Select Language

HONG KONG (Reuters) - Hong Kong's economy is expected to grow 2% to 3% this year after growth of 2.5% in 2024, as authorities seek to tackle a fiscal deficit amid rising global uncertainty and a weak property market, Financial Secretary Paul Chan said on Wednesday.

Investing.com-- U.S. stock index futures rose on Tuesday evening after growing concerns over a cooling economy and increased trade tariffs sparked a series of steep losses on Wall Street.

Focus was now squarely on quarterly earnings from market darling NVIDIA Corporation (NASDAQ:NVDA), which are due after the close on Wednesday. The stock clocked three straight sessions of steep losses, as investors locked in profits ahead of its earnings.

Gains in futures were limited as U.S. President Donald Trump threatened to impose trade tariffs on copper imports, claiming that production and refinement of the red metal needed to return to the U.S.

Wall Street was also nursing a series of bruising losses as signs of weakening consumer sentiment drummed up concerns over a cooling economy. Trump’s repeated tariff threats also weighed, as did a rout in technology shares ahead of Nvidia’s earnings.

Trump threatens copper import tariffs, Freeport rallies

Trump on Tuesday signed an executive order exploring import tariffs on copper over what he alleged were unfair global trade practices.

Trump claimed the move was to spur more domestic copper production and was also aimed at reducing the dominance of one entity- likely China- in the global copper market.

Freeport-McMoran (NYSE:FCX)- the biggest copper producer in the U.S.- rallied as much as 5% on Trump’s order.

Trump’s threat comes after he imposed 25% tariffs on steel and aluminum imports earlier this month, with both moves aimed at pushing up local production, while also pressuring top exporter China.

But the president’s tariff threats were received poorly by markets, given that they pushed up concerns over retaliatory measures and disruptions in global trade.

Trump’s tariffs- which will be borne by U.S. importers- are also expected to disrupt some business operations, and could underpin inflation.

Trump signaled earlier this week that his planned 25% tariffs on Canada and Mexico will likely take effect from the first week of March.

Nvidia rises after bruising losses; earnings in focus

Nvidia rose 1.3% in aftermarket trade on Tuesday, after the stock clocked three straight days of steep declines in the run-up to its earnings.

While the company is expected to clock strong earnings growth on sustained demand from the artificial intelligence industry, its outlook on future demand will be closely watched.

Nvidia makes the most advanced AI chips in the market and is considered as a bellwether for the industry. Wednesday’s print also comes amid growing doubts over the need for outsized capital investment in AI, especially after the release of China’s DeepSeek.

Losses in Nvidia spilled over into broader tech stocks, which in turn pressured Wall Street this week. U.S. stocks were also dented by growing concerns over a cooling economy.

The S&P 500 fell 0.5% to 5,955.36 points, while the NASDAQ Composite fell 1.4% to 19,026.39 points. The Dow Jones Industrial Average rose 0.4% to 43,621.34 points.

By Adriana Barrera

MEXICO CITY (Reuters) - Mexico's lower house of Congress on Tuesday approved a constitutional reform to ban the planting of genetically modified (GM) corn, a move that could lead to more tension with the United States after the resolution of a trade dispute, analysts said.

The initiative by President Claudia Sheinbaum comes after a trade-dispute panel ruled in December that Mexico's restrictions on GM corn, mostly imported from the United States, violate the U.S.-Mexico-Canada Agreement (USMCA).

As a result of the USMCA panel ruling, Mexico repealed its import restrictions on GM corn for human, livestock and industrial uses.

Mexico, the birthplace of modern corn, had already prohibited the commercial planting of GM corn strains, arguing they will contaminate native strains of the grain, but Sheinbaum pledged to officially prohibit the planting of GM corn within its territory via the Constitution.

With Sheinbaum's reform approved with 409 votes in favor and 69 against, native corn is branded as an "element of national identity" and GM corn is officially banned from being planted in Mexico.

"Any other use of genetically modified corn must be evaluated ... to be free of threats to the biosecurity, health and biocultural heritage of Mexico and its population," the text of the reform states.

The reform will now go to the Senate for final approval.

Mexico buys about $5 billion of U.S. GM corn each year, mostly for livestock feed.

Some analysts said the reform could spark a new controversy with the U.S. because it also refers to the use of GM corn, and not just the planting of the grain.

The Agricultural Markets Consulting Group (GCMA), a major consultancy in Mexico said the government's decision to strengthen its position against GM corn generates "uncertainty" in the relationship with the United States, its primary source of yellow corn imports, which are mainly dedicated to livestock feed.

"Following the adverse ruling by the USMCA dispute panel, the insistence on these restrictions is likely to trigger retaliatory measures by the US government," GCMA said in a recent report.

Investing.com-- Gold prices fell in Asian trade on Tuesday, but remained close to recent peaks as safe haven demand was underpinned by concerns over higher U.S. trade tariffs and worsening relations between Washington and Beijing.

The yellow metal had risen in overnight trade, coming within spitting distance of a record high amid persistent safe haven demand. This trend was furthered by U.S. President Donald Trump signaling that he still planned to impose 25% tariffs on Canada and Mexico by next week.

This came after Trump over the weekend signed a sweeping executive order aimed at leveling more trade and investment restrictions against China, which could point to further worsening in relations

Spot gold fell 0.5% to $2,947.73 an ounce, while gold futures expiring in April fell 0.3% to $2,952.99 an ounce by 01:03 ET (06:03 GMT). Spot prices hit a record high of $2,956.37 an ounce last week.

Trump tariff threats, China jitters buoy gold

Gold demand remained underpinned by Trump’s latest comments on tariffs against Canada and Mexico, both of which could be imposed as a March 4 deadline expires next week.

Such a move is likely to draw retaliatory measures from the two countries, escalating a global trade war.

Additionally, Trump’s hawkish stance against China could also draw more retaliation from Beijing. Trump had earlier in February imposed 10% tariffs on all Chinese imports, with Beijing imposing a slew of trade tariffs and export controls in retaliation.

Bloomberg reported that Trump’s administration was considering tighter controls on chip exports to China, a move that could further draw Beijing’s ire.

This was after Trump over the weekend signed a sweeping executive order seeking to further curb Chinese investments and exports.

Dollar, yields undermined by US economic fears

The dollar slid to an over two-month low this week, benefiting metal prices as investors also fretted over a potentially cooling U.S. economy.

Treasury yields also softened on this notion, as data over the past two weeks showed a cooling U.S. consumer sentiment and spending.

This weighed on the dollar, amid bets that the Federal Reserve will have to cut rates further to support the economy. U.S. fourth-quarter GDP data due later this week is set to offer more cues on this trend.

A softer dollar benefited metal prices, although they broadly lagged gold. Platinum futures fell 0.5% to $971.65 an ounce, while silver futures steadied at $32.623 an ounce.

Among industrial metals, benchmark copper futures on the London Metal Exchange fell 0.3% to $9,465.20 a ton, while March copper futures fell 0.4% to $4.5420 a pound.

Investing.com-- Oil prices jumped in Asian trading on Tuesday as the U.S. government's imposition of new sanctions targeting Iran's oil industry sparked fresh supply disruption worries.

Brent Oil Futures rose 0.6% to $75.19 per barrel as of 21:14 ET (02:14 GMT), while West Texas Intermediate (WTI) crude futures gained 0.7% to $70.92 per barrel.

US sanctions on Iran spark supply concerns

The sanctions, announced by the Treasury Department, aim to intensify economic pressure on Iran by targeting over 30 entities and individuals involved in the country's oil supply chain, including brokers and tanker operators in the United Arab Emirates, Hong Kong, and China.

The action is part of President Donald Trump's "maximum pressure" campaign, explicitly aiming to halt Iran's petroleum exports, particularly to major consumers like China.

Treasury Secretary Scott Bessent emphasized the administration's commitment to using all available tools to target Iran's oil supply chain, warning of significant sanctions risks for those dealing in Iranian oil.

In response to these developments, oil futures experienced modest gains on Monday. The market's reaction reflected concerns over potential foreign supply constraints due to the new sanctions on Iran.

Markets uncertain amid complex supply-demand scenario

Despite the upward pressure from the sanctions, the overall outlook for oil prices remains uncertain.

Potential cease-fire agreements between Russia-Ukraine and Israel-Hamas could alleviate some market fears, potentially offsetting price increases.

Media reports have shown that OPEC and its allies, collectively known as OPEC+, are contemplating further delays in increasing oil production due to persistently weak demand and rising output from non-member countries.

Originally, the group planned to ease production cuts starting in April 2025, but this timeline has been postponed multiple times, with the latest adjustment pushing the start to April 2025.

These potential production delays are expected to support oil prices by limiting supply. However, the global oil market is projected to return to a surplus in 2025, despite OPEC+ extending supply cuts, which could lead to lower prices in the coming year.

Additionally, the resumption of Iraqi oil exports from the Kurdish region may influence supply dynamics.

Investing.com-- The Bank of Korea cut interest rates as expected on Tuesday, as some clearing political turmoil in the country granted the central bank enough headroom to resume its easing cycle.

The BOK cut its benchmark rate by 25 basis points to 2.75%, in line with market expectations. The cut is the BOK’s third such move since it kicked off an easing cycle in late-2024.

Markets had largely anticipated the cut, given that the BOK provided a dovish outlook on rates amid cooling inflation, softening economic growth and weak business activity in South Korea.

The central bank had unexpectedly kept rates steady in January amid heightened political tensions in the country, after a failed attempt to impose martial law by President Yoon Suk Yeol.

But these tensions now appeared to have eased, after Yeol was impeached, arrested, and put on trial over his actions.

South Korea’s economy is heavily dependent on technology exports- which have weakened in recent years, despite some support from artificial intelligence demand.

This has translated into weaker overall economic conditions in the country, necessitating more rate cuts from the BOK. South Korea also faces headwinds from increased U.S. trade tariffs under President Donald Trump.

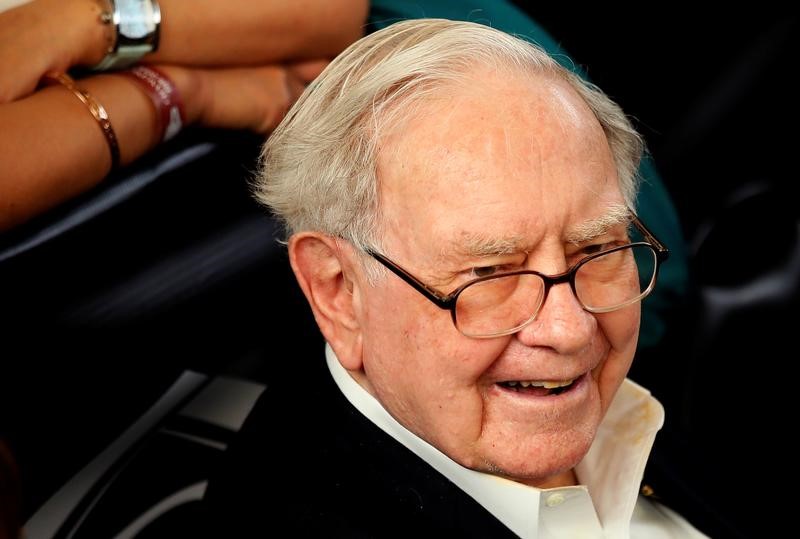

Investing.com-- Shares of Japan’s five biggest trading houses rose sharply on Tuesday after billionaire investor Warren Buffett signaled that Berkshire Hathaway (NYSE:BRKa) will likely increase its holdings in the companies.

Itochu Corp. (TYO:8001), Mitsui & Co., Ltd. (TYO:8031), Sumitomo, Mitsubishi Corp. (TYO:8058) and Marubeni Corp. (TYO:8002) rose between 2% and 7% in Tokyo trade, outperforming a 1.5% slide in the Nikkei 225 benchmark.

Buffett told Berkshire shareholders last week that the hedge fund will increase its holdings in the five, especially after their boards agreed to “moderately relax” limits that curbed Berkshire’s ownership to below 10%. Berkshire owned about $23 billion in the five companies by end-2024, the company’s annual report showed last week.

Buffett said the hedge fund was investing for the “very long term” in the five companies, lauding their capital spending, their management, and their attitude towards investors.

Buffett had begun investing in the trading houses in 2019, drawn by their finances, accessible stock prices and a softer yen. Buffett has at least 5% ownership in each company.

His investments paid off in 2023 and 2024 following a stellar rally in Japanese stocks, as the Nikkei scaled a series of record highs.

Berkshire has spent about $13.8 billion on its stakes in the trading houses, and expects $812 million of dividend income from them in 2025. The Omaha-based hedge fund clocked a record operating profit in 2024.

Japanese trading houses are among the largest companies in the country, and invest in a wide range of sectors, including commodities, food, and logistics. They are also closely tied to economically relevant sectors such as shipping, steel, and real estate.

By Sinéad Carew and Johann M Cherian

(Reuters) - The Nasdaq Composite fell more than 1% on Monday, with big technology stocks creating the biggest drag as investors worried about demand for technology supporting artificial intelligence while they waited for results from market heavyweight Nvidia (NASDAQ:NVDA).

The S&P 500 closed slightly lower, marking its third straight day of declines, while the Dow managed to eke out a tiny gain. It was also Nasdaq's third consecutive loss and its fourth daily drop of more than 1% so far in February.

Investors were concerned about future demand for Nvidia's pricey AI chips as they awaited its quarterly results on Wednesday. Worries about hefty spending on the technology have mounted since low-cost AI models from China's DeepSeek rattled the industry in January.

Adding to uncertainty, a TD Cowen analyst note published late on Friday reported that Microsoft Corp (NASDAQ:MSFT) has scrapped leases for sizeable data center capacity in the U.S., suggesting a potential oversupply of AI infrastructure.

Microsoft said its plan to invest over $80 billion in AI and cloud capacity this fiscal year was intact but that it "may strategically pace or adjust" infrastructure in some areas.

"Markets are already jittery and looking for a reason to take profits," said Gene Goldman, chief investment officer at Cetera Investment Management, noting that any question about AI is seen as a reason to take profits since the technology has driven market growth for the last few years.

Along with worries about tariffs and inflation, investors are getting more anxious about economic growth after last week's batch of weak economic data and a disappointing forecast from Walmart (NYSE:WMT).

"Volatility is being driven by market uncertainty about whether we're facing a growth scare or an inflation scare," said Goldman.

The Dow Jones Industrial Average rose 33.19 points, or 0.08%, to 43,461.21, the S&P 500 lost 29.88 points, or 0.50%, to 5,983.25 and the Nasdaq lost 237.08 points, or 1.21%, to 19,286.93.

The more defensive healthcare index led percentage gains, closing up 0.75% while technology was the biggest laggard, ending down 1.43%.

Nvidia was the S&P 500's biggest index point drag, ending the session down 3.1%, and it was followed by chip maker Broadcom (NASDAQ:AVGO) Inc, down 4.9%, Amazon.com (NASDAQ:AMZN), down 1.8%. Microsoft shares ended down 1%.

The tech sector's biggest percentage decliner with, a 10.5% drop, was another popular AI stock, Palantir Technologies (NASDAQ:PLTR).

"The dominance of the AI tech trade has run its course, not that these companies aren't great stocks. We're headed for a major digestion phase," said Peter Boockvar, CIO at Bleakley Financial Group.

On the data front, the Personal Consumption Expenditure index - the Federal Reserve's preferred inflation gauge - is expected on Friday and could help markets gauge the timing of the central bank's first rate cut this year.

Interest rate futures indicate trader expectations that the Fed will leave borrowing costs unchanged until June, according to CME Group's (NASDAQ:CME) FedWatch tool.

In individual stocks, Apple (NASDAQ:AAPL) finished up 0.7% after the iPhone maker unveiled plans to spend $500 billion in U.S. investments in the next four years, including setting up a factory in Texas for AI servers.

"Volatility is being driven by market uncertainty about whether we're facing a growth scare or an inflation scare," said Goldman.

The Dow Jones Industrial Average rose 33.19 points, or 0.08%, to 43,461.21, the S&P 500 lost 29.88 points, or 0.50%, to 5,983.25 and the Nasdaq lost 237.08 points, or 1.21%, to 19,286.93.

The more defensive healthcare index led percentage gains, closing up 0.75% while technology was the biggest laggard, ending down 1.43%.

Nvidia was the S&P 500's biggest index point drag, ending the session down 3.1%, and it was followed by chip maker Broadcom (NASDAQ:AVGO) Inc, down 4.9%, Amazon.com (NASDAQ:AMZN), down 1.8%. Microsoft shares ended down 1%.

The tech sector's biggest percentage decliner with, a 10.5% drop, was another popular AI stock, Palantir Technologies (NASDAQ:PLTR).

"The dominance of the AI tech trade has run its course, not that these companies aren't great stocks. We're headed for a major digestion phase," said Peter Boockvar, CIO at Bleakley Financial Group.

On the data front, the Personal Consumption Expenditure index - the Federal Reserve's preferred inflation gauge - is expected on Friday and could help markets gauge the timing of the central bank's first rate cut this year.

Interest rate futures indicate trader expectations that the Fed will leave borrowing costs unchanged until June, according to CME Group's (NASDAQ:CME) FedWatch tool.

In individual stocks, Apple (NASDAQ:AAPL) finished up 0.7% after the iPhone maker unveiled plans to spend $500 billion in U.S. investments in the next four years, including setting up a factory in Texas for AI servers.

By Bing Hong Lok

SINGAPORE (Reuters) - Singapore's key consumer price gauge rose 0.8% in January from a year earlier, lower than economist forecasts, official data showed on Monday.

The core inflation rate, which excludes private road transport and accommodation costs, compared with a 1.5% forecast by a Reuters poll of economists.

Headline inflation was 1.2% in annual terms in January, lower than economists' forecast of 2.15%.

Statistics Singapore said the CPI had been rebased to a base year of 2024 from 2019. The annual change in the headline inflation rate in December was revised to 1.5% from 1.6%

By Alexander Marrow and Darya Korsunskaya

LONDON (Reuters) - Russia's overheating economy is on the cusp of serious cooling, as huge fiscal stimulus, soaring interest rates, stubbornly high inflation and Western sanctions take their toll, but after three years of war, Washington may just have thrown Moscow a lifeline.

U.S. President Donald Trump is pushing for a quick deal to end the war in Ukraine, alarming Washington's European allies by leaving them and Ukraine out of initial talks with Russia and blaming Ukraine for Russia's 2022 invasion, political gifts for Moscow that could also bring strong economic benefits.

Washington's push comes as Moscow faces two undesirable options, according to Oleg Vyugin, former deputy chairman of Russia's central bank.

Russia can either stop inflating military spending as it presses to gain territory in Ukraine, he said, or maintain it and pay the price with years of slow growth, high inflation and falling living standards, all of which carry political risks.

Though government spending usually stimulates growth, non-regenerative spending on missiles at the expense of civilian sectors has caused overheating to the extent that interest rates at 21% are slowing corporate investment and inflation cannot be tamed.

"For economic reasons, Russia is interested in negotiating a diplomatic end to the conflict," Vyugin said. "(This) will avoid further increasing the redistribution of limited resources for unproductive purposes. It's the only way to avoid stagflation."

While Russia is unlikely to swiftly reduce defence spending, which accounts for about a third of all budget expenditure, the prospect of a deal should ease other economic pressures, could bring sanctions relief and eventually the return of Western firms.

"The Russians will be reluctant to stop spending on arms production overnight, afraid of causing a recession, and because they need to restore the army," said Alexander Kolyandr, researcher at the Center for European Policy Analysis (CEPA).

"But by letting some soldiers go, that would take a bit of pressure off the labour market."

War-related recruitment and emigration have caused widespread labour shortages, pushing Russian unemployment to a record low 2.3%.

Inflation pressure could also ease, Kolyandr added, as peace prospects may make Washington less likely to enforce secondary sanctions on companies from countries like China, making imports more straightforward and, therefore, cheaper.

NATURAL SLOWDOWN

Russian markets have already seen a boost. The rouble surged to a near six-month high against the dollar on Friday, buoyed by prospects for sanctions relief.

Russia's economy has grown strongly since a small contraction in 2022, but authorities expect 2024's 4.1% growth to slow to around 1-2% this year and the central bank is not yet seeing sustainable grounds to cut rates.

When holding rates at 21% on February 14, Central Bank Governor Elvira Nabiullina said demand growth has long been faster than production capacity, hence the natural slowdown in growth.

The bank's challenge in finding a balance between growing the economy and lowering inflation is complicated by rampant fiscal stimulus. Russia's fiscal deficit ballooned to 1.7 trillion roubles ($19.21 billion) in January alone, a 14-fold increase year on year as Moscow frontloads 2025 spending.

"...it is very important for us that the budget deficit...remains as the government is currently planning," Nabiullina said.

The finance ministry, which expects a 1.2-trillion-rouble deficit for 2025 as a whole, rejigged its budget plans three times last year.

CARROT & STICK

The war has brought economic advantages for some Russians but pain for others.

For workers in sectors linked to the military, fiscal stimulus has sharply raised wages, while others in civilian sectors struggle with soaring prices for basic goods.

Some businesses have seized opportunities presented by huge shifts in trade flows and reduced competition. For example, Melon Fashion Group's revenues have steadily risen as it has ridden the consumer demand wave.

Melon's brands have significantly expanded over the last two years, the company told Reuters, and since 2023, the average size of stores it opens has doubled.

But for many others, high rates pose a serious challenge.

"At current lending rates, it is difficult for developments to launch new projects," said Elena Bondarchuk, founder of warehouse developer Orientir. "The once-wide circle of investors has narrowed and those who remain are also dependent on banks' terms."

Lower oil prices, budget constraints and a rise in bad corporate debt are among the top economic risks facing Russia, internal documents seen by Reuters show. And Trump, though dangling the carrot of concessions over Ukraine, has threatened additional sanctions if no deal is forthcoming.

"The United States has significant leverage in terms of the economy and it's why the Russians are happy to meet," Chris Weafer, chief executive of Macro-Advisory Ltd, told Reuters.

"The United States is saying: 'We can ease sanctions if you cooperate, but if you don't we can make it a hell of a lot worse'."

($1 = 88.5000 roubles)