to record highs amid softer yields, rate cut watch

Spot prices came within spitting distance of a record high of $2,685.96 an ounce on Wednesday.

Bullion prices were supported by weakness in Treasury yields, with the 10-year rate falling 0.5% on Wednesday amid increased speculation that Donald Trump will win a second term.

Trump was seen pulling ahead of Vice President Kamala Harris on online betting markets, while recent media polls showed Harris slightly in front. But with about three weeks left to the ballots, markets are bracing for a tight race.

Trump’s policies are expected to be inflationary- a notion that weighed on Treasury yields and boosted the dollar to its strongest levels since early-August.

Markets were also awaiting more interest rate cuts from major central banks. The European Central Bank is widely expected to cut interest rates at the conclusion of a meeting later on Thursday.

Other precious metal prices were mixed. Platinum futures rose 0.5% to $1,012.40 an ounce, while silver futures fell 0.7% to $31.760 an ounce.

Copper dips as China property cues underwhelm

Benchmark copper futures on the London Metal Exchange fell 0.6% to $9,548.50 a ton, while December copper futures fell 0.6% to $4.3445 a pound.

Both contracts extended recent losses after China’s latest briefing on economic support plans also largely disappointed. China’s housing minister outlined more measures to help support the property market on Thursday- including a bigger whitelist of developers with access to government funding.

But a lack of new features, along with scant details on the implementation of the features, disappointed investors hoping for more bumper measures.

Thursday’s briefing was the latest in a series of stimulus briefings from China, as Beijing mobilizes more support for the economy. But past briefings had also underwhelmed.

This left copper nursing steep losses over the past week, amid doubts over the world’s biggest copper importer. Chinese third-quarter gross domestic product data is due on Friday.

Nevertheless, a quarterly central bank survey suggested the headwinds from the slowing global economy have yet to be fully felt by manufacturers, with the business mood holding up and companies retaining robust spending plans.

That opens up the risk that things could get much bumpier in the coming months, especially as worries over slow global growth join nervousness around the outcome of the U.S. presidential election next month and an escalating conflict in the Middle East.

($1 = 149.5400 yen)

By Makiko Yamazaki

TOKYO (Reuters) - Japan's exports fell for the first time in 10 months in September, data showed on Thursday, a worry for policymakers as any prolonged weakness in global demand will delay plans for a further interest rate hike.

Soft demand in China and slowing U.S. growth have been cited by analysts as a key risk factor for Japan's export-reliant economy and one that could complicate the central bank's path toward fully exiting years of ultra-easy monetary policy.

Total exports dropped 1.7% year-on-year in September, Ministry of Finance data showed, missing a median market forecast for a 0.5% increase and following a revised 5.5% rise in August.

Exports to China, Japan's biggest trading partner, fell 7.3% in September from a year earlier, while those to the United States were down 2.4%, the data showed.

Imports grew 2.1% in September from a year earlier, compared with market forecasts for a 3.2% increase.

As a result, Japan ran a trade deficit of 294.3 billion yen ($1.97 billion) for September, compared with the forecast of a deficit of 237.6 billion yen.

Bank of Japan (BOJ) Governor Kazuo Ueda has highlighted external risks such as U.S. economic uncertainties in his recent dovish commentary, emphasising that policymakers can afford to spend time scrutinising such risks in timing the next interest rate hike.

While the BOJ is expected to keep interest rates steady at its Oct.30-31 meeting, it will roughly maintain its forecast for inflation to stay around its 2% target through March 2027, according to sources familiar with its thinking.

(Reuters) - Goldman Sachs said on Wednesday it expects the U.S. Federal Reserve to deliver consecutive 25-basis-point (bps) interest rate cuts from November 2024 through June 2025 to a terminal rate range of 3.25-3.5%.

Last month, the U.S. central bank cut the overnight rate by half a percentage point, citing greater confidence that inflation will keep receding to its 2% annual target.

The overnight rate, which guides how much interest banks pay each other and affects rates for consumers, is now at 4.75%-5.00%.

Markets are currently pricing in a 94.1% chance for a cut of 25 bps at the Fed's next meeting, with only a 5.9% chance the central bank will hold rates steady, according to CME's Fedwatch Tool.

Goldman Sachs also said it expects the European Central Bank to cut interest rates by 25 bps at its monetary policy meeting on Thursday, and noted it sees sequential 25-bps cuts until the policy rate reaches 2% in June 2025.

By Donny Kwok and James Pomfret

HONG KONG (Reuters) -Hong Kong's leader pledged on Wednesday to reform and revive the economy and financial markets including slashing liquor duties, while seeking to improve dire living conditions for the city's poorest.

John Lee, in his third annual policy address, highlighted the need to "deepen our reforms and explore new growth areas," in line with China's national priorities and recent calls from Beijing for all sectors to unite to promote development and economic growth.

Hong Kong's small and open economy has felt the ripple effects of a slowdown in the Chinese economy and political tensions including a years-long national security crackdown.

It grew by 3.3% in the second quarter from a year earlier, and is forecast to grow 2.5%-3.5% for the year.

Although tourism has rebounded since COVID, with 46 million visitors expected this year, consumption and retail spending remain sluggish, while stock listings have dried up and capital flight remains a challenge.

Lee told Hong Kong's legislature that duties on liquor would be slashed to 10% from 100% for drinks with more than 30% alcohol content, in a bid to stimulate the trade in spirits. The lower duties apply only to spirits priced over HK$200 ($26), and for the portion above that amount.

The move would "promote liquor trade and boost development of high value added industries including logistics and storage, tourism as well as high end food and beverage consumption," Lee said.

He hoped the move would benefit Hong Kong in the way that it became an Asian wine trading hub after wine duties were abolished in 2008.

By Andrea Shalal and David Lawder

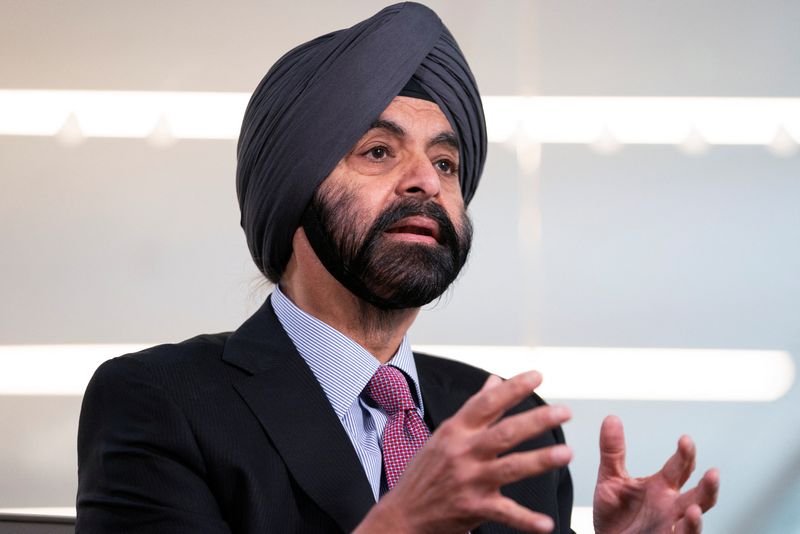

WASHINGTON (Reuters) -World Bank President Ajay Banga on Tuesday warned that a significant widening of the Israel-Gaza war could lead to major impacts on the global economy, calling the steep loss of civilian lives in the region "unconscionable."

Speaking in a Reuters NEXT Newsmaker interview, Banga said the war has had a relatively small impact on the global economy thus far, but a significant widening of the conflict would draw in other countries that are larger contributors to global growth, including commodity exporters.

"First of all, I think this unbelievable loss of life - women, children, others, civilians, is just unconscionable on all sides," Banga said. "The economic impact of this war, on the other hand, depends a great deal on how much this spreads."

"If it spreads regionally, then it becomes a completely different issue because now you start going into places that are far larger contributors to the world economy, both in terms of dollars, but also in terms of minerals and metals and oil and the like," he said.

Some Western countries are pushing for a ceasefire between Israel and Lebanon, as well as in Gaza, though the United States, Israel's strongest ally, has expressed its continued support and is sending it an anti-missile system and troops.

Israel launched the offensive against Hamas after the militant group's Oct. 7 attack on Israel, in which 1,200 people were killed and around 250 taken hostage to Gaza, by Israeli tallies. More than 42,000 Palestinians have been killed in the offensive so far, according to Gaza's health authorities.

Israeli strikes have also killed at least 2,350 people over the last year in Lebanon and left nearly 11,000 wounded, according to the Lebanese health ministry, and more than 1.2 million people have been displaced.

Banga said war damage from Israeli strikes on Gaza is now probably in the $14-20 billion range, and destruction from Israel's bombing of southern Lebanon will add to that regional total.

Banga said the World Bank had provided $300 million, six times what was normally given, to the Palestinian Authority to help it manage the crisis on the ground, but that was small compared to the "large number" it would ultimately need.

He said the multilateral development bank had also assembled a group of experts from Jordan, Israel, Palestine, Europe, the U.S. and Egypt to study what short- and longer-term actions it could take if a peace agreement could be reached.

"We're going to have to figure out how to have that publicly discussed and debated and then find the resources for it," he said, adding that the effort would require private and public resources.

By Ankur Banerjee

SINGAPORE (Reuters) - Asian equities fell on Wednesday after disappointing earnings from Europe's biggest tech firm ASML (AS:ASML) dragged chip stocks around the world, while expectations that the Federal Reserve will take a modest rate cut path propped up the dollar.

Also weighing on the market was lacklustre earnings from French luxury giant LVMH that showed demand in China for luxury goods worsened, denting some of the enthusiasm around China spurred by stimulus measures.

Tech-heavy South Korean stocks fell 0.6%, while chip stocks led Japan's Nikkei 1.8% lower. Taiwan stocks slipped 1.2%. That left MSCI's broadest index of Asia-Pacific shares outside Japan down 0.32%.

Matt Simpson, senior market analyst at City Index, said investors are likely questioning how exposed to risk they really want to be, given there are risk events and a U.S. election looming on Nov. 5.

"I expect investors to become increasingly twitchy as we head towards November 5th, and keen that book profits at frothy levels."

ASML, whose customers include AI chipmaker TSMC, logic chip makers Intel (NASDAQ:INTC) and Samsung (KS:005930) as well as memory chip specialists Micron (NASDAQ:MU) and SK Hynix, forecast lower than expected 2025 sales.

The Dutch chip equipment maker said despite a boom in AI-related chips, other parts of the semiconductor market are weaker for longer than expected, leading to customer cautiousness.

"The AMSL numbers were not good and suggest that all is not well in semiconductor chips outside of AI," said Nick Ferres, CIO at Vantage Point Asset Management in Singapore.

A Bloomberg News report that U.S. officials have been considering implementing a cap on export licenses for AI chips to specific countries also weighed on sentiment.

The dour mood meant Chinese stocks fell in early trading as investors awaited concrete details on stimulus plans. The blue-chip CSI300 index fell 0.6%, while Hong Kong's Hang Seng Index was 0.7% lower in early trading.

Investor focus is now on Thursday when China will hold a press conference to discuss promoting the "steady and healthy" development of the property sector.

"We believe investors should view the policy announcements since Sept. 24 as an integrated plan rather than isolated messages - the policy pivot looks very much here to stay," HSBC strategist Steven Sun said in a report.

RISING DOLLAR

On the macro side, investors remain enthralled by U.S. rates and the shifting rate cut expectations in the wake of data that has shown the U.S. economy to be resilient and inflation to tick just a bit higher.

That has kept traders on the fence of how deep the rate cuts will be in the near term, with traders pricing in 46 basis points (bps) of easing this year. The Fed started its easing cycle with an aggressive 50 bp cut in September.

Markets are ascribing a 96% chance of a 25 bp cut from the Fed next month, CME FedWatch tool showed, compared to a 50% chance a month earlier when investors were weighing towards another 50 bp cut from the U.S. central bank.

The dollar as a result has surged in recent weeks, with the U.S. dollar index, which measures the U.S. unit versus major rivals, at 103.24, hovering near its highest levels since early August.

The euro loitered around two month lows and last fetched $1.0887 in early trading ahead of the European Central Bank's policy meeting on Thursday, where the central bank is largely expected to cut rates again.

The yen was steady at 149.155 per dollar but is down 3.6% in October as the dovish tilt from the Bank of Japan drags the currency.

In commodities, oil prices were steady after steep declines in the previous session as investors contended with uncertainty around tensions in the Middle East and what it means for global supply. [O/R]

Brent crude oil futures rose 0.4% to $74.56 a barrel. U.S. West Texas Intermediate crude futures rose 0.5% to $70.93 per barrel.

By Jamie McGeever

(Reuters) - A look at the day ahead in Asian markets.

Three monetary policy decisions dominate Asian markets on Wednesday, with investor sentiment and risk appetite likely to be kept in check by a selloff on Wall Street and worries over tech and the global economy the day before.

The central banks of Indonesia, Thailand and the Philippines all set interest rates on Wednesday, while the latest New Zealand inflation, South Korean unemployment and Japanese machinery orders are also on deck.

Oil prices are on the slide again, partly reflecting soft demand, particularly from China. Crude futures slumped nearly 5% on Tuesday, pushing U.S. crude below $70 a barrel and bringing the year-on-year decline back to 20%.

Tech worries pushed U.S. shares into the red, despite upbeat earnings from financial heavyweights Goldman Sachs, Citi and Bank of America. Nvidia (NASDAQ:NVDA) and ASML (AS:ASML) shares led the global tech slump, and attention later in the week turns to Taiwan Semiconductor Manufacturing Co, the contract manufacturer that produces Nvidia's processors.

It is expected to report a 40% leap in quarterly profit on Thursday, thanks to soaring demand.

On Wednesday, meanwhile, Bank Indonesia is expected to leave interest rates unchanged despite inflation falling to its lowest level since 2021, with the exchange rate at the forefront of policymakers' thinking.

Inflation is down to 1.84% and has been within BI's target of 1.5% to 3.5% all year, but the rupiah has fallen more than 3% from a September peak.

The Bank of Thailand is also expected to stay on hold and leave its one-day repo rate at 2.50% for the rest of the year. Four out of 28 economists in a Reuters poll predicted a quarter-point cut.

The Philippine central bank, on the other hand, is expected to cut its overnight borrowing rate by 25 basis points to 6.00%, and again in December as policymakers strive to support economic growth as inflation remains under control.

The central bank kicked off its easing cycle in August, and since then inflation has dropped below the bank's 2%-4% target.

Meanwhile, investors continue to digest the details and steer from China at the weekend about its stimulus measures, and the recent slew of data. None of that has been particularly encouraging and Chinese markets are drifting lower, although equities are still up substantially from 'pre-stimulus' levels.

Beijing on Tuesday announced that a press conference will be held on Thursday to discuss promoting the "steady and healthy" development of the property sector. If this announcement was aimed at reassuring investors, however, it has fallen flat.

Shanghai's blue chip index is down 13% from last Tuesday's peak, but is still up 20% from the day before Beijing first unveiled its measures to support markets, the property sector and growth.

Here are key developments that could provide more direction to markets on Wednesday:

- Indonesia, Thailand, Philippines rate decisions

- Bank of Japan's Seiji Adachi speaks

- New Zealand inflation (Q3)