Select Language

Investing.com-- Most Asian stocks fell on Monday, tracking steep declines on Wall Street amid persistent concerns over a cooling U.S. economy and increased trade tariffs under President Donald Trump.

A tech-fueled rally in Hong Kong paused, with investors turning averse towards the broader tech sector before hotly anticipated earnings from market darling NVIDIA Corporation (NASDAQ:NVDA) this week.

Weakness in Asian markets came largely tracking steep losses on Wall Street on Friday, where a mix of soft economic data and persistent tariff tensions battered markets. Wall Street futures advanced in Asian trade on Monday, signaling some signs of a recovery.

Asia tech skittish with Nvidia in focus

Tech-heavy Asian bourses led declines on Monday, with Japan’s Nikkei 225 index losing 1.2%, while South Korea’s KOSPI shed 0.6%.

Hong Kong’s Hang Seng index was flat on some gains in locally listed Chinese stocks. But tech shares- which drove a stellar rally in the Hang Seng over the past month- mostly retreated.

Alibaba Group Holding Ltd (HK:9988) (NYSE:BABA) was an exception, curbing a bulk of its initial losses after the ecommerce giant said it will invest about 380 million yuan ($52 billion) in AI over the next three years.

Regional tech shares largely tracked Friday declines in their U.S. peers, as investors dumped AI-linked shares ahead of key earnings from Nvidia this week. Nvidia had fallen more than 4%.

The company’s earnings- which are due on Wednesday- will be closely watched to see whether the AI trade remained feasible, especially after the release of China’s DeepSeek in January sparked doubts over AI investment.

By Wayne Cole

SYDNEY (Reuters) - European shares steadied on Monday as Germany's election produced no nasty surprise, while Wall Street futures firmed on hopes results from AI diva Nvidia (NASDAQ:NVDA) this week would justify the tech sector's sky-high valuations.

DAX futures firmed 0.2%, while EUROSTOXX 50 futures were flat. The euro edged 0.3% higher to $1.0493 after the CDU/CSU won as polls predicted.

German's new conservative leader Friedrich Merz has to form a coalition government and it is not yet clear whether that will include one or two partners, with the latter likely to take more time and horse trading.

The uncertainty comes as European Union leaders are set to hold an extraordinary summit on March 6 to discuss additional support for Ukraine and how to pay for European defence needs.

Liquidity was thinned by a holiday in Tokyo markets and MSCI's broadest index of Asia-Pacific shares outside Japan dipped 0.15%. Nikkei futures traded at 38,300, under the cash close of 38,776.

S&P 500 futures added 0.4% and Nasdaq futures 0.5%. The Nasdaq had fallen 2.5%, its worst week in three months, with losses led by the Magnificent Seven. [.N]

That pullback raises the stakes for Nvidia's results on Wednesday where investors are looking for fourth-quarter sales around $38.5 billion and first-quarter guidance around $42.5 billion.

As usual, options point to a share price move of around 8% in either direction should the results surprise.

Wall Street had taken a hit on Friday when a survey on services showed a shock slide in activity amid concerns about tariffs and cost pressures. There were even reports the White House was pressuring Mexico to put its own tariffs on Chinese imports as part of a deal.

By Jonathan Landay

WASHINGTON (Reuters) - President Donald Trump’s administration on Sunday said it was placing all but a handful of USAID personnel around the world on paid administrative leave and eliminating some 2,000 of those positions in the U.S., according to a notice sent to agency workers reviewed by Reuters.

Just before midnight on Sunday U.S. Eastern Time, all United States Agency for International Development direct hire personnel with the exception of workers essential for critical functions, will be placed on leave. At the same time the agency is "beginning to implement a Reduction-in-Force" affecting about 2,000 USAID personnel in the U.S., the notice said.

The White House did not immediately respond to request for comment.

Billionaire Elon Musk’s Department of Government Efficiency has led an effort to gut USAID, the main delivery mechanism for American foreign assistance, a critical tool of U.S. "soft power" for winning influence abroad.

On Friday, a federal judge cleared the way for the Trump administration to put thousands of USAID workers on leave, a setback for government employee unions that are suing over what they have called an effort to dismantle it.

Two former senior USAID officials estimated that a majority of some 4,600 USAID personnel, career U.S. Civil Service and Foreign Service staffers, would be placed on administrative leave.

"This administration and Secretary (of State Marco) Rubio are shortsighted in cutting into the expertise and unique crisis response capacity of the U.S.," said Marcia Wong, one of the former officials. "When disease outbreaks occur, populations displaced, these USAID experts are on the ground and first deployed to help stabilize and provide aid?"

"Unsigned notices like this are not self-implementing. They must be followed up by an individual personnel action or at least an approved leave slip, properly executed by someone with that authority," said the second former official, who asked not to be further identified.

Trump ordered a 90-day pause on foreign aid shortly after taking office, halting funding for everything from programs that fight starvation and deadly diseases to providing shelters for millions of displaced people across the globe.

The administration has approved exceptions to the freeze totaling $5.3 billion, mostly for security and counter-narcotics programs, according to a list of exemptions reviewed by Reuters that included limited humanitarian relief.

USAID programs received less than $100 million in exemptions, according to the list. That compares to roughly $40 billion in USAID programs administered annually before the freeze.

By David Milliken

LONDON (Reuters) - Britain's government ran a record budget surplus of 15.4 billion pounds ($19.5 billion) last month, official figures showed on Friday, but in a setback for finance minister Rachel Reeves it was well below economists' and officials' expectations.

Britain's public finances typically show a surplus in January when annual income tax bills for the previous financial year fall due for many taxpayers.

However, cumulative borrowing for the first 10 months of the financial year totalled 118.2 billion pounds, the Office for National Statistics said.

That is 11.6 billion pounds more than at the same point of the 2023-24 year and above the 105.4 billion pounds which the Office for Budget Responsibility forecast in October for this point in the financial year.

The OBR expected a 20.5 billion-pound surplus for January.

The figures come after a number of economists estimated that Reeves risks missing her debt reduction goals when the government's forecasters publish updated borrowing estimates on March 26.

Reeves' first budget last year left her with only 9.9 billion pounds of headroom to meet a target of balancing day-to-day spending and tax revenues by the 2029-30 financial year, despite announcing Britain's biggest tax rises in decades.

Since the budget, government borrowing costs have risen globally and British business sentiment and growth prospects have weakened, reflecting Reeves' 40 billion-pound tax rise and uncertainty created by trade tariffs announced by U.S. President Donald Trump.

Public sector net debt excluding public sector banks totalled 95.3% of annual gross domestic product in January, 0.1 percentage points higher than a year earlier and around levels last seen in the early 1960s, the ONS said.

Public sector net financial liabilities - a measure targeted by Reeves which includes illiquid assets - stood at 82.7% of GDP in January, up 2.0 percentage points on the year.

($1 = 0.7891 pounds)

By Rae Wee

SINGAPORE (Reuters) - Asian shares rose on Friday, reversing Wall Street's negative lead as the U.S. exceptionalism narrative continued to lose its shine, while once unloved Chinese stocks found themselves more buyers thanks to optimism over artificial intelligence (AI).

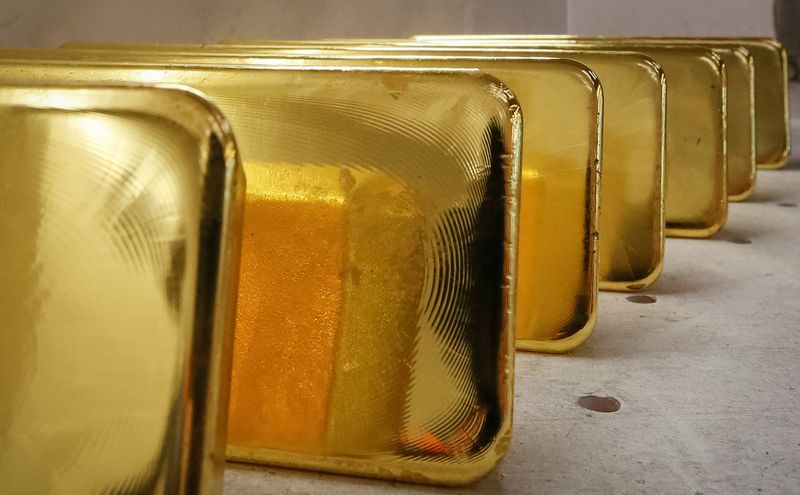

Gold hovered near a record high and was set to extend its gains for an eighth consecutive week, helped by safe-haven flows due to concerns over Donald Trump's tariff threats and amid contentious talks as the U.S. President pushes for a quick deal to end the Russia-Ukraine war.

MSCI's broadest index of Asia-Pacific shares outside Japan rose 0.8% in the early Asian session, boosted by a jump in Hong Kong-listed stocks.

Hong Kong's Hang Seng Index advanced 1.8% shortly after the open, while tech shares surged 2.5%. [.SS]

Similarly, China's CSI300 blue-chip index gained 0.2%, with the CSI big data index rising 2%.

Chinese stocks have been on a tear in recent days, driven by DeepSeek's AI breakthrough that reignited investor interest in China's technology capabilities.

While the Hang Seng Tech Index has gained 26% for the year thus far, the S&P 500 is up just 4% over the same period.

"DeepSeek has been a catalyst for sentiment changing," said Brian Arcese, portfolio manager at Foord Asset Management.

Earlier this week, Chinese President Xi Jinping held a rare meeting with some of the biggest names in China's technology sector, urging them to "show their talent" and be confident in the power of China's model and market.

"I think that is a shift in China. These things are done for a reason, nothing's really coming out of the meeting other than the fact that we're showing that we've met... but that is a big signal, you don't do that lightly," said Arcese.

Elsewhere, Nasdaq futures ticked 0.02% higher while S&P 500 futures fell 0.03%, both struggling to recoup Wall Street's losses from the previous session. [.N]

Thursday's downbeat forecast from Walmart (NYSE:WMT), the world's largest retailer, dampened investor sentiment and stoked concerns about the outlook for the world's largest economy.

"The Walmart report, it's such a bellwether for the U.S. economy, and usually probably in isolation you could look through it ... but following the weak retail sales data, suddenly there's some concerns out there," said Tony Sycamore, a market analyst at IG.

EUROSTOXX 50 futures were down 0.05%, while FTSE futures lost 0.08%.

Japan's Nikkei edged up 0.05%, with its gains capped by a stronger yen. (T)

DOLLAR EASES

While the threat of further import duties from Trump continued to cast a pall over markets, traders are also sobering up to the fact that the start of his second term has been mostly bluster on the tariff front.

The dollar was headed for a third straight weekly loss, as bulls who had built up big long positions in anticipation of a trade war have backed off while Trump equivocates about tariffs.

Several Federal Reserve officials on Thursday said they are taking note of what they see as rising inflation risks and the uncertain impact of Trump's trade, immigration and other policies.

The weaker dollar left sterling at a two-month high of $1.2674, while the euro steadied at $1.0490 ahead of a weekend election in Germany.

The yen, meanwhile, fell more than 0.4% to 150.28 per dollar, after having jumped on Thursday on heightened bets of further Bank of Japan (BOJ) rate hikes this year.

Data on Friday showed Japan's core consumer inflation hit 3.2% in January, its fastest pace in 19 months.

"The data supports the growing market conviction of a BOJ rate hike by July, and a possible third hike by year-end," said Alvin Tan, head of Asia FX strategy at RBC Capital Markets.

U.S. Treasury yields steadied on Friday, after falling in the previous session following comments from Treasury Secretary Scott Bessent who said any move to increase the share of longer-term Treasuries in government debt issuance is some way off.

The two-year yield was last little changed at 4.2635%, while the benchmark 10-year yield stood at 4.4975%. [US/]

In commodities, oil prices dipped but were headed for a weekly gain. [O/R]

Brent crude oil futures eased 0.1% to $76.40 a barrel, but were set to rise more than 2% for the week. U.S. West Texas Intermediate crude eased 0.07% to $72.43, but was also on track for a weekly gain of over 2%.

Investing.com-- Japanese consumer price index inflation grew more than expected in January amid robust consumer spending, pointing to a hawkish outlook for the Bank of Japan in its plans for more interest rate hikes.

Headline national CPI surged to a two-year high of 4.0% year-on-year in January from 3.6% in the prior month, government data showed on Friday.

Core CPI, which excludes volatile fresh food items, grew 3.2% y-o-y, more than expectations of 3.1%. The print was at a 1-½ year high.

A core CPI reading that excludes both fresh food and energy costs rose slightly to 2.5% y-o-y from 2.4% in the prior month. The reading is a key gauge of underlying inflation used by the BOJ, and was well above the central bank’s 2% annual target.

January’s inflation print was driven chiefly by strong consumer spending through the year-end holidays, while food prices also rose sharply for a second consecutive month.

Friday’s reading ties further into the BOJ’s expectations of higher inflation, which is expected to elicit more rate hikes from the central bank this year. The BOJ had hiked rates by 25 basis points in January, and signaled more hikes were likely.

BOJ board member Naoki Tamura recently signaled that the bank’s benchmark rate could rise by another 50 bps to 1% in 2025.

A rebound in Japanese inflation was driven chiefly by strong wage growth through 2024- a trend that is expected to be repeated in 2025’s springtime wage negotiations.

The anti-inflationary effects of government subsidies are also expected to peter out in the coming months, keeping inflation underpinned.

Friday’s data comes just days after stronger-than-expected gross domestic product data for the fourth quarter, which showed continued resilience in the Japanese economy.

Strength in the economy and sticky inflation gives the BOJ more headroom to keep raising interest rates.

Investing.com - The S&P 500 closed lower Thursday after disappointing sales outlook from big-box retailer Walmart raised concerns about the consumer and underlying economic strength.

At 4:00 p.m. ET (21:00 GMT), the benchmark S&P 500 fell 0.4%, the Nasdaq Composite fell 0.5% and the 30-stock Dow Jones Industrial Average slipped by 450 points or 1%.

Walmart sales outlook spooks markets

Walmart (NYSE:WMT) fell more than 6% after unveiling an outlook for sales in its 2026 fiscal year that were below forecasts, in a potential sign that the big-box retailer may feel the impact of fading optimism among inflation-hit consumers.

Analysts have widely viewed the ubiquitous chain that offers everything from retail goods to groceries as a possible bellwether for the state of the U.S. consumer during the early months of 2025.

Arkansas-based Walmart said it expects annual consolidated net sales to increase in the range of 3% to 4%, versus analyst projections of a 4% uptick, according to LSEG data cited by Reuters.

The pullback in Walmart, however, is an opportunity for investors to buy the stock "aggressively," Truist Securities said in a recent note, citing market chain gains and increased margins.

Still the warning from Walmart rattled other retailers, with Target Corporation (NYSE:TGT) and Costco Wholesale Corp (NASDAQ:COST) also trading in the red.

Meanwhile, U.S.-listed shares in Alibaba (NYSE:BABA) rose by more than 8% after the Chinese e-commerce titan reported better-than-anticipated third-quarter revenue.

Carvana (NYSE:CVNA) shares slumped 11%, as analysts flagged a lack of details around the used-car platform's current year outlook that overshadowed strong returns in the fourth quarter.

Birkenstock's (NYSE:BIRK) stock price slipped 1% after the sandal maker left its annual margin forecast unchanged despite receiving a boost from holiday-season sales.

Fed speak continues to point toward long pause

St. Louis Federal Reserve President Alberto Musalem said Thursday that while he continues to expect inflation slow toward the Fed's 2% target, he backs the rate cuts to remain on hold "until inflation convergence is assured."

The remarks mainly echoed that other Fed members calling for the evidence of disinflation progress. Atlanta Fed president Raphael Bostic, however, leaned slightly dovish on Wednesday, forecasting that the Fed will cut rates twice this year, though acknowledged that uncertainty has increased.

(Scott Kanowsky contributed to this report.)

Investing.com-- Gold prices rose in Asian trade on Thursday, briefly hitting a record high as safe haven demand was underpinned by U.S. President Donald Trump threatening to impose more trade tariffs.

But gains in the yellow metal were stymied by some resilience in the dollar, following hawkish signals from the minutes of the Federal Reserve’s January meeting.

Spot gold rose 0.3% to $2,940.96 an ounce, briefly hitting a record high of $2,947.23 an ounce earlier in the session.

Gold futures expiring in April rose 0.2% to $2,957.80 an ounce.

Gold buoyed by haven demand as Trump talks tariffs

Trump on Wednesday said his planned 25% tariffs on automobiles, pharmaceuticals, and semiconductors will be imposed within the coming month.

He also flagged the potential for 25% tariffs on all lumber imports to the U.S.

Trump’s comments ramped up concerns that increased U.S. tariffs will disrupt global trade and spark a renewed trade war between the world’s biggest economies.

The U.S. President had recently threatened to impose reciprocal tariffs on major trading partners. Still, Trump also said on Wednesday that a trade deal with China was possible, even though he recently imposed 10% tariffs on the country, drawing ire and retaliation from Beijing.

Concerns over Trump’s trade policies battered risk-driven markets on Thursday, pushing up demand for safe havens such as gold and the yen. U.S. policy uncertainty has been a key driver of gold’s recent gains.

Other precious metals also advanced, but were nursing some losses this week. Platinum futures rose 0.2% to $992.70 an ounce, while silver futures rose 0.9% to $33.353 an ounce.

Among industrial metals, copper prices advanced as top importer China kept its benchmark loan prime rate at record lows. Benchmark copper futures on the London Metal Exchange rose 0.7% to $9,507.30 a ton, while March copper futures rose 0.2% to $4.5785 a pound.

Dollar strength, Fed jitters limit gold gains

Gold spent only a brief period at record highs, as strength in the dollar and concerns over high-for-longer U.S. interest rates weighed.

The greenback caught some bids this week as several Fed officials reiterated the bank’s caution over cutting interest rates further, due to signs of sticky inflation and resilience in the U.S. economy.

This messaging was repeated in the Fed’s January minutes on Wednesday, which showed policymakers also cautious over the inflationary effects of Trump’s trade policies.

By Ankur Banerjee and Chibuike Oguh

SINGAPORE/NEW YORK (Reuters) - Asian shares fell sharply on Thursday, tracking choppy trading on Wall Street and a dip in European stocks as U.S. President Donald Trump's tariff plans and a cautious stance from Federal Reserve policymakers hurt risk sentiment.

The risk-off mood lifted gold prices to a record high, while safe-haven currencies led by the Japanese yen also firmed on geopolitical worries. [GOL/] [FRX/]

Trump said on Tuesday that sector-wide tariffs on pharmaceuticals and semiconductor chips would start at "25% or higher," rising substantially over the course of a year. He intends to impose similar tariffs on autos as soon as April 2.

That along with other threats has exacerbated fears of a wide-ranging trade war, leaving investors jittery, although some analysts see the moves by Trump as a negotiation tool.

"In general the bias for markets remains upwards but if you look shorter term over the last few days, it's more mixed because the market tends to trade around the latest indications of the Trump administration," said Julian McManus, portfolio manager at Janus Henderson Investors.

"That tends to be unsettling and markets tend to trade off whenever they hear the word tariff because they think it means either risk for a particular country or they think inflation."

MSCI's broadest index of Asia-Pacific shares outside Japan fell 1% in early trading. Japan's Nikkei slid 1.4% on the strong yen.

Chinese stocks had a muted start to the session, with the blue-chip index down 0.4%. Hong Kong's Hang Seng Index slid 1.7%, having touched a four-month high earlier this week boosted by a blistering rally in tech stocks. (HK)

On Thursday, Hang Seng's tech stocks index fell more than 3%, on course for its worst one-day drop in three months. Still, the index is up nearly 6% so far in February.

Wall Street's main indexes finished higher on Wednesday, with the S&P 500 edging to a second straight closing high after wobbling between green and red throughout the session.

The pan-European STOXX 600 index dropped 0.9%, logging its biggest daily fall since the start of the year.

Trump's initial policy proposals raised concern at the Fed about higher inflation, with firms telling the U.S. central bank they generally expected to raise prices to pass along the cost of import tariffs, according to the Fed's January meeting minutes released on Wednesday.

"Trump's policies ... no doubt added complexity to the Fed's balancing act between inflation and employment, forcing policymakers to lean into a wait-and-see approach," said Yeap Jun Rong, market strategist at IG.

"That said, with market expectations already well aligned for a rate hold over the next two FOMC meetings, the minutes served more as confirmation of existing sentiment."

The yen gained as market jitters escalated on geopolitical worries after Trump denounced Ukrainian President Volodymyr Zelenskiy as a "dictator" amid talks to end the Ukraine war.

The yen hit an over two-month high against the dollar and was last up nearly 0.6% at 150.57 per dollar. The yen has risen more than 4% against the dollar this year boosted by rising odds of the Bank of Japan hiking rates again in 2025.

The dollar index, which measures the greenback against a basket of currencies including the yen and the euro, eased 0.1% to 107.07. The euro was steady at $1.0429.

Gold prices rose to a fresh record high of $2,946.85 an ounce on safe-haven demand, reaching a new peak for the ninth time this year. The yellow metal was last at $2,940.63.

Oil prices eased away from a one-week high on worries about supply disruptions in Russia and the U.S., even as the market awaits the outcome of talks to end the war in Ukraine. [O/R]

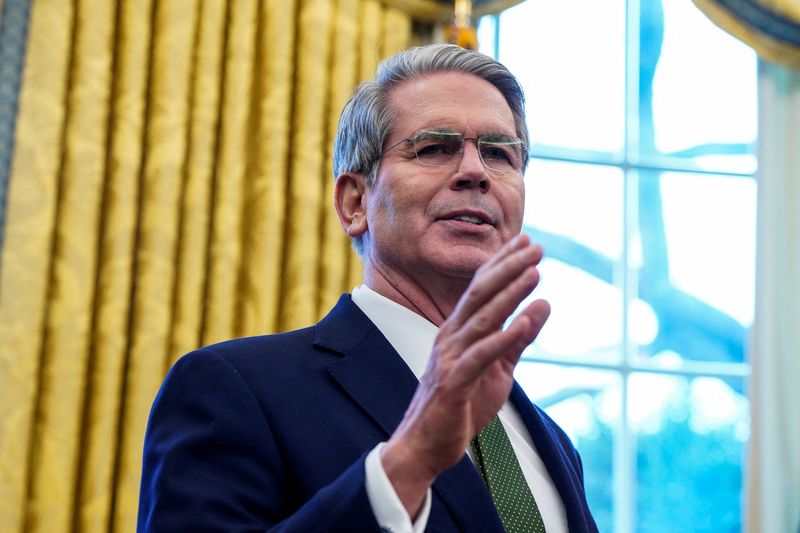

By Andrea Shalal, Christian Kraemer, David Lawder

MIAMI/BERLIN (Reuters) -U.S. Treasury Secretary Scott Bessent said on Wednesday he will skip next week's meeting of finance ministers and central bank governors from the Group of 20 major economies in Cape Town, South Africa.

The decision to miss the regular gathering of finance leaders from the world's largest economies is highly unusual for a U.S. Treasury secretary, as the U.S. often leads G20 agreements on financial and monetary policy matters.

Bessent said in a post on X that he would not attend the summit due to "obligations in Washington". A senior official would attend in his place, he added.

He said he looked forward to seeing his global counterparts in Washington meetings of the International Monetary Fund and the World Bank in coming months.

One of the sources told Reuters that G20 member countries had been informed of Bessent's decision not to attend. A second source said Bessent could not attend because he had "duties with the president."

It was not immediately clear if those duties were linked to a possible summit meeting between U.S. President Donald Trump and Russian President Vladimir Putin.

Trump on Tuesday told reporters he would "probably" still meet with Putin to discuss ending the Ukraine war before the end of the month. The Kremlin echoed that hope early Wednesday, but said the meeting could happen later.

The White House and U.S. Treasury did not respond to requests for comment on Bessent's plans. The New York Times (NYSE:NYT) first reported Bessent's planned absence.

The G20 group - which includes the U.S., China and Russia among others - has tackled a range of issues affecting the global economy, from responding to the COVID-19 pandemic and fighting inflation to dealing with climate change, debt distress and trade conflicts.

SOUTH AFRICA TENSIONS

South Africa holds the G20 presidency from December 2024 to November 2025. The U.S. will head the group next year.

Tensions between the U.S. and South Africa have risen in recent weeks following complaints from Trump over South Africa's land policy.

Earlier this month, Trump said that "South Africa is confiscating land" and "certain classes of people" were being treated "very badly."

The White House said Washington would formulate a plan to resettle white South African farmers and their families as refugees, with U.S. officials to prioritize humanitarian relief for Afrikaners in South Africa, who are mostly white descendants of early Dutch and French settlers.

U.S. Secretary of State Marco Rubio subsequently canceled a trip to Johannesburg for a meeting of G20 foreign ministers on Thursday and Friday.

Mark Sobel, a former senior Treasury official, said the decision to skip the G20 gathering was a huge error.

"This was a golden opportunity for Bessent to meet his counterparts in plenary sessions and more importantly in behind-the-scenes bilaterals, including with China," for discussions on global economic and tax policy and exchange rates, said Sobel, U.S. chair of the OMFIF think tank.